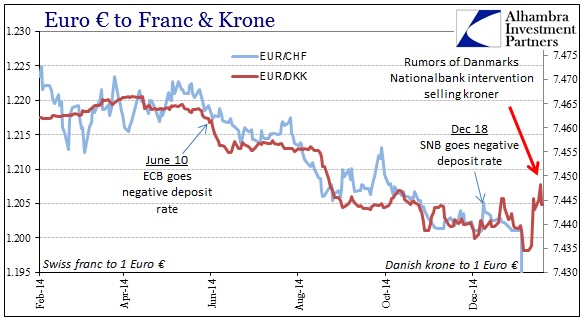

The Danish central bank, Danmarks Nationalbank, reduced its deposit rate floor by 15 bps to -0.5%. In what looks like a preemptive move aimed at potential destabilization ahead, so far they have managed to keep the krone from following in the franc’s destructiveness (short run). I think it is more than credibility at this point, after all the Swiss National Bank had that too, as there just isn’t a massive “dollar” problem for Denmark. They can “afford” to defend the currency because their banking system is much more directly related to the euro, and thus, once more, financial concerns override any potential economic fallout from being secured to the sinking Europeans.

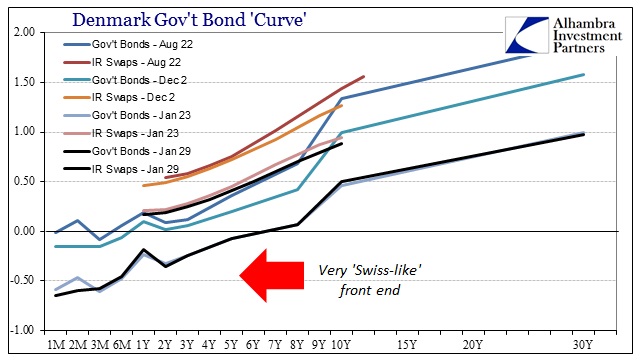

It was a pretty turbulent week in Europe, but the Danish Government bond curve barely budged. About the only parts moving were interest rate swaps, and they declined more or less in anticipation of exactly what Danmarks Nationalbank did today. By and large, the effects on kroner have been to create a divergence with the franc, finally recognizing a fundamental difference in those currency areas.

This isn’t to say that the passing of the Greek election and the QE in Europe have ended prior turmoil, only that “investor” reaction in the money markets has been bifurcated by the conditional realities that were before January 15 deemed unimportant.

Of course, this could all be temporary as there is far more than a trivial chance that disorder returns in quick succession. But with these currency system alternatives now moving in opposite directions it may signal the start of the next phase of this renewed crisis. By keeping the krone to the euro, it might reduce the effectiveness of any hedge against Europe, and therefore move pressure elsewhere. In other words, as is typical, a chain reaction may develop in terms of countermeasures as the Danmarks Nationalbank has put out the “unwelcome” sign to those uneasy about the acceleration of the European depression. I doubt they will be the last.

If it turns out to be the case, that might tend to accelerate the financial end of it as essentially the exits have been narrowed. Right now there are much calmer markets, not coincidentally like the same appearance in “dollars”, but it is only a matter of time before something renews the urgency. It will be interesting at that point to see what holds and what breaks, as that would suggest future direction and depth.

Stay In Touch