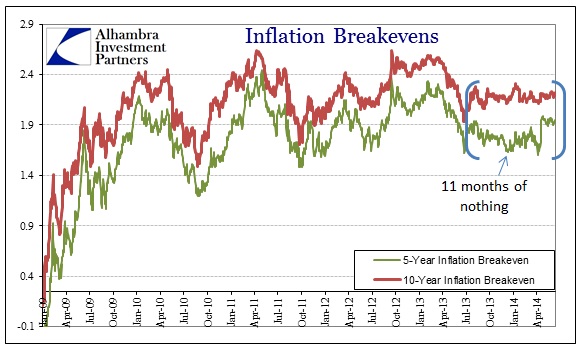

Despite all the fireworks in the treasury market at the end of May, the gripping stasis in inflation trading remained undeterred by the round trip. We have passed into the eleventh consecutive month of such dearth, an absolutely astounding stretch unmatched by anything since TIPS were introduced in 2003. At this point it becomes a race to see how long this part of the credit market can remain so visibly entrenched on the sidelines.

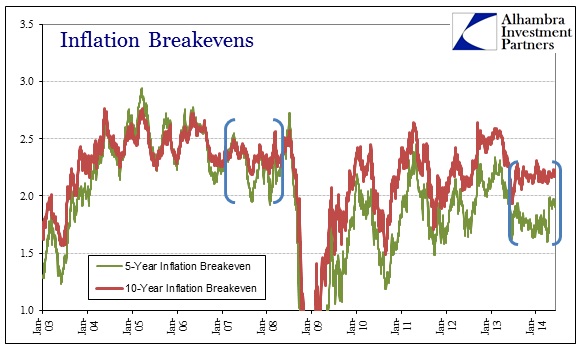

The only prior period even remotely comparable to this current stasis is, of course, the months leading up to the Great Recession. And why wouldn’t it be that way, given the contradictory positioning and overviews of 2007 and 2008. That included everything we have today, from policy uncertainty to dramatic financial irregularities (though in different places), and behind it all the conflict between the nagging feeling the economy was in trouble balanced against nothing more than Fed economists’ word that it wasn’t (and then Bernanke’s promise that he could contain and fix it).

Normally you would expect TIPS trading to be somewhat alive given that market’s place as a secondary outlet for hedging rate exposure. That we see nothing in breakevens despite clear indications of hedging over-extended credit positions recently is more than curious. Has the recent central bank-induced credit market shakedown removed so much volume as to make this market unsuitable? You do have to wonder about downstream effects if that is true, after all collateral problems have been a persistent downside to all of this monetarism.

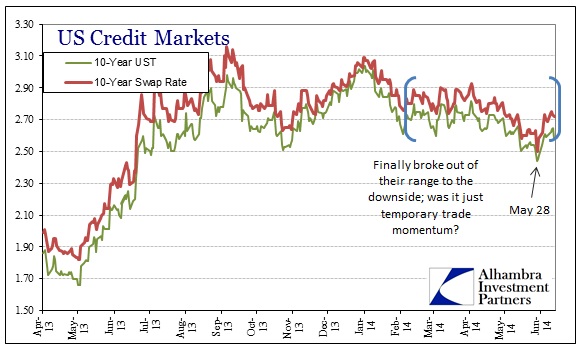

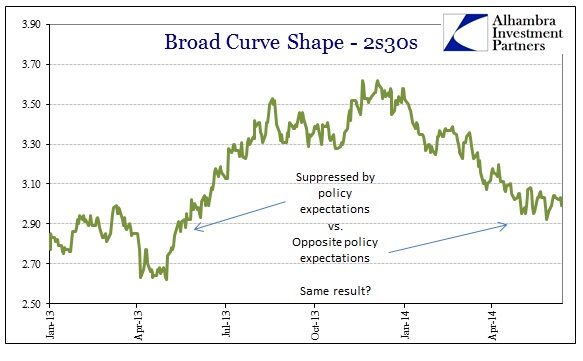

With so many treasury shorts, the immense, near-vertical bear flattening finally erupted into irregularity on May 28 and 29. The 10-year UST broke down below 2.50% and clearly disrupted markets, as there were notations in both swaps and eurodollars.

Both eurodollars and swap spreads indicate a surge in hedging activity to either offset short exposure or to significantly re-adjust duration and slope positions. It was very interesting that eurodollar swaps moved lower all the way down into 2015, quite far into the expected “policy window.”

Through the whole of the episode, the bear flattening was never disturbed – at most put on hold temporarily. Flattening continues to clutch the credit curves across funding markets and treasuries, with the belly moving now to a new post-selloff low/flat.

Again, no matter all of this, inflation indications remain dead silent. I suppose there could exist circumstances where this would be considered normal or intuitive, but they escape me.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch