I probably should start by issuing the caveat that it is dangerous to compare anything of the modern age to the revolution in astronomy dating back to the time of Copernicus. This is not at all about the supposed lack of tolerance at the time, as it seems as if there was more than enough willingness to at least hear what Copernicus had to say. But then, like in so many disciplines undergoing changes, those struggling to hold the older paradigm were increasingly blinded by ideology in the face of empiricism.

One of the arguments advanced against the Copernican model was that it “required” a great deal of space to explain the lack of movements among the stars. If the earth was rotating around the sun as he (and others) alleged, then certainly the stars would have to move as our relation to them did. To the limited observation techniques of the time, the stars were fixed and thus “confirmed” that the earth must be as well.

So in that respect, the old view was running against the new mathematics in what was seemingly irreducible disagreement. The absence of ability to measure the stellar parallax meant that for more than two hundred years there was no way to confirm Copernicus in observation, which allowed alternate theories to be maintained and expanded. Part of the problem was that observers could indeed measure a parallactic shift, but in almost every case it was in the “wrong” direction or contrary to theory (or crude mathematical calculations).

That limitation convinced even the great astronomer Tycho Brahe to maintain the Aristotelian “laws” of motion and physics, as he was indefatigable in his careful observations – he could not measure any shift in the movement of the stars, going so far to even disprove everyone else that said they could (to that point). The simplest explanation to maintain consistency with the math rather than the ancient philosophy was too difficult. Brahe’s story shows that very well especially in his measurements of the movements for the Comet of 1577 which proved that the “universe” had to be bigger than anyone previously suggested, yet it was still somehow too unbelievable to make the intuitive leap to such an immense scale as to explain seemingly immovable stars.

From that hyperbolic setup I go to this (from the WSJ):

Last Monday, CFTC officials briefed the federal government’s Financial Stability Oversight Council on activity in Treasury-futures trading on Oct. 15. The amount of Treasury futures traded at CME Group Inc. doubled from the prior day’s levels.

The moves also dominated recent discussions with the Treasury Borrowing Advisory Committee, but the group said “no firm conclusions could be drawn without further analysis” about who and what was driving it.

There have been a trickle of references only here and there to the extraordinary events of that day, October 15, which would be surprising to even your average “investor” who probably has heard little of it. But what is numbing to anyone with a reasonable intuition is that last sentence quoted above, as if “no firm conclusions could be drawn without further analysis” about an episode that has been cultivating and burning underneath for months. This is most decidedly not Tycho Brahe’s epistemology waiting a quarter of a millennium for more advancement in telescopes.

Take the descriptions that keep leaking out, again from WSJ:

The yield on the 10-year Treasury note took a sharp dive below 2% within minutes, and few could understand exactly why. Some dealers immediately pulled the plug on automated trading systems that provided price quotes to customers. Fund managers rushed to convene meetings. Many investors scrambled to pinpoint the reason behind the accelerating decline…

At the time, bond-market analysts attributed the fall in yields to weak U.S. economic data, shaky European markets and hedge funds scrambling to cover wrong-way bets. But many investors felt that didn’t fully explain why the yield on the 10-year Treasury note tumbled to its biggest one-day decline since 2009. When yields fall, prices rise.

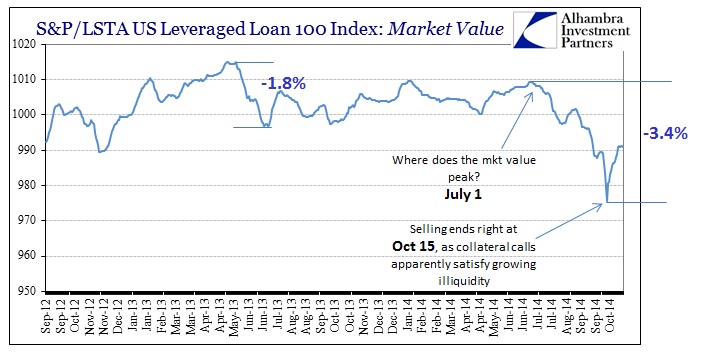

Of course those descriptions failed to account fully, as the direction of the “crash” (and the timing right at the open) was as important as the magnitude. If you want a proximate cause for what might cause highly leveraged positions to suddenly and sharply post collateral, there is no math needed:

The junk market for corporate debt had simply grown largely untenable by the middle of October, and for a lot of the same reasons that were used to describe the reduction in treasury yields. From highly leveraged price reversal to collateral calls is not that far of a leap, especially since the prices shown here are the “most” liquid, meaning that the vast majority of junk credit was likely in far worse shape than we could/can measure.

