The discrepancy I highlighted in last month’s jobs report (June) closed a bit in July as the Household Survey reported growth at a higher rate than the Establishment Survey (+227k vs. +162k). On the other side of the BLS ledger, the same charade continued with the official labor force falling by 37k. Those “not in the labor force” increased by 240k, greater than the jobs advance from either method.

That means we are left with the same problems that we have seen consistently since the middle of last year (not coincidentally the same timeframe as the current downturn in nearly every other economic series).

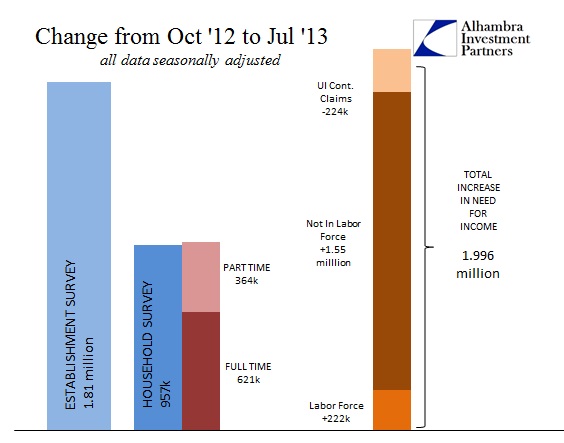

If the Household Survey is even close to matching actual economic conditions, there have only been a net of 621,000 full time jobs to be distributed among 2 million additional persons who might need them (on top of the unemployed leftover from 2008-09).

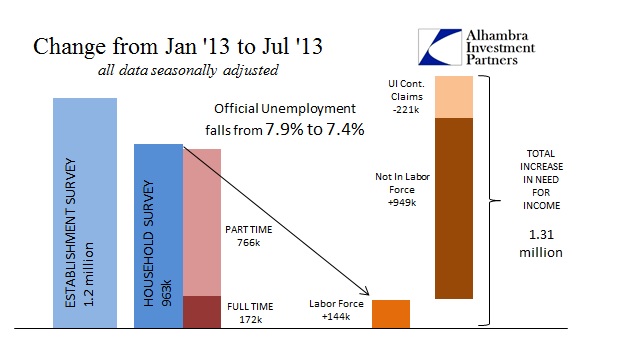

In 2013, the pace of full time employment has fallen dramatically even though overall job growth (including part time) has been more consistent.

Again, if the Household Survey better reflects reality, then 172,000 full time jobs for the 1.3 million additional persons that need them adds up to less than “muddle through”.

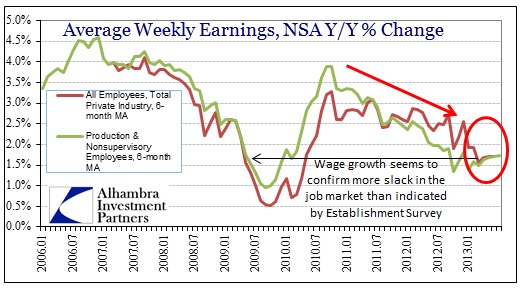

The issue, as it has been for this “recovery” period, indeed for all of this century, is that wages have not kept pace with either historical expectations or even population growth. Income is what matters, regardless of the numerical job count. The only time income can underperform and the economy can maintain its pace is with supplementation. In the case of the last decade(s), supplementation was accomplished by monetary policy’s dubious “wealth effect” channeled through massive debt accumulation.

Without the debt supplementation, as that monetary channel remains “clogged” or fully disabled, this “recovery” is what you get. Asset prices can only mask these deficiencies for so long before the flow of real money through income becomes more than a drag on the sectors of the economy more attuned to monetary manipulation (economic bifurcation).

The current pace of wage growth, which is curiously uniform for both series, has been averaging (6-month) 1.5% – 1.7% for the past six months in nominal terms. If we add even a small amount of inflation, we can begin to understand the economic problem more clearly.

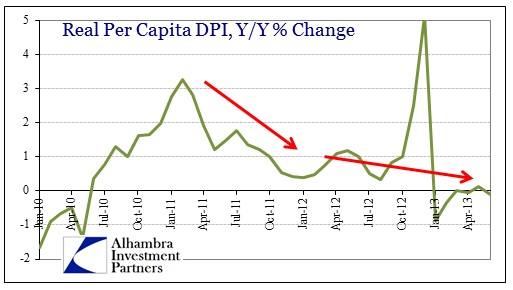

What we have is a “celebrated” jobs recovery that can neither keep pace with population growth or produce pay rates that grow in real terms. The result is:

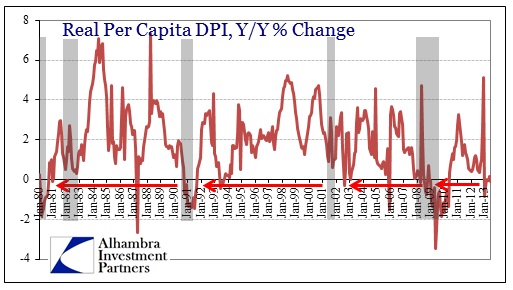

We have gotten to a point, again, where real DPI per capita is contracting, having been at or below zero since January. In terms of historical context, the only time we see such extended periods of income deprivation is during recession. Even the false positives of the previous jobless recovery periods were much shorter in duration, suggesting this is more than the usual lackluster outcome.

It is exceedingly difficult to see how the economy is supposed to rebound given the actual state of labor income. The various data here conforms to the Household Survey interpretation of labor weakness far more than the Establishment Survey narrative of successful monetary intervention. This is an economy getting worse, leaving the optimistic view relying solely on statistical adjustments and theories.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch