There is so much depth that is missing from the ongoing discussion about the state of “markets” as the Federal Reserve purportedly moves toward “normalizing” its regime. That isn’t all that surprising given that most people still have never heard of these various moving parts, and certainly cannot easily grasp the concepts without some degree of studied initiation. While you would expect that of the general public, it seems to be the case for policymakers too.

In some respects, that isn’t all that unexpected either since the vast majority of policymakers are economists, with a few bankers thrown in here and there. The bankers, especially at FRBNY, clearly understand some of the implications and difficulties, but to the economists (who are really just statisticians) generic terms like “interest rates” and “money supply”, leading to a “loose” policy stance, are all that they care and apply. Again, the lack of depth is disturbing when so much is riding on these people to get it right (because they never seem to be linked to how they have been so wrong for so long).

And there is so much depth to financial markets in this modern age, tracing back to the point at which the traditional banking system, and even the actual practical application of “currency”, changed forever. Many still haven’t got that memo and remain anchored anachronistically to a system that no longer exists in anything but college textbooks (yes, I am still talking about economists).

The media drives convention, unfortunately, from the economists and therefore so much vital information is lost, creating unending misleading commentary and total misdirection. So it is now with October 15 and the “buying panic” in UST, somehow now blamed solely on electronic trading. Again, such simplistic views are frustrating in how little they fit the circumstance but also understandable coming from a group of policymakers so steeped in generic concepts as to be totally unprepared for their own activities.

I was going to use this space to write an obituary for the Fed’s “genius” “exit strategy” as it related to the “unquestionably effective” abilities of “our” central bank in its reverse repo program, but the folks at ZeroHedge have done an excellent job describing what is heretofore being totally ignored. In short, rather than admit the reverse repo program completely and utterly failed, the Fed is simply setting it aside and is on to the “next big genius idea” of “segregated cash accounts.” The mechanics and details there are important and I urge everyone to read them (if only to peer mercilessly into the next “unexpected” policy failure), but for my purposes here the point is that economists have admitted, internally yet again, they don’t know what they are doing.

The logical relation of that is to be completely wrong about October 15 and what has happened in global “money” dating back one year and one day. I dedicated my weekly Friday column to describing details both before and after October 15, but the main point of relation on that day was thus:

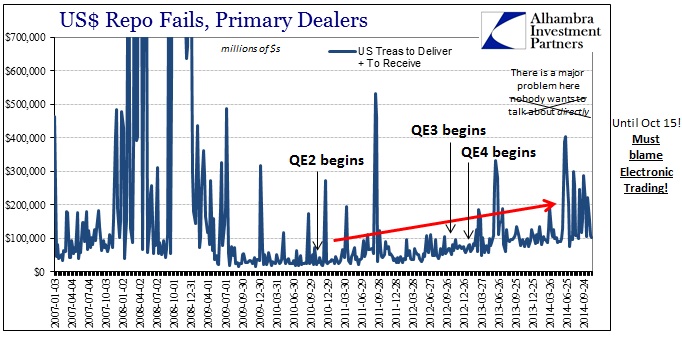

There is a mechanism in UST trading which is supposed to mitigate any such supply and demand imbalances, as the role of primary dealers is to see such “arbitrage” and use their immense balance sheet power to restrain it and turn it back toward “equilibrium” (if such a thing exists more than brief and fleeting moments). That clearly did not happen, so the presence of electronic order systems and even high frequency trading does not explain, at all, the absence of dealers.

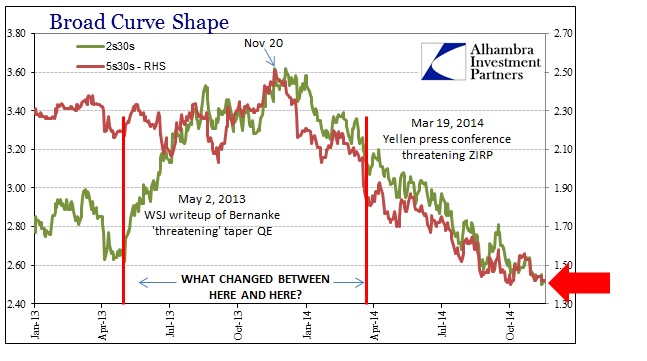

The appeal of electronic trading as a scapegoat is simply how it fits with the “narrative” whereby markets have been made “resilient” by QE, which goes doubly for the economy at large. If you actually study the behavior and details, what has transpired in the past six months in particular is a case study in ideological blindness. Credit and wholesale markets have been warning for some time that “resilience” is a myth, further that QE played a direct role in diminishing systemic capacity to which the reverse repo was supposed to alleviate, and by extension the recovery idea is not just an illusion but one which has lost its capacity for anesthetizing good sense.

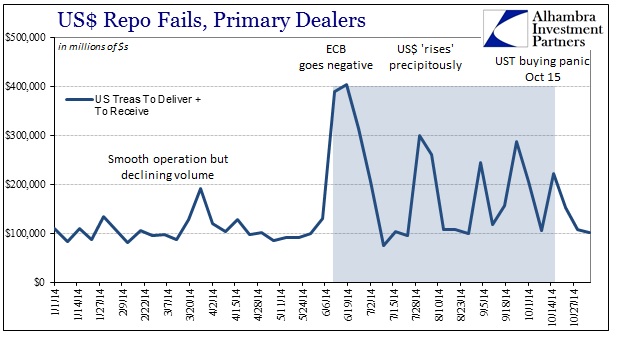

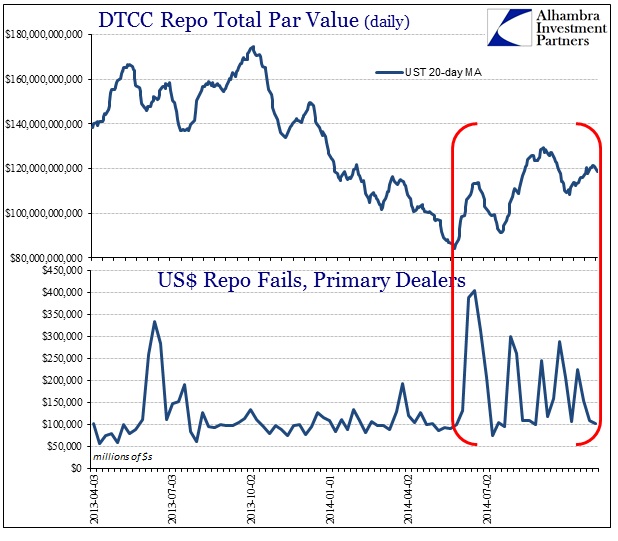

My intent here is a companion to that description with graphical details of the repo markets as good evidence of observation, which is inexorably linked to not just UST trading irregularity on October 15 but also systemic liquidity driving the global “dollar” positioning.

You might dismiss it as mere coincidence the sudden and significant appearance of repo fails the very week that the ECB desperately rode its rate “floor” to a negative nominal position, but there are vast and tight links between US$ behavior and the participation factors of European banks. Whatever set them afire, and I tend to believe it was a nervous shock that such a step was deemed “necessary” by the ECB, thus triggering a chain of balance sheet restraint that worked first through repo, everything set in motion at that time.

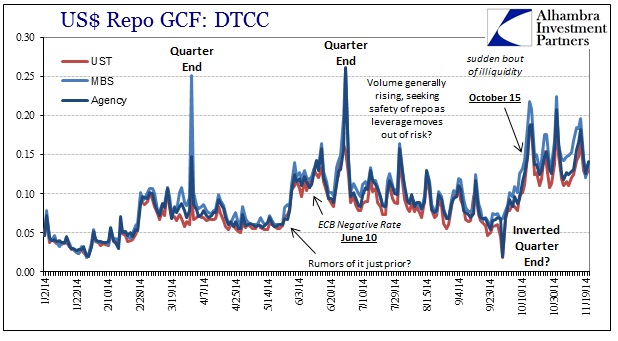

While repo fails are the most visible sign of distress here, and of its correlated timing, repo rates are also complimentary of the idea. Shown below are the General Collateral rates on trades flowing through DTCC, which means they are not comprehensive of the whole of the repo market in two important respects: they don’t include bespoke, bilateral repo arrangements which still make up the majority of repo finance; and general collateral is a generic rate that does not pick up “specialness” of individual securities that are, for whatever reasons, trading deeply special (and generating the fails).

That said, the GCF rates in each class are still illustrative of this behavior as I have described it:

There are a number of compelling points to be made here, but the most obvious is the jump in rates just prior to the ECB’s action on June 10. It wasn’t as if the decision was secret as Mario Draghi had been hinting (and no doubt “consulting” with banking contacts) beforehand, and it was actually announced on June 5. If there was a rush of “funds” coming out of Europe to flee the negative deposit rate, I would expect (with some important caveats, given the inordinate number of factors here) GCF rates to fall. Instead, there sudden and sustained rise which seems to indicate a sharp rise in demand for repo funding (less leverage available elsewhere in the liquidity system), which matches perfectly the rise in volume.

At quarter’s end on September 30, all three GCF rates inverted their usual quarter-end window dressing, suggesting a rush of funds seeking safety from other places – but only temporarily. From that point, all the way through October 15, GCF rates spike sharply higher which would, again, indicate troubling liquidity. In other words, these are all but symptoms of larger reverberations, ripples of disorder running through global markets unobstructed by the laughable reverse repo program or any such market and dollar “resiliency.” The fact that this was not contained in just esoteric markets such as repo, instead breaking out severely in foreign stock markets, bond markets and their currencies, as well as domestic stocks, particularly those most susceptible to leverage shifting, and even the price of oil, more than suggests this was a global shock – one that has yet to run its course.

The basis of that shock was, once more, in mechanical terms the deterioration of actual market function derived from four iterations of QE:

More importantly, however, this was the visible sign, a buildup across months and oceans, that the economic narrative is not penetrating global credit and leverage as it once did. The media can say it, but economic weakness and even the possible appearance of recession in locations all over the world, including the US, will not be “unexpected.”

Stay In Touch