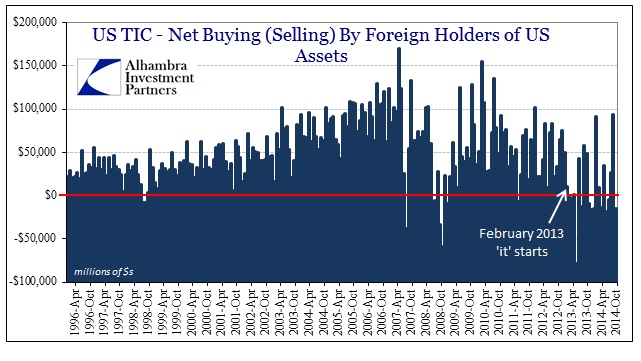

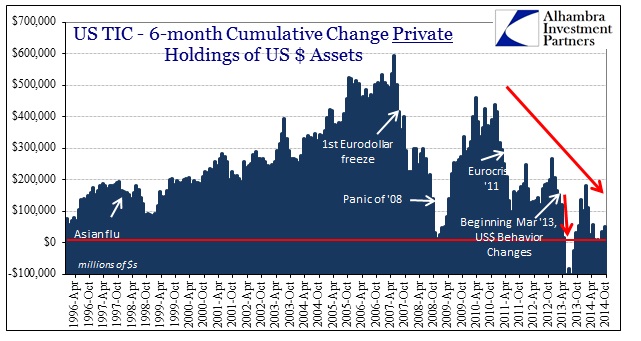

With the latest TIC data in hand it looks more and more like “dollar” problems started in the interior and spread outward. What I mean by that is eurodollar banks were the first to see or cause disruption which radiated outward into other currencies and credit systems. That would seem to confirm (for me, anyway) the ECB’s role in kicking off this second global “dollar” event.

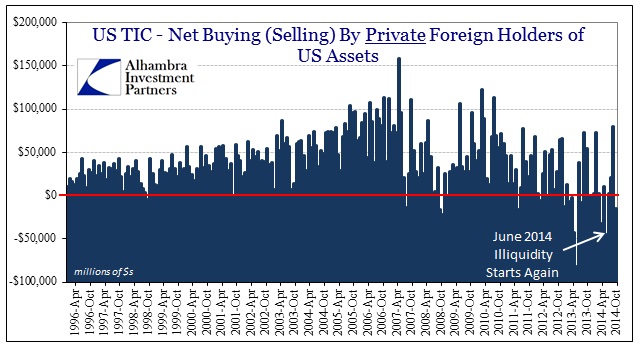

The first evidence of anything amiss is shown in June 2014’s private flows.

With October showing much smaller private “outflows” in October, but still an “outflow”, the comparison to June suggests that global disruption occurred afterward as I noted yesterday (the widespread “alert” in June was followed by what looked to be very calm in TIC flows while illiquidity grew internally). That would set up the expectation for November’s TIC data to see a much larger private outflow (and perhaps some broader central bank action) which would match the larger currency (and gold) effects witnessed post-October 15.

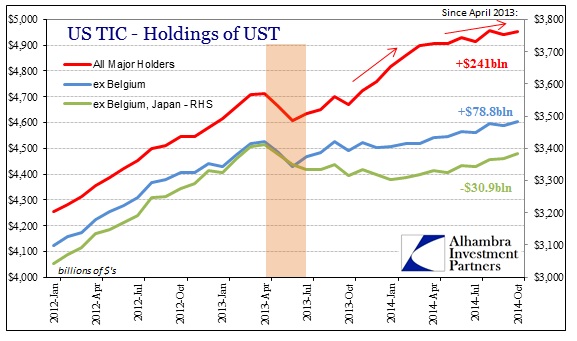

I also think these latest estimates confirm that Asia is if not the primary center of the disruption than at least somewhere far closer to it than anything seen before. That is a dramatic shift as Europe had always been the primary location of the “dollar short.” China’s ability to fund through dollars seems to have been permanently altered by the 2013 “tightening”; with major flares throughout 2014 related to “reform.”

The TIC data for October catches what looks like the beginning of the post-October 15 ripple into the exterior of the eurodollar system. The major focus for November will be on any central bank activity in the “official” segments to gauge how far and how deep this wave of disorder penetrated. Again, judging by currency prices almost everywhere, this has the makings of something larger than 2013’s version. “Tight dollars” are not an expression of optimism; to this degree is quite meaningful.

Stay In Touch