Even though this was released last week, I place a great deal of importance on earned income as an economic indicator so I wanted to mention it anyway. A healthy economy will produce healthy wage gains because work is the basic exchange that creates wealth. Actual, productive wealth is the foundation for long-term economic expansion, of the sustainable kind, so wages are both a signal (not the only) and a predicate condition.

Unfortunately, the economics “profession” has ceased to identify with earned income, fashioning more of a fancy with price changes and what is really Fabianist “underconsumption” glossed by elegant, but misused, regression statistics (a tendency to totally dismiss savings as a primary productive tool).

Japan is the primary example of all of that, having spent now a quarter of a century in economic purgatory created by the persistence of such ideology and its command-type structure. In the last year or so, the primary symptom of this pathology has been to intentionally trade “deflation” (badly defined here) for “inflation” as if one was not simply the related but inverse case of the other. In other words, one kind of instability has been traded for another with the incoherent expectation that it will somehow stir the pot into a healthy and true expansion.

The initial estimates for May in terms of Japanese labor showed an actual increase in scheduled wages. That would be the first such increase in two years, except that this would also be the third time the initial data indicated as much. The two previous instances of initial increases were eventually revised below zero, owing to the manner in which the data is collected. For some reason, the Ministry of Health, Labour and Welfare does not receive wage data from part-time employment in proportion at the advance.

That simply means as more data comes in to round out the statistics, it is disproportionately part-time, and thus biased lower – likely meaning that this third “first time” increase will not be the last, nor will it last.

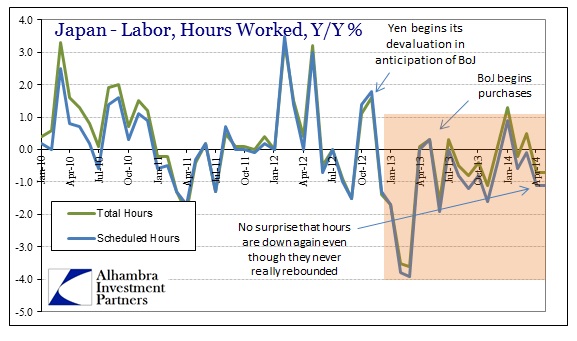

Again, you can change the unit of account (currency) or the second derivatives of prices and it is still not the same thing as creating productive wealth. As with wages, productive utilization of labor is the foundation of the modern, non-barter economy. Fewer aggregate hours worked is not a positive signal as it undermines the yen-driven picture of “pump priming” – making businesses nominally more profitable is not the same thing as an actual increase in business volume.

Setting all that aside, however, the Bank of Japan has gained exactly what it identified would be the key to Japan’s assumed recovery. Prices have changed, and noticeably so in exactly that manner. The more this takes place, though, the further behind Japanese households become; even if wages did actually grow nominally in May they are so very far behind the cost of living as to be inconsequential.

There is no reason to wonder why household spending collapsed far worse than expected in May as there is simply no way to sustain any kind of actual growth from intentional instability. There is no recovery here on any terms but financialisms.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch