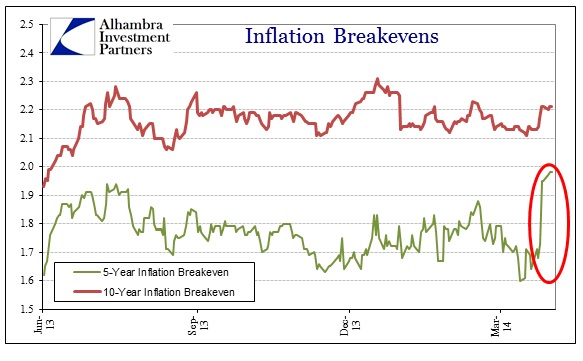

Unfortunately, the SOMA details for the week ended April 23 show no Open Market purchases of any TIPS. I say that is unfortunate because it would have provided an easy answer to the breakevens mystery I noted on Wednesday. As it is, the 5-year breakevens remain elevated on apparently well-bid 5-year TIPS.

Swap spreads have decompressed almost fully in the 10-year maturity, indicating no such concurrence out that far on the curve, and, as noted in the chart above, 10-year breakevens remain well within (suspiciously or confusingly) the range that has hardily prevailed since June. Five-year swap spreads have decompressed by a one basis point, offering no confirmation to the breakevens. Eurodollars continue to spill no secrets and no other parts of the money or credit markets are worth mentioning – the 5-year TIPS remain alone. If swaps had been the market to stand out, I would think it a far more meaningful change, but TIPS is a guppy among sharks, more easily susceptible to the potential of non-market allures.

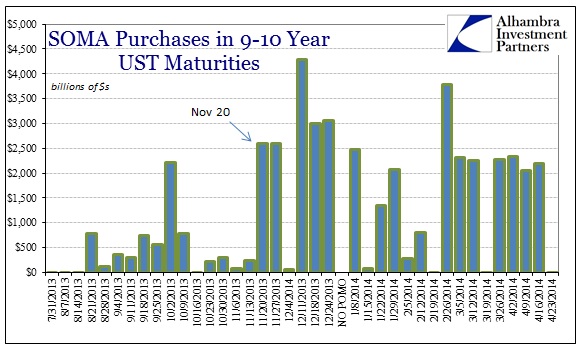

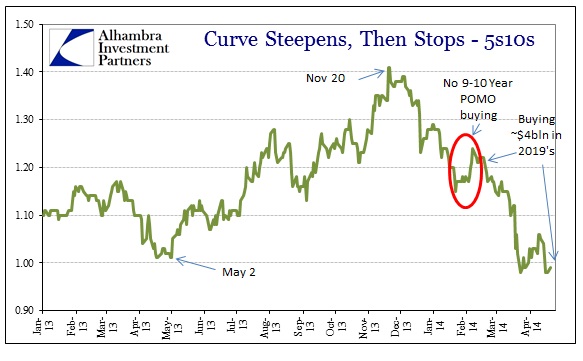

That doesn’t mean the 5-year space is without colorable commentary. We know that the Fed intentionally deviated from “established” (whatever that may mean, more on that below) POMO buying on November 20 in what can only be discerned as an attempt to “rescue” the 10-year. Not only did we see a swaps anomaly on that date, but that was also the exact apex in the steepening trend rippling out of the violent midyear credit market selloff.

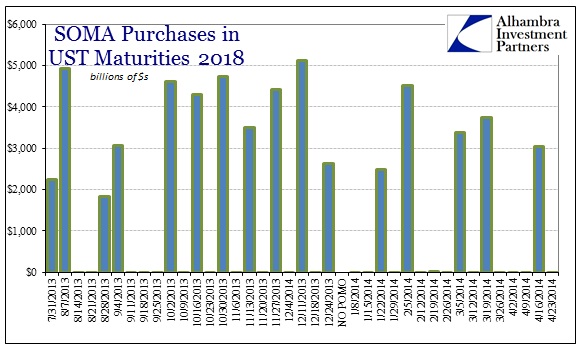

Aside from the week of October 2, the change in behavior is obvious as POMO mostly stayed away from the 2023 and 2024 maturities until November 20. That is in sharp contrast to buying behavior in the 2018’s – which would have counted in the 5-year at points last year.

The contrast is quite remarkable, I think, in that the pattern in the 2018’s appears almost preset. Up until September 4 (remember that date was a major turning point in eurodollars) the Open Market Desk was buying 2018’s in a four week recurring pattern – about $2 billion, the next week heavier, then two weeks off. After re-engaging in early October, taking pause around the memorable September FOMC meeting, the Open Market Desk bought nearly the same amount every other week until Christmas. Depending on what they do next week, it appears as if a new pattern is repeating in 2014 – buying similar amounts in two out of three weeks, then skipping three weeks.

In other words, in this maturity it looks pre-programmed to where they are just buying because they have to buy. It seems very much intentional in its conveyance of not trying to intervene or influence, exactly the opposite of the 10-year.

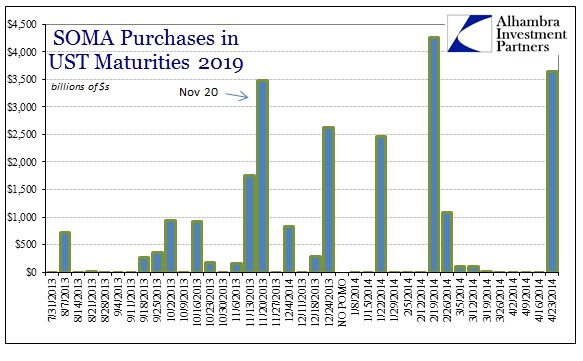

At the other end of the 5s10s curve shape, the history of disruption in the 2019’s are much like the 2023’s and 2024’s.

The sporadic buying here could just be randomness, a plugline at the end of the POMO list, but given the importance of the 5-year, as with the 10-year, it does create some wonder. The weekly amounts when the Fed did commit argue against randomness, however, particularly November 20 and the two heavy weeks in 2014: February 19 and, of course, the latest week (which also includes the Thursday before Easter).

Might there have been some spillover into 5-year TIPS? Perhaps, but I’m not sure why or how that would work; what mechanism might exist – traders simulcasting the Open Market Desk in a much less liquid market on a very low liquidity day? It doesn’t seem very likely, only very curious that they would pick this week to suddenly jump into the 5-year.

Maybe this is just we are to expect given the “confused” state of credit markets. None of this would at all matter if the Fed was an economic buyer, placing funds for fundamental and economic reasons rather than “trying to send a message”, as it were. In that case, we would only take note of the interest rate or the bond price and be imbibed with real and true information which could set up fruitful analysis. Instead, too much emphasis remains on policy disruption because of where it all ends up.

Despite any interventions, the ranges that have captured all these segments remain firmly in place. More mud for what is already a muddy state, where the mystery and stasis will both endure for at least another week, it appears.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch