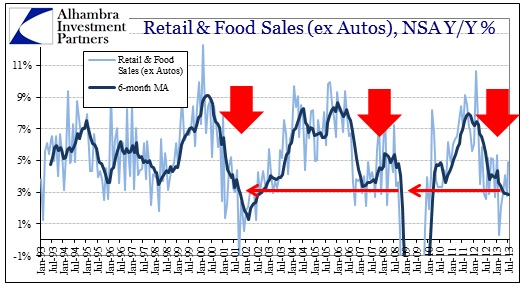

This week’s retail sales report has been used over and over as “evidence” for the second half bounce that every economist and policymaker is expecting (and proclaiming without reservation). Without fail, there is no context accompanying the month-to-month focus on pseudo-precision designed into existence by statistical modeling. The trend continues to be, as it has been for over a year now, underwhelming at best.

First, here’s the fuller context:

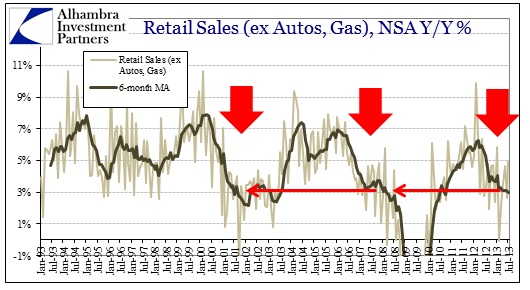

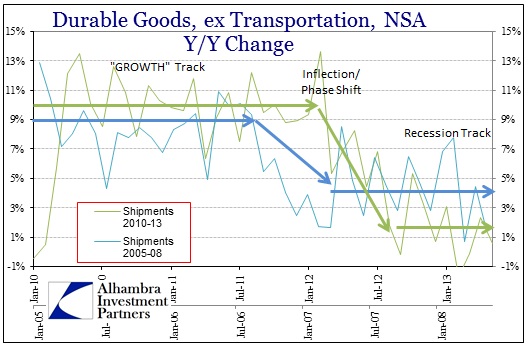

Notice the bounce higher at the far right in the chart above, the pseudo-precision. It occurs in other series as well:

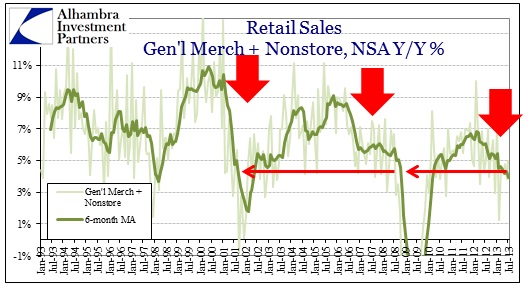

It is, however, less pronounced in our broad consumer proxy series (general merchandise stores + nonstore retailers).

There is no question that there has been a larger positive number next to July’s retail sales figures. So what? Context matters far more.

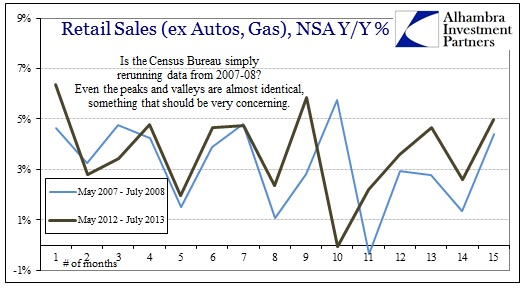

Retail sales growth also decelerated rapidly toward the end of 2006 and into the early months of 2007. A bounce higher in later 2007 was followed by a decline to zero, then finally a pickup through the middle of 2008. While there is an impulse to attribute that rise to an “inflationary” pickup at the time, stripping out gasoline and auto sales does not erase it; making the inflation narrative much less plausible.

Charting the two periods together produces an uncanny similarity, as if the Census Bureau is just regurgitating results from five years earlier. But we know that is not the case, particularly in the unadjusted data that I used here. That means, in context, the economic picture produced by the retails sales report is not at all dissimilar to 2007-08, hardly a reason for optimism.

In fact, this is not the only time I have highlighted the eerie similarities between the first stages of the Great Recession and now, the Great QE.

There are too many parallels between 2007-08 and 2012-13 to simply ignore them, putting full faith in QE. The recession that came in 2008 was not just due to financial panic, it was already well established by the time the panic occurred. It was the financial component that made it “Great”, but there was already nasty recession without it.

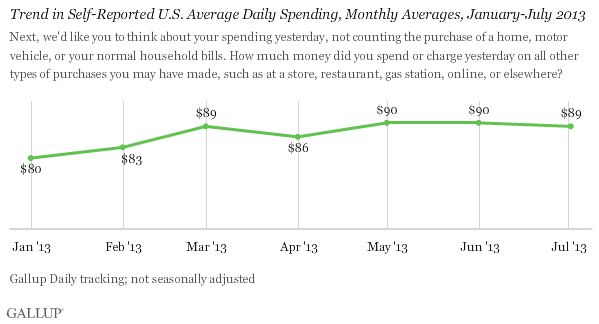

Other measures of spending are also far less robust, and contradictory toward second half optimism. Gallup, for example, comes right out and says it:

“Still, at this point, Gallup’s economic data do not support the idea of a significantly improving U.S. economy in the second half of the year. In turn, this suggests retailers may be disappointed with the Back-to-School spending season.”

Part of the reason for their relative pessimism is “self-reported” spending data coming out of their polling operations.

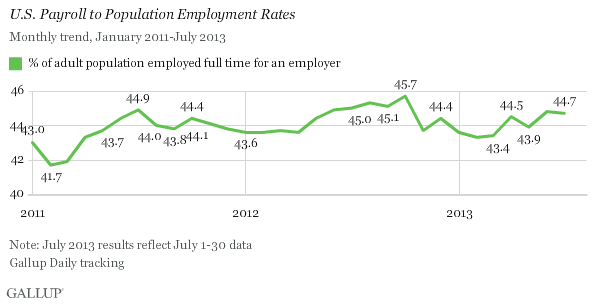

But Gallup’s figures also run counter to the optimism some are taking out of the Establishment Survey, making the Gallup employment numbers just one more data point that opposes the mainstream employment outlook.

“A broader measure of the nation’s employment situation is Gallup’s P2P employment rate, which shows basically no growth in full-time jobs in the U.S. since 2011. There has been some growth in part-time jobs this year vs. last, but this means there are more Americans working part-time jobs who actually want full-time positions.”

Given all this data, particularly how alarmingly similar retail sales are to 2008, by all means taper QE; it might be just the antidote the economy needs to recover, though full repeal would likely produce far better economic results. Asset markets might not be as receptive to such policy prescriptions, but asset markets and the economy are very different systems in 2013.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch