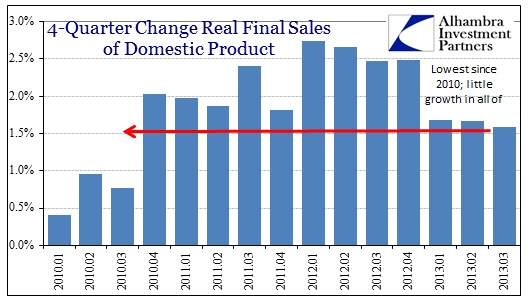

If one were to objectively at a broad range of data points, you might be tempted to declare, as the NBER does, a cycle peak for some time in mid-2012 (perhaps October?). Given yesterday’s update to GDP, increasing the growth rate by 0.8% to an illusory 3.6%, one might also conclude a peak in the mini-cycle.

Of all the subcomponents, almost every single line was revised downward, particularly in the segments that matter the most. That would include consumption, as PCE growth has clearly slowed to the lowest point in the “recovery.”

Apart from inventory, there was a slight revision upward in business investment, but merely from slightly negative Q/Q to zero.

US purchases of imported goods have not changed since the first quarter of 2012, meaning stagnation in global trade. The US imported an estimated $2.76 trillion (annual rate) of goods and services in Q1 2012, and a revised $2.77 trillion in Q3 2013. That would seem to align with yesterday’s post about the recent desire to try to explain why the world isn’t growing like economists believe it should. Some of that decline in importation is due to petroleum, but that is not what is depressing marginal demand inside the US for all goods and services.

In fact, it is both production and supply ex inventories that are showing lingering and pestering weakness.

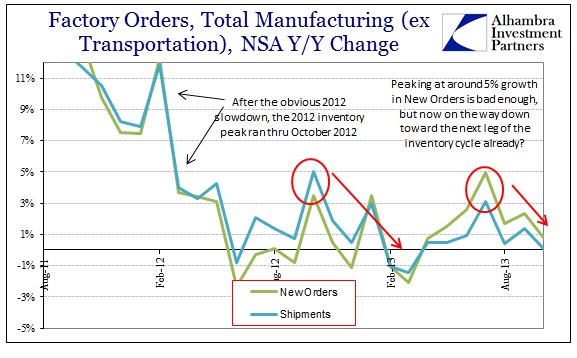

There is little economic growth to be had in this environment, and what growth is actually being achieved is most susceptible to dire reversal. Getting back to the inventory theme, according to this morning’s factory orders estimates we may already have seen the inventory tide begin to turn backward.

Since the middle of last year, factory production has been running at levels below even the first part of 2008. Examining this year and last more closely, we see the inventory mini-cycles as pronounced as the inventory estimates from the GDP release charted above.

Unlike last year, however, the peak in production seems to have occurred earlier in the year. That would conform to the picture provided by the anecdotes from retailers that have been leaking into the wider consciousness since September, including WalMart.

Combined with employment recently, it corroborates the inflation readings that have to be perplexing the orthodox economists on the FOMC. GDP of 3.6% sounds terrific, but if it was “real” growth it would not be accompanied by all these other contradictory points. That includes, of course, weakness in global trade.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch