For all the drama and activity of bearishness in August, curve steepening has been the primary influence in September. There haven’t been as many notable events that would easily and cleanly explain the sudden shift, other than peculiarities in the cash markets (including supply flow). In other words, I don’t think it much of a breakout of sudden optimism but rather some very real questions about what a broad “exit” might look like in the US spilling over to global funding.

I think that was the message provided by eurodollar behavior as the curve remained quite as flat, but the pivot upon that point clearly shifted to the end of 2017 and even 2018.

You can attribute that to “hawkishness” or less “dovishness” or whatever, to me it is very much an uncertainty by which funding markets don’t know how to “price” the disparity between a potential end to ZIRP and “secular stagnation” (and how would they, nothing like this has ever occurred).

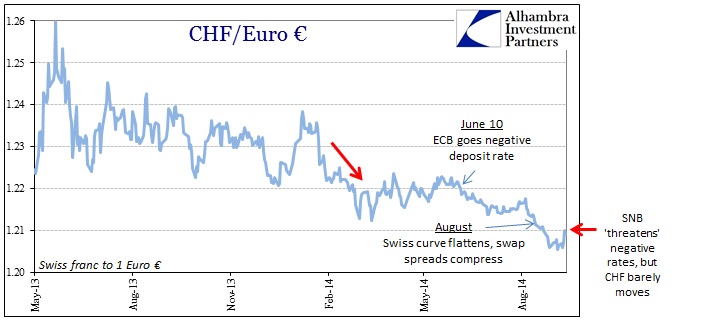

Whether that spilled over into global credit or not, particularly Europe, is unclear, as it may be European factors taking hold of European bonds. However, given the state of derivatives markets, particularly Swiss swaps and the Swiss franc, it doesn’t appear as if sentiment has shifted all that much whatever the cash market positions.

That said, bond curves removed much or all of August’s flattening:

And where the Swiss gov’t curve followed, swaps did not as spreads remained quite compressed.

Again, the franc seems to be more aligned with swaps than cash bonds, meaning still unresolved uncertainty about Europe and the euro. Instead, there seems to be growing unease about how interest rates in general will look around the world, as well as funding availability for all these positions once (or if) the Fed gets to any “exit” point. That, of course, remains to be seen, but uncertainty in all these places is not such a good place to start. Volatility around inflections is expected, but usually that happens from a relatively benign start.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch