There was a lot to talk about at the last FOMC meeting, where most are focused on “patience” and all that about rate hikes. Less discussed and analyzed, as these areas are often difficult to parse for outsiders, was the fact that the savior of rate “normalization” has been totally and completely put out to pasture. The reverse repo program (RRP), once hailed as the tool of all tools, is now just a nice little experimental exercise in futility.

From the December meeting:

Regarding the ON RRP testing–during which the offered rate was varied between 3 and 10 basis points–increases in offered rates appeared to put some upward pressure on unsecured money market rates, as anticipated, and the offered rate continued to provide a soft floor for secured rates. Changes in the spread between the rate paid on reserves and the ON RRP offered rate did not appear to affect the volume of activity in the federal funds market. While the tests of ON RRPs had been informative, the staff suggested that additional testing could further improve understanding of how this supplementary tool could be used to achieve greater control of the federal funds rate during policy normalization.

In other words, if it was effective at all it wouldn’t require “additional testing.” If that wasn’t enough to effectively “kill” the idea, the committee voted unanimously for the $300 billion cap, meaning that the RRP is relegated to being essentially a backup of a backup.

Relatedly, there was (at least according to the minutes, though the full transcripts might reveal more depth in five years when they are released), absolutely no discussion whatsoever about October 15 or the disorder in repo markets. It could very well be that the Fed has decided it was unimportant, though I doubt that. Instead, better to ignore it than to shine official light upon a staining episode of serious disorder. While there has been relative calm in the weeks since October 15, that does not mean harmony. Repo fails spiked yet again in the second week of the month ending a quarter.

That would suggest at least continued perturbation in funding markets and at least minor collateral unsettling. Given the price action in corporate and high yield, especially leveraged lending, this is not at all surprising (especially as that week saw the near-term apex of the ruble fiasco and credit markets were deeply unsettled). There is nothing definitive about repo markets in December, only suggestions of continued and unwelcome unease.

The next option the Fed has been considering as a rate “floor” is the Term Deposit Facility, which is all but a carbon copy of the ECB’s usage. While there was heavy testing into December, there was almost no mention of the TDF in the minutes other than to acknowledge its basic existence.

Regarding the TDF testing, the introduction of an early withdrawal option led to significant increases in the number of participating depository institutions and in take-up relative to earlier operations without this feature. As expected, both participation and take-up in the operations continued to be sensitive to the offering rate and maximum individual award amount.

If they needed testing to find that out they are further behind the curve than anyone imagines (myself included). What those lines amount to is a word salad about the fact that they did “something”, conspicuously leaving out that said “something” was supposed to be useful in attaining the Fed’s stated goal, and thus how far along the testing went toward meeting that goal.

Given the hideous performance of the RRP, you would expect the FOMC to be speaking in glowing terms about the TDF if it had even the slightest reason to do so. Instead, the bland nothingness to which it is referred conveys a similar lack of satisfaction in that area. If this were baseball, that would be strike 3 on the Fed’s intended rate floor (with the first strike being the IOER and its tortured history).

As if it was needed, this is another reason the Fed is going to be awful slow toward lifting off ZIRP. That itself is made far more difficult by the fact that they don’t know what they are doing and just making it up as they go (with all fingers crossed). The backdrop of perpetual, it seems, repo disorder and a recalcitrant eurodollar market makes this a very dangerous game they are playing.

Another possibility was that market-based measures might be assigning considerable weight to less favorable outcomes for the U.S. economy in which the federal funds rate would remain low for quite some time or fall back to very low levels in the future, whereas the projections in the SEP report the paths for the federal funds rate that participants see as appropriate given their views of the most likely evolution of inflation and real activity.

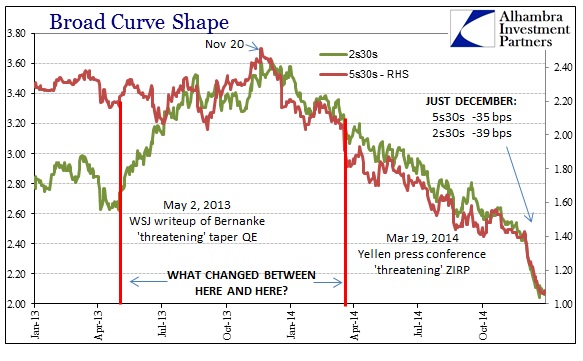

The SEP report is the Fed’s Summary for Economic Projections. In other words, “markets” realize the myriad complications for what the FOMC proclaims they want and that there is far more than a trivial chance they get it totally wrong (again); whereas the SEP is nothing but in-house, rosy projections about everything going right. Small wonder in which the FOMC says they place full confidence. Again, I think that was the essence of November 20, 2013, where the market “awoke” to the fact that the “exit” isn’t going to be anything like a “soft landing.” Continued testing in these areas is just more confirmation. That counts on both the economic front as well as these repeated and droll attempts at ECB mimicking.

Stay In Touch