The preliminary look at Q2 GDP in Europe has given hope that the corner has been turned and the bottom has finally been found. On a seasonally adjusted, Q/Q basis, Eurozone GDP grew by 0.3%.

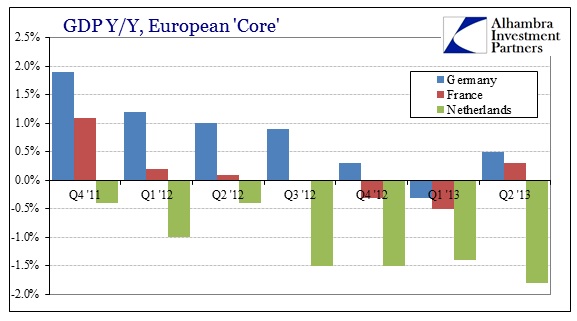

Before optimism became too entrenched, however, the Bundesbank threw some cold water on these interpretations. Noting seasonal factors, including comparisons, GDP may not have been as robust as first appears. Looking at it Y/Y, there is much less of a “turned corner”.

Beyond total Eurozone aggregates, it is particularly clear that economic fragmentation remains unresolved. The “core” of Europe seems to have reached a reprieve from contraction, but the PIIGS have not.

The depression remains as firmly in place as it has been since 2011. Even the improvement in the core countries is rather narrow.

The positive numbers for both Germany and France hold the possibility of a new upward trend, but there is really no reason at this point to believe that a relapse is not a good possibility. The volatility in retail trade shows this idea quite clearly – a positive rebound in the core countries for May, but then “unexpected” weakness in June.

The risks to the core remain weakness in the periphery. Spain and Italy, primarily, are still gripped by seemingly unending contraction in every manner possible. As such, unemployment continues to rise as do other financial problems – bad loans.

There was no shortage of optimism at the outset of 2013 in Spain as the bad debt problem was thought to be on its way to resolution once SAREB (Spain’s “bad bank”) began receiving NPL’s (non-performing loans) from weakened Spanish institutions. The rate of NPL’s fell from 11.4% in November to 11.2% in May, but have again risen to 11.6% and a new record high.

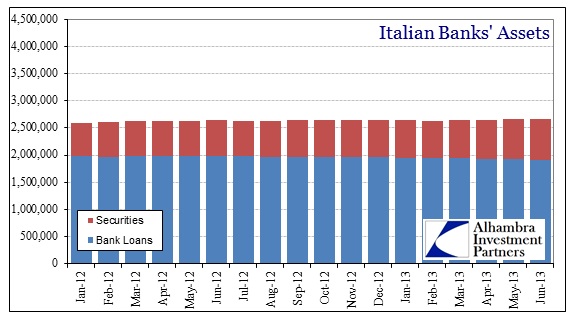

In Italy, there has been no disruption in the deterioration of bank books.

And, as expected, Italian banks both shift out of traditional lending to the real economy (running off loans and buying Italian government bonds) and continue to deleverage.

Given the cumulative data here, it appears more likely that the core countries in Europe may be lucky enough to be “scraping along the bottom” (a common phrase used in America in 1930 and 1931 to describe slightly positive data) while there is little change elsewhere. Without real improvement in the periphery, there will not likely be any durable rebound in Germany and France (among others). I don’t see anything that would suggest the depression is over in Europe; certainly banks are acting that way.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch