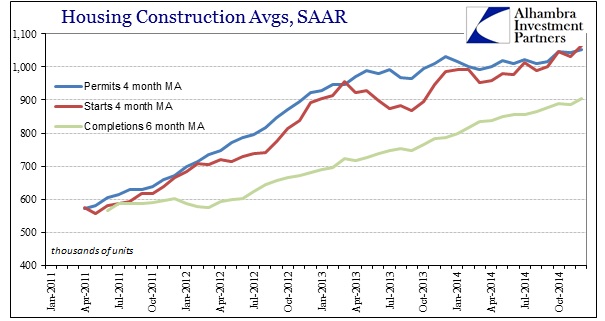

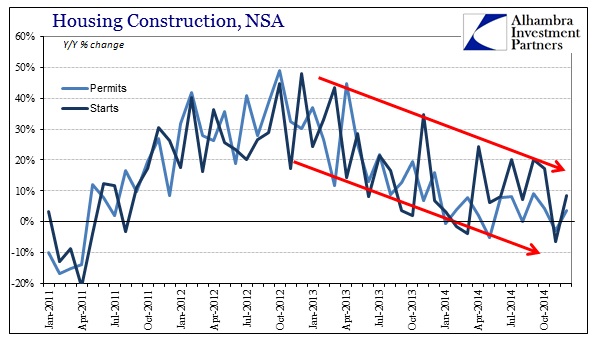

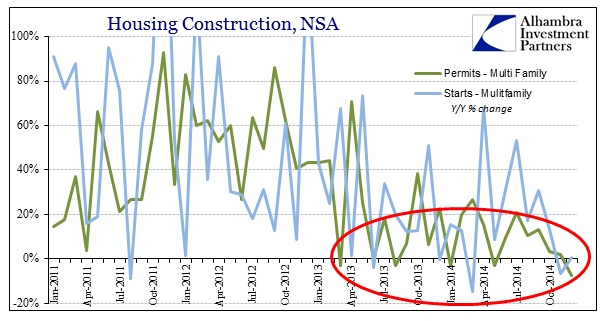

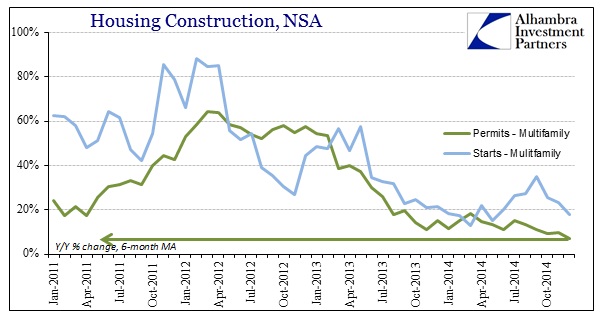

The latest figures on housing construction have almost flipped the circumstances from late 2013. It was apartment construction that kept up hope that any retrenchment in single family construction would not be so devastating. Permit and start activity was, at the margins, almost totally dependent on multi-family construction to offset weakness in single homes.

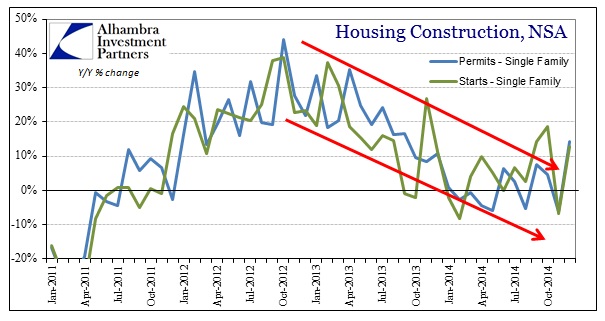

As of December 2014, the flattening of single family construction is all that is left to general home building. The apartment trend is as good as dead at this point, a curious result of an economy in the throes of a purported “boom.”

As it is, the single family figures may not even be “real” insofar as revisions have been serious and significant throughout the latter half of 2014. That means we will have to see more than a month of single family data to confirm any echo bounce (on top of the difficulty in the relatively large month-to-month volatility that gets worse in the winter).

For a good part of 2011 and most of 2012, economic activity in terms of construction was due almost exclusively to apartments (especially in the “old” bubble areas). You have to wonder, in real terms beyond silly GDP mechanics, what the erosion in apartment momentum might do to the effects of construction in these areas. In the first place, the fact that the multi-family segment is heading in this direction is not a very comforting gesture about the underlying state of households in the US.

Given the duration, relatively short, it takes on the elements of serious misallocation. In other words, cheap debt, institutionalized by QE2 and then QE3, created another wave of euphoria that did not live up to expectations. Now with all those apartments having hit the market, profits are proving far more difficult and thus are actually signaling the slowdown to current agents. In that respect, it would more than suggest that assumptions about the state of households made in the exhilaration over the QE’s were largely incorrect, and that the current state is seriously different, and diminished, against those expectations.

At the time it was unquestioned “wisdom” that QE would produce not just a “boom” in real estate construction, as it clearly did, but that such a “boom” would lead to a broader and general economic expansion – “aggregate demand” theory of spending for the sake of spending; in this case construction for the sake of construction once more. That flawed premise is yet again revealed in the relatively short duration of the up and then down of apartment activity.

As the FOMC was forced to recognize:

Although a few participants suggested that the recent uptick in the employment cost index or average hourly earnings could be a tentative sign of an upturn in wage growth, most participants saw no clear evidence of a broad-based acceleration in wages.

That was entirely the point of all this monetary intrusion, that spending even on and for construction would create exactly the circumstances where wages would rise and demonstrate that which we have all been waiting for. An economic “expansion” without wage growth is not a true expansion but rather far too artificial. Even if there were payroll enlargement in 2014, it is clearly still deficient by any reasonable standard.

The harsh reality of even the best case for jobs entering 2015 is that there may indeed be payroll expansion these days but it is still simply overwhelmed by past economic transgression. For all the hoopla about robust growth, the sad fact is full-time employment is still almost 2 million jobs behind the November 2007 peak. Yet, over the same period the population grew by 16.1 million! These are not the results of any true economic expansion, leaving only artificial conditions (at best) to explain the appearance of such.

So many Americans without gainful employment would certainly lead to depressed circumstances in home construction as they simply cannot afford anything but continued cohabitation under whatever individual circumstances have dominated since 2007 (and even as far back as 2006). And that would mean all the activity taking place in 2011 and 2012 was a false or artificial economic trend and condition. Redistribution very much tends to act in that manner.

Stay In Touch