Sovereign debt is the tangible pivot by which everything in Europe depends. That speaks not just to persistent fiscal imbalances that remain, years later, unresolved, but the unspeakable financial equivalent to a doomsday scenario. The damage to the European economy from the last financial panic is slowly being revealed (as with the unrequited and un-criticized promises of central banks), which only heightens worries if there is to be a “next” one. That is piqued further by the very parallel revelations that the ECB actually accomplished very little despite trillions of euros in “aid.”

As noted with the bank “stress tests”, the ECB took December 2013’s bond prices to be the “adverse scenario”, meaning they cannot allow sovereign bonds, even PIIGS, to stray too far away from current levels. That was patently absurd on its face since Europe had very close experience, meaning reality, that was far, far worse than December 2013. The emphasis then was simply that they could not even hint that Draghi’s promise from July 2012 would be challenged, or all the artificial prices built up in bank books would, figuratively first, blow up.

While I don’t doubt that Draghi is looking to shore up his “intent” on managing inflation expectations with talk of European “QE”, there is at least an indirect point of emphasis toward sovereign bond prices to not even think about challenging his promise to “do whatever it takes.”

Draghi reiterated the ECB was ready to do more if inflation remained too low for too long, saying ECB staff was preparing the ground for further steps should they become necessary, and such new measures could include purchases of sovereign bonds.

‘We see early indications that our credit easing package is delivering tangible benefits,’ Draghi told lawmakers in the European Parliament, adding that more time was needed for the latest measures to unfold.

And added: ‘We need to remain alert to possible downside risks to our outlook for inflation, in particular against the background of a weakening growth momentum and continued subdued monetary and credit dynamics.’

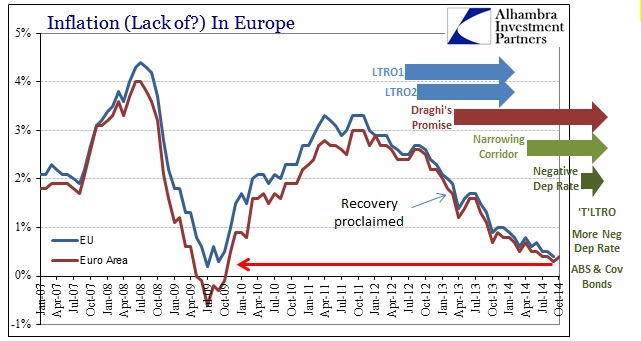

Again, I don’t know how Draghi can get away with saying things like that, “to do more if inflation remained too low for too long.” This is not a “problem” (for orthodox economists, anyway) that just appeared as if from nowhere yesterday. The track of “inflation” in Europe has been established and durable for more than three years now despite everything the ECB has done, up to and including that July 2012 “promise.”

In other words, if “markets” begin to doubt the ECB where will that show up first? Likely in PIIGS bond prices as they are nothing if not fully artificial to the July 2012 “promise.” If the ECB’s pledge on inflation is invalidated by economic failure, i.e., reality, then there is nothing left holding PIIGS in check – and the ECB well knows that if prices start to roll downhill they will quickly pick up steam with all the leverage piled into that space predicated on only one factor, namely that prices “can’t” ever reverse.

So where Draghi and the ECB publicly proclaimed QE as “unnecessary” and previously disallowed, we now see his staff suddenly “looking into it.” Panic in PIIGS is the end of the road, a road that may have just gotten a little shorter.

Stay In Touch