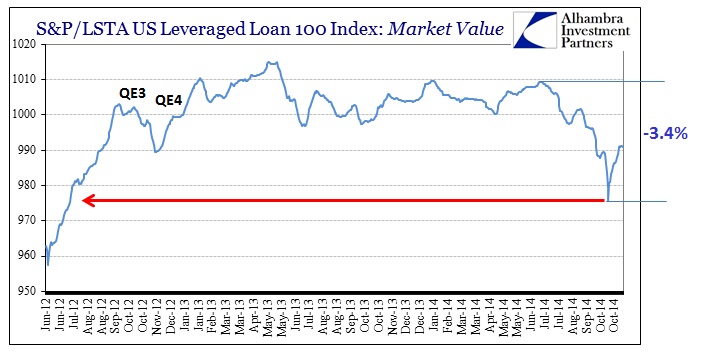

Where this becomes problematic is in the orthodox treatment of it all, and thus conforms to the (admittedly forced) Brahe narrative. If you believe that liquidity and the “markets” surrounding it and by it are “resilient” as Janet Yellen does, then none of this makes sense – October 15 was a bolt out of the blue that was a sudden and intense shock causing no less than sudden and intense shock in regulators. In other words, if you are operating under the impression that almost every large financial issue has been successfully lambasted by QE’s and “macroprudential” policies, then you have been likewise busy in downplaying the appearance of incongruities. If you start from the fixed position that the financial world has never been better, then anything inconvenient is extraordinarily difficult to interpret.

