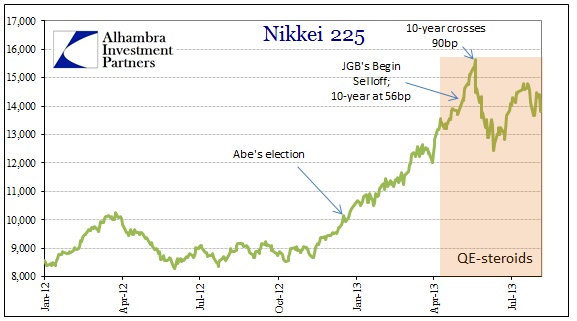

The old military axiom that battle plans never survive first contact with the enemy appears to have a corollary in the central banking world of interventionist finance. The allure of QE in Japan was an irresistible impulse to believe that a durable solution was to be had by retrying old ideas in a different scale. While that appeals to the Paul Krugman’s of the world and their sense of government power and ability, the simple fact is this new QE drive is and has been a huge gamble. From the moment Abe’s election went from probability to near lock, however, markets went into optimism overdrive to bet on it.

The actual implementation of the Bank of Japan’s “arrow” of the returned Prime Minister’s new policy quiver, however, has been far less smooth. Like a battle plan experiencing its first taste of uncertainty, the liquidity issues that QE-steroids engendered have yet to be resolved.

Since the implementation of QE in early April, the Nikkei is up 9.4%, but was far higher until the bond selloff began to generate funding issues in the interbank space. Repo markets, abhorring volatility, seem to have put a lid on asset inflation excess. So, at this point, there was exuberance leading into the plan, but real problems in implementation.

That extends into the banking sector as well, since Japanese banks are behaving very much like their American Primary Dealer cousins. The biggest banks in Japan continue to sell their JGB’s to the Bank of Japan in QE and placing that “money” back at the central bank. That seems to be the universal process of QE in all nationalities – it sounds like it should work until banks actually analyze credit and true market conditions before taking on “risk”. QE in the real economy doesn’t ever survive the first live bullet; banks would rather stay hunkered in their liquidity preferences despite all intentions otherwise.

At the same time banks turn their newfound optimism into useless base “reserves”, Japanese corporations take the currency hit and react in exactly the “wrong” way. Manufacturers, in a survey released this week, expected to increase capital spending by about 10% vs. only 3% last year. That seems to confirm the BoJ’s plans are working, or at least moving in the “right” direction. However, the same survey noted that Japanese manufacturers plan on increasing overseas spending by 26%.

None of this will help the real and growing problem across Japan, the fact that June marked the twelfth consecutive month of trade deficits. If the Japanese were importing luxury or discretionary items, a yen-devaluation policy might (emphasis on might) make sense to turn domestic demand toward domestic production. But the importation of vital energy and even manufactured items and components (as Japan loses ground to low-cost labor nationalities) during a yen-devaluation only speeds up the inevitable.

Where QE could never have effects is on global demand itself. An export economy will always be susceptible to the mercantile conditions elsewhere. The Bank of Japan can try to make Japanese goods more competitive in terms of cost, but that never happens in a vacuum and other national players eventually respond. In the meantime, the damage done internally rots the system from the inside out.

Industrial production fell sharply in June, as did household spending. Intentional appeals to “inflation” are more than dangerous, they are asymmetric in the wrong direction (limited upside, huge downside). But it all sounds good on paper.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch