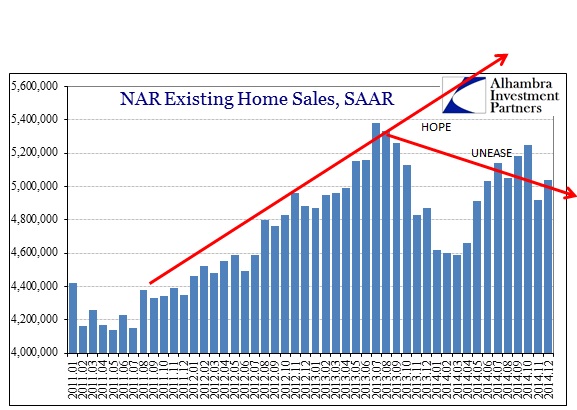

Another “unexpected” decline in home data has raised even bigger questions about the idea that the real estate market is settling into some steady and slow growth period. That has been the revised hope after the MBS disaster in late 2013. The middle of 2014 saw a renewed not-quite-enthusiasm for real estate which led to the belief that housing might be kept off the list of economic concerns, but it is increasingly looking like the typical retracement in a larger declining trend.

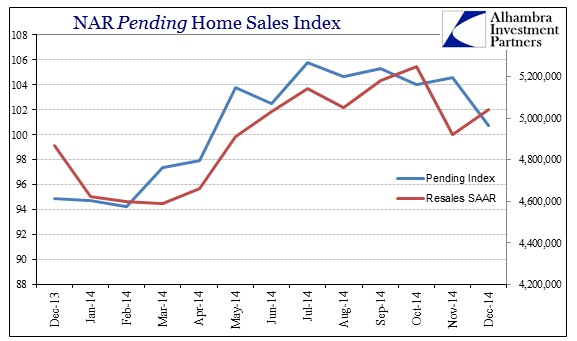

Both the data series presented above are seasonally-adjusted, so take that into consideration. According to these estimates, the trend in pending contracts peaked in July 2014; actual sales followed a few months later. However, with December’s decline, the trend, which had already begun to falter, is not setting up as extrapolated.

The National Association of Realtors said Thursday that its pending home sales index, which tracks contract signings for purchases of existing homes, dropped 3.7% to a seasonally adjusted 100.7 in December from a downwardly revised 104.6 in November.

It was the index’s steepest monthly decline since December 2013. Economists surveyed by The Wall Street Journal had expected pending home sales would rise 0.6% in December from the prior month.

As it is, only the “South” region remains significantly above the lowest point earlier in 2014. The other three regions are within a few index points of where they were the year before, this December without the negative factor of dramatically declining mortgage volume.

That would seem to suggest that the potential housing retrenchment is now beyond simple finance and perhaps penetrating perceptions. That would seem to be the case as inventory has been taken off the market these past two months, as even the NAR has admitted.

Lawrence Yun, the NAR’s chief economist, said potential buyers in December faced rising prices and fewer choices as total inventory declined. “With interest rates at lows not seen since early 2013, the strength in existing-sales in upcoming months will largely depend on the willingness of current homeowners to realize their equity gains from the past couple years and trade up,” Mr. Yun said.

Of course, extrapolations continue as “more jobs” are supposed to save housing in 2015 even though they did not in the “robust” economy of 2014.

Adds Yun, “More jobs, increasing consumer confidence, less expensive mortgage insurance and new low down payment programs coming into the marketplace will likely lead to more demand from first-time buyers.”

Consumer confidence has been at new cycle highs throughout, but home sales have not kept pace (maybe because consumer confidence is driven by those 65+ and those still in school, lagging in the middle ages where real spending power resides). Instead, the economy isn’t producing the kind of growth that would lead the home market toward more sustainable activity.

The problem with artificial economic conditions is the instability it breeds, amplified by the monetary intrusions that have marked the entire “recovery.” In that respect, the housing market exemplifies this economy, such that it is under so much repressive restraint. Even growth periods that look like vivid acceleration fall apart so easily, thus ruining cumulative expectations and hopes for actual progress. People very much want to believe in the magic, that QE can create jobs and that institutionalized frenzy over home inventories can recreate the get-rich-quick pattern of the last decade, but in the end it’s just a parlor trick. True economic expansion is sustainable because it is so broad in its effects; QE by definition is decidedly narrow and thus “aggregate demand” remains just a flawed theory even in real estate where it was supposed to have by far the most potency.

Stay In Touch