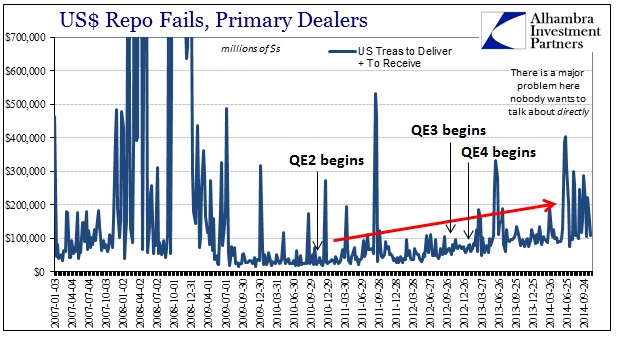

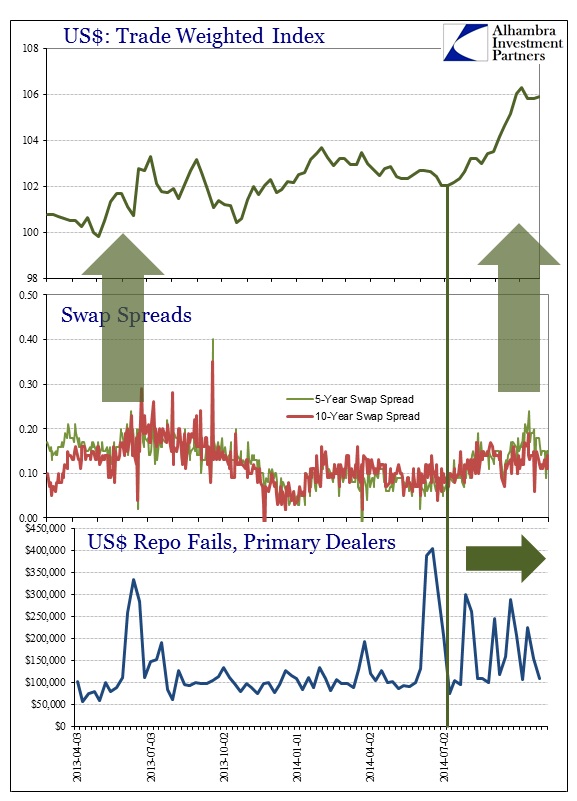

The chief “incongruity” to which regulators (and most commentary) have been trying desperately to ignore is the sudden bout of repo fails. You can hear Brahe-like explanations about “too many” UST shorts looking to confirm the Fed’s preferred narrative about a healthy economy and actual exit. Instead, there is a much deeper problem that should not lack for appreciation but does because ideology demands conformity of, ironically, sunshine.

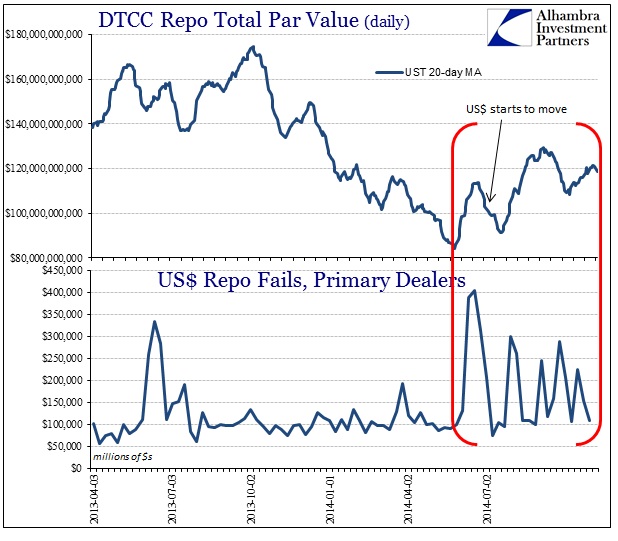

With everything that has transpired in the past few months, October 15 should have been anticipated not shocking. The increase in repo volumes starting in mid-June corresponded with a growing sense of nervousness about risk (ECB and Japan central bank failures), thus the rise in repo volumes that triggered an as-yet concluded spate of repo failures was easily viewed as a systemic liquidity degradation. So the adjustment in “dollars” was certainly in response to adjustments in central bank views, another facet that cannot be fathomed by the orthodox interpretation.

Unfortunately, this was not a local problem limited to a small and unimportant segment of a market nobody has really heard of. The last part remains true, but the importance of systemic liquidity via repo, especially at the margins, it seems, cannot be overstated.

Again, the connections here are not difficult to make and it doesn’t really require much specific knowledge of repo function (though some basic understanding of jargon and incentives is helpful). Previewing the change in physics into the 20th century with Einstein and relativity, everything here is relative to everything else and globally.

Instead of connecting these dots (at least in public, private conversations among policymakers may actually be starkly different) they remain confounded instead groping for answers among HFT and trading via electronic screens rather than telephone calls to salespeople. It really is too much for these people to accept illiquidity having seen four separate QE’s and trillions of “reserves” “created.” To say to them that QE reserves are inert, unimportant and totally irrelevant is too damaging to that worldview, especially in that the implications are also more than suggestive of monetary failure. To be more precise, they will probably never accept the idea that QE has been actually more harmful than beneficial.

In terms of “markets”, that would mean far less resilience and efficacy of central bank action than what has clearly built so much complacency. Thus October 15 has largely been discarded, banished from the primary place in topical discussions in favor of how stocks saw such a “healthy” correction in October and are primed for even more bullishness as the economy reaches its boom (though that too requires downplaying severe rebuke, this time in an angry electorate moved to the current elucidation of pitchforks by all the economic “progress”).

All this just means the next outbreak of “inconvenient” function will be just as surprising, though it clearly should not be. Illiquidity since June spawned a global “pause” in pricing that may have, this time, only perturbed just the surface. Like any complex system in a critical state, the appearance of disruption is not the end result, but a marker about progress toward the eventual shift to something more stable (paradigm shifts are rarely orderly).

Stay In Touch