The FOMC policy statement confirms without much doubt that there has been a major shift in conditions and outlook. To reiterate in what cannot be overstated, the purpose of implementing QE was to create economic conditions that conformed to the historical understanding of economic growth. If not so much 1995, Bernanke’s FOMC wanted to return to at least 2005 and even encouraged another housing “anomaly” to do it with their MBS interference in production coupon spreads. Outwardly, at least, there was no doubt of QE’s potential efficacy at the start of QE3 (much like QE2), as every single orthodox model, from ferbus to GARCH to the TVP-VAR varieties, was absolutely assured that a full and sustainable recovery would result merely from the implementation.

The major thrust of QE is, again, psychology and rational expectations theory. It was believed then without critical comment or reservation that a negative real interest rate would “push” activity forward, creating spending that begets more spending and so on. To obtain a negative real interest rate was the assumed inflationary function of QE psychology; generically, monetary policy is believed by policymakers to have such an influence on “market” participants.

Without wasting time with a rehash of events since then, the main point here is that the current beliefs about QE have certainly “evolved”, due in full part to the failure of it to live up to Bernanke’s expectations and public proclamations. We won’t know until the actual transcripts are released five years from now how much the Yellen change has had to do with it, or whether Bernanke himself developed his views last year toward the end (really since he first uttered the word taper in May 2013).

But that doesn’t mean what I think it should mean in terms of revisiting the subject in light of this “evolution.” Instead, what is taking place is an unseemly effort to maintain the full paradigm while incorporating this new information. The Wall Street Journal’s Jon Hilsenrath provides today’s context:

Critics have long argued the program risks causing another financial bubble or excessive inflation, without giving an obvious boost to hiring. Fed officials and other supporters of the program argue it has helped the economy grow faster than it would otherwise grow, with limited risk.

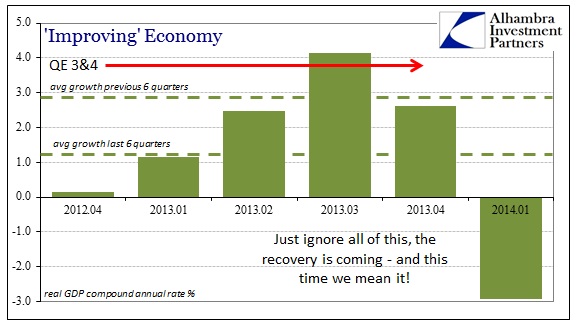

Like the ARRA, disparagingly known to history as “the stimulus bill”, QE is being placed in the category where it did not “create” jobs as thought, but may have “saved” them in a manner wholly impenetrable to falsification. Monetary policy did not perform as advertised, but in downgrading the assessment the committee is at least maintaining the absurd idea that QE at least performed in some manner. It’s an admission without admitting much, certainly staying away from full surrender despite the obvious contradiction of the past few years (not the least of which was recent history of the “unexpectedly” horrendous first quarter).

This reduction of standards is the way in which the orthodoxy maintains the illusion of authority. In November 2010, nearly four years ago now, a full recovery was promised; and then again in September 2012. As quietly as a church mouse, with nary but a whimper, the very guarantors of economic function are now unobtrusively rewriting QE to hold far less power than first thought, and that the fault in the calculation lay not in its practitioners’ simplifications, theories and modeled assumptions but in you and me.

Relatedly, the FOMC statement also included a reference to what I believe is the optimal control reasoning for ending QE.

Nonetheless, the risks to the forecast for real GDP growth were viewed as tilted a little to the downside, as neither monetary policy nor fiscal policy was seen as being well positioned to help the economy withstand adverse shocks.

In other words, there is no way they can be operating a QE program, even tapered, while the economy falls into recession. Outwardly, that would destroy all credibility which is the one assumed engine of monetary policy that actually falls inline with modern rational expectations theory. While the FOMC statement totally ignores what happened in the first quarter, only vaguely referencing (and only one time) “downward surprises” (and actually using that in the context of both unemployment and real GDP), they still maintain that the economy will pickup from here on. Talk up only the good “expectations” while downplaying the “surprise” reality?

The other piece of confirmation here is that there is a limit to how far they can stretch these “expectations” while maintaining even a shred of plausibility. Like Wal-Mart, they are forced to admit what is reality, and it is a huge blow to monetarism. While they grope around to try to maintain the illusion for a little while longer, such as ending QE before it really gets “unexpectedly” worse, there has to be some luster lost for their trouble. I think that is the bond market as the curve flattens broadly – an end to central bank promises on the front end coupled to the economic disenchantment on the back.

Again, I think this confirms without much doubt the idea of a monetary policy shift. Unfortunately, it should be more of a harsh and paradigm-ending rebuke than a cause for slight recalibration. As such, the road to Japan circa 1994 is sadly still wide open.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch