Although there is correlation and relation between the consumer environment and business spending, there are times when the two diverge. Typically, this might occur at the outset of actual recovery where businesses invest productively first, which then leads to increases in overall employment, wages and incomes; thus bringing consumer spending up after some lag.

With consumer spending heading lower, consistent with Great Recession levels, the only hope for economic salvation (and thus possibly avoiding monetary policy failure and retribution) lies in the recent propensity of businesses to invest in their operations. Despite an historic aging of the productive base, this “cycle” has been utterly disappointing and contrary to all expectations given that observation. There just isn’t any demand from business to increase production capacity (for good reason, unlike retailers).

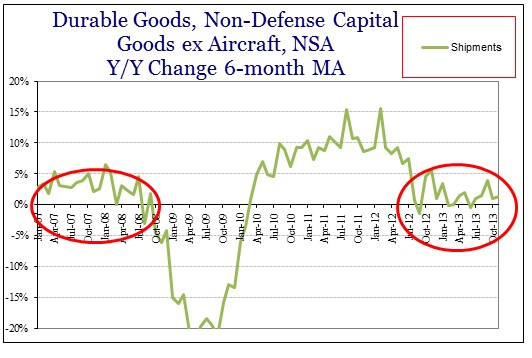

Even given the current boost to durable goods production from automobile credit growth, the overall segment is growing at levels considered previously to be recessionary (the standards of recovery appear to have been much reduced in the past few years).

As if there were any doubts, in terms of historical context the current pace of activity is uninspiring, and certainly not up to carrying the hopes for any recovery.

That leaves only inventory and cold weather.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch