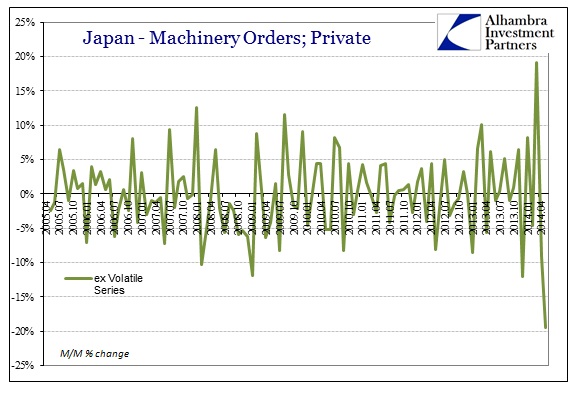

The post tax data coming in from Japan continues to perform far worse than expected under the assumption of an actual recovery (that’s too long for mainstream adoption, but if there was a common mantra for the globe since 2009 that’s as close as it may get). Household spending and real estate contracted in April, as expected, but it wasn’t limited to a single month which “complicates” the recovery theory. As if on cue, machinery orders, which is the prime gauge of capital spending, had its worst month on record in May.

As if to prove this point fully, economists were actually predicting a gain over April, as if that one month’s decline was to be the full extent of the tax intrusion:

The slide, the biggest in data back to 1987, was larger than forecast by all 23 economists surveyed by Bloomberg News. The median projection was for a 0.7 percent gain.

That’s a pretty significant miss in expectations, as instead of +0.7% M/M the actual figure was -19.5%. That is not a typo in the previous sentence, the actual monthly change was -19.5% rather than the expected slightly positive growth.

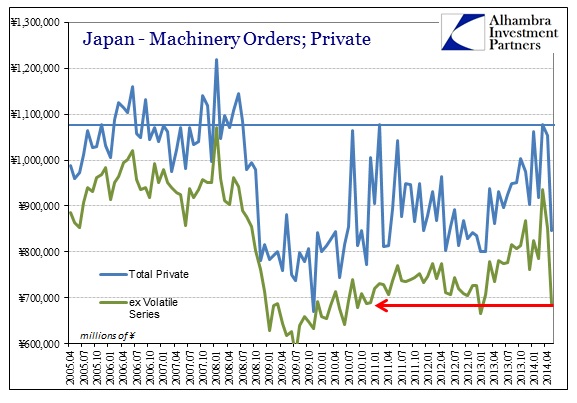

Worse, though, the decline in machinery orders in the private economy actually sunk back to levels not seen since before the earthquake in 2011 – a level not much better than the worst days of 2009.

And none of these figures take into account yen devaluation, which has distorted nominal prices in capital goods far more than those of consumer goods.

Despite all of this, there is nothing that will dethrone the recovery idea as it governs all of economic commentary. The Bank of Japan says it will force a recovery so nobody bothers to argue otherwise, and any contradictory data (which is practically all of it) is just a temporary hurdle to be overcome by financialism – at some distant point that never seems to arrive.

“While this a very volatile indicator, today’s figure is still ugly,” said Hiroshi Shiraishi, senior economist at BNP Paribas SA in Tokyo. “It will take a while for Japan to achieve a self-sustained recovery as consumer spending will slow on the sales-tax hike, exports are weak and capital spending is only gradually recovering.”

Taking that last sentence from the obligatory credentialed economist, in other words there is nothing in Japan to indicate a recovery, consumers, exports, businesses, etc., but faith in it remains steadfastly unshakable. What science ignores all observation? Such is the unearned power of monetarism, despite two and a half decades of it (and more, since we cannot forget about how Japan fell into such disrepair in the first place) in only increasing dosages, there is no end in sight to its hold on the mainstream canonical faith.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch