The housing construction data was delayed purportedly by the government shutdown in October. The expectation was that the September data would be released concurrent with the October data; which itself would be delayed by a few weeks. Given the state of housing uncertainty driven by financial parameters and recent trajectories, these are relatively important statistical updates.

Rather than get the expected data, the Census Bureau only updated permits.

“The lapse in federal funding affected the data collection schedule for the Survey of Construction, the source of data on new housing units started and completed. Accurate data collection for September and October could not be completed in time for this release. Data on housing units started and completed in September, October, and November 2013 will be released on December 18, 2013”

You would have to think that they would have at least procured and statistically machinated September’s numbers by now, and could at least update every series through September. These statistical agencies are doing themselves no favors.

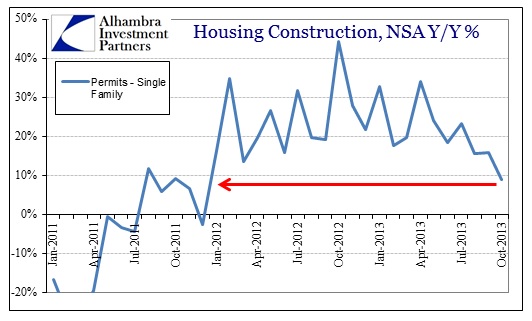

What we did get is relatively as expected. Construction permits for single-family homes are growing at the slowest rate since this mini-boom began. The 8.9% growth over October 2012 is about where we were in the last months of 2011.

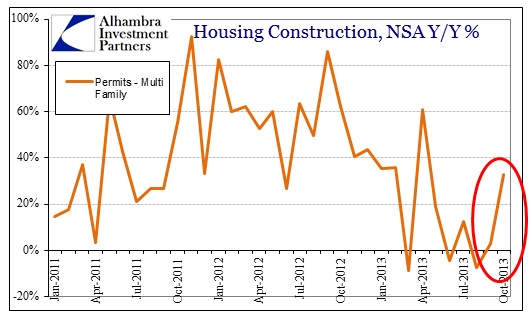

On the apartment/multi-family side, there was a noticeable jump in permits.

However, this kind of movement is perfectly compatible with volatility seen just this year. After collapsing in March 2013, permit activity in April was 61% above April 2012’s pace, only to have fallen back by this summer. Unlike single-family, there is little visibility in what multi-family permit activity portends. It could be nothing more than another volatile oddity, or it may suggest renewed interest in apartment building. There may be a tendency to want to dismiss the latter given institutional retreat this year, but it is entirely possible that housing market investors are seeing the downward trend in single-family homes and are projecting an increase in rental demand once again.

That would certainly be consistent with the latest estimates of home sales from the National Association of Realtors. Pending sales declined M/M for the fifth straight month, and were down 1.6% on a Y/Y basis. Some argue that is due to higher activity in the middle of the year as mortgage-financed borrowers raced to lock in rates before the credit market selloff, thus offering a negative “base effect.” Construction and mortgage data appear to argue otherwise.

As is usually the case, the vast majority of mainstream analysis tends toward straight-line extrapolation. Responding to the NAR pending sales figures, Bloomberg quotes a REIT executive extolling this “wisdom”:

“‘Many housing analysts agree with the basic premise that housing demand in the future will exceed supply,’ said Samuel Landy, president and chief executive officer of UMH Properties Inc., a real-estate investment trust based in Freehold, New Jersey , on a Nov. 21 earnings call. ‘The stronger housing market is predicted to last for a decade.’”

The last housing market boom was predicted to never end. Nothing says a decade-long housing boom like a 60% decline in mortgage finance, including layoffs throughout the mortgage industry.

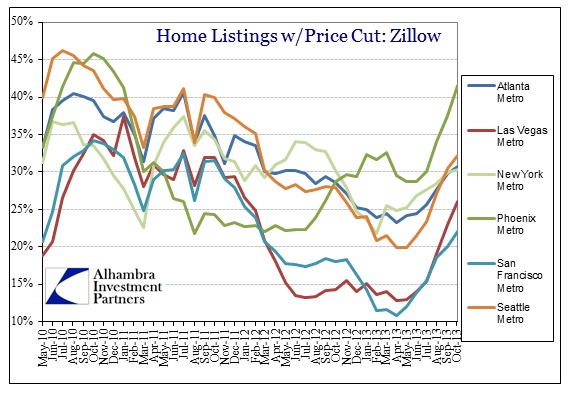

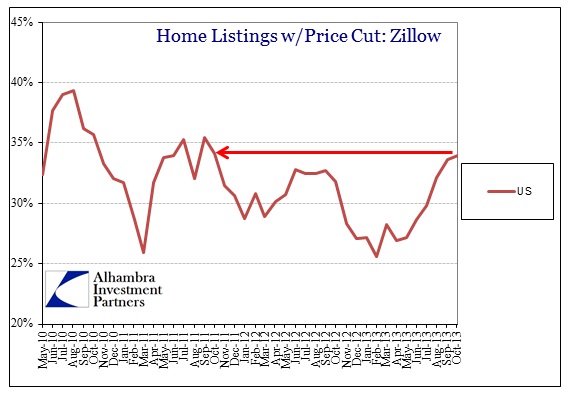

And while we won’t know for sure if housing can rebound without mortgages, it is increasingly likely that real estate overall is returning to “headwind” status. That covers not only construction activity, but any hopes for consumers and the nefarious “wealth” effect through home prices. Taken together, all these individual data points, contra the REIT industry “expertise”, is what an inflection actually looks like.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch