The idea of economic instability is not just academic conjecture, as there is a great deal of evidence to support this kind of fragility. And it is fragile in the sense as Nassim Taleb describes, namely that what looks to be stable and growing on the surface is “somehow” susceptible to the slightest provocation; such as cold winter.

Again, that makes intuitive sense since an economy truly growing in a 4-6% range consistently can withstand the negative pressures that may know a percent off GDP. In real terms, economic agents are more likely to dismiss any “shock” in that situation especially compared to a “cycle” stuck closer to zero.

That is essentially how to describe the introduction of the serial asset bubbles. The conventional narrative holds that economic theory, especially interest rate targeting, has been wildly successful in reducing economic variability (through lower consumer inflation, ignoring, obviously, asset inflation). In other words, by targeting consumer “inflation” the economy has been better off. However, even the statistic most charitably constructed toward that interpretation completely disagrees, as the hidden effects of ignored asset inflation are obviously depressive.

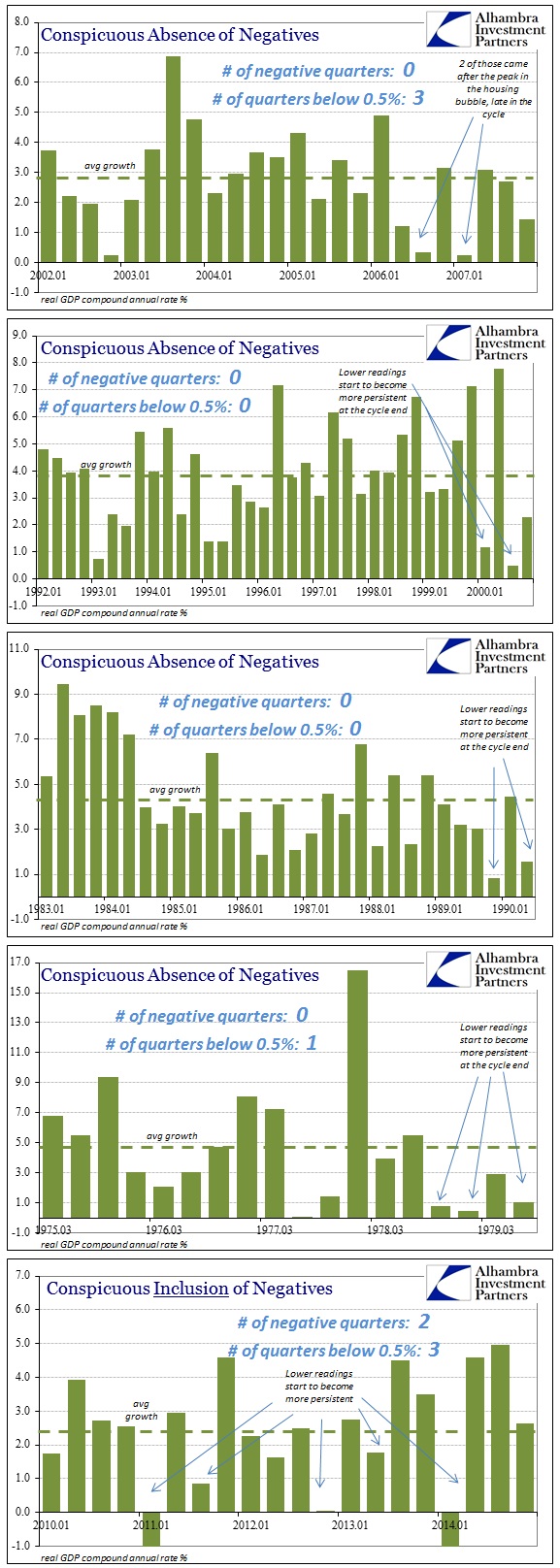

I have not included recessions in the above periods, only the “growth” parts of each cycle. It is true that the standard deviation (FWIW, if GDP follows standard normal) in each successive cycle has declined – but so too has the average. That means in each cycle the bottom of the range approaches zero. You have to believe that economic agents pay attention to growth that cannot sustain itself for long (which is what a low average and standard deviation suggest, matching observations from the past five years).

It’s not just that the average growth rate has fallen with a slight reduction in variability, it is that even GDP itself becomes unsound as to economic projection. The inclusion of heavy redistribution especially since the late 1990’s answers to a high degree why that would be the case. And if I included recessions for a review of complete cycles, these comparison would be even worse as the essentially the Great Recession meant a well-above average decline and a very below-average upturn.

Recent results in 2014 bear that out almost too perfectly. There were high GDP readings in the middle quarters that seemingly excited most of mainstream commentary, but bookended by weakness on both sides (especially the winter). With inventory so high now, would anyone really be surprised if Q1 were even less, perhaps even negative yet again? That is instability and the longer it continues the worse shape the economy will be when the cycle does eventually end.

Stay In Touch