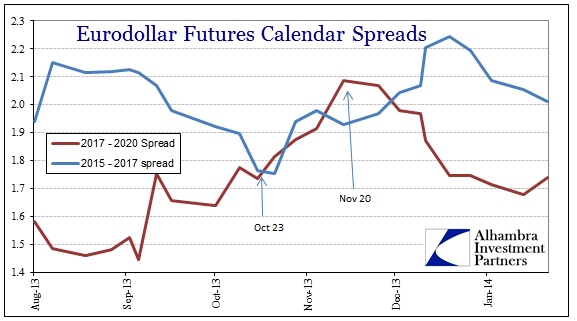

The immediate response to the December taper was to sell off in dollar funding markets, but overall the shape of the yield curve has been decidedly toward flattening. That started conspicuously on November 20 (with the Fed’s sudden POMO interest in the 10-year) and has only increased in the weeks since taper. We will have to see about today’s additional taper, but this flattening trend is deepening and almost seems fully apart from whatever the Fed does about the overall pace of QE. And that is fully contrary to the idea that interest rates are “normalizing” to the removal of “emergency” monetary intrusion.

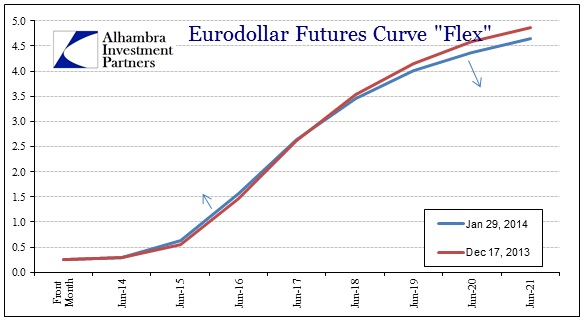

Since November 20, and further back to the inflection on September 5, credit markets that had been very well correlated have taken into separate actions and relieved themselves of any real cohesion about fundamental factors. If we start with funding markets, the eurodollar curve is pretty much right where it was the day of the December taper.

Overall, the curve has flattened generally, with some minor selling and volatility in the “money” part of the curve and buying toward the outer years. That would help explain why emerging markets continue to find themselves in dollar trouble, as the so-called flight to safety does not extend to eurodollars where the trillions trade.

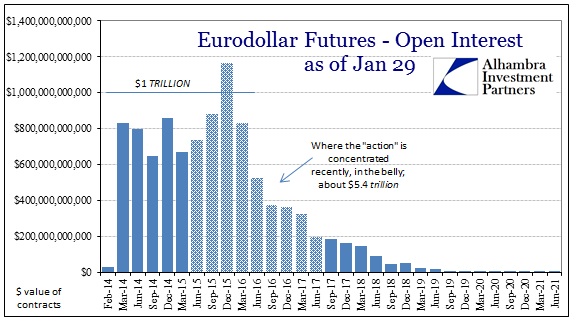

Open interest has been shifted lower in the month since taper, though the effect on the interest rate level has been relatively minor.

The positioning here in terms of open interest is similar to what we believe is happening across the curve – flat and flatter.

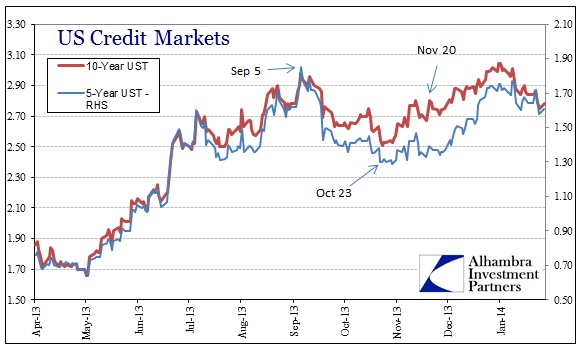

That echoes across the treasury curve as the 5-year, for example, has not been bid anywhere near what we have seen in the 10-year (which you would expect given the extra bidder there).

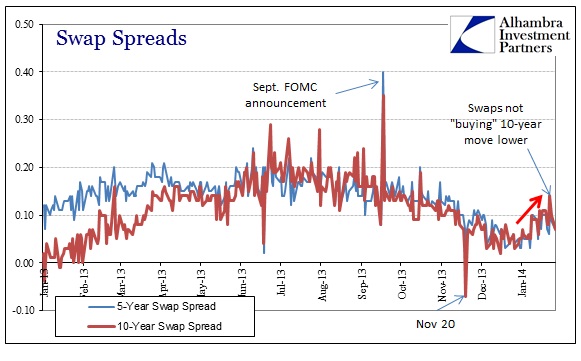

Since the 10-year has re-converged back with the 5-year, you have to wonder how much buying support there will be to take the curve even flatter. That sentiment is echoed in swaps rates, as spreads have continued wider than more recent indications.

Perhaps this is a highlight of the impact the Fed’s new 10-year purchases is having on that part of the curve, making it appear more bid than the rest of the market actually is willing. Since the Fed cares little for such fundamental factors, they would buy the 10-year regardless of any correlations or tight financial relationships across derivatives markets, that the rest of the market is not following is unsurprising. That suggests the limitations to the Fed’s actual abilities beyond moral suasion.

What is really interesting is that the rest of the credit markets, using less than ideal proxies here, have noticeably moved in opposite directions. High yield and muni bonds are back at levels we saw almost before the big selloff at midyear.

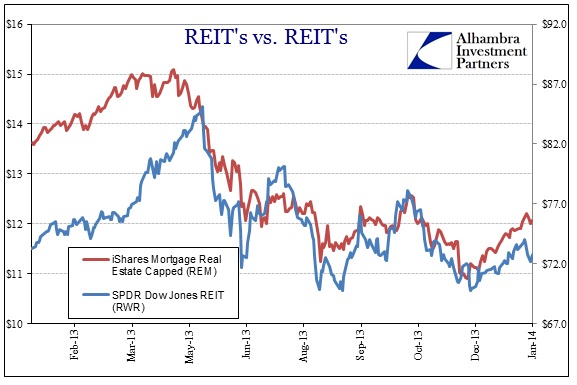

High yield debt is actually well above (lower yield) where it stood to start 2013, meaning that investors here have largely discounted any and all volatility and rate structure changes. But that does not extend into REIT’s, in either type. While there has been some renewed buying more recently, prices and yields are nowhere close to the pre-selloff levels, another divergence that opened when the funding markets “turned” on September 5.

So where does that leave credit markets in the wake of two consecutive tapers? I think it leaves them in pieces where markets have ceased to operate as a monolithic whole (or at least as much as they did when everything was going up in price simultaneously prior to the first taper hint), making credit far more complex. As the FOMC vehemently protests, taper is not tightening, and in some markets (more retail oriented) that mythology seems to be holding up. In other markets, particularly foreign trade and the eurodollar nexus, that seems far less to be the case. Credit markets are not amused by such complexity and volatility.

As is usual with paradigm shifts, there is growing element of disorder across the complex, some of which is being captured in volatility of not only rates (even the 10-year has seen some pretty violent swings in the past few days) but in funding. As I noted yesterday, that means a change in financial modeling across participant sectors. Now that disorder has become more entrenched (see November 20) we will see where those downstream effects become most concentrated – we already know that emerging markets are bearing the heavy burden right now.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch