There isn’t a whole lot to say about the payroll report this month, as there hasn’t been much that is different. The Establishment Survey continues to dazzle, while the Household Survey lags (factoring the monthly volatility) and the labor force itself undercounts with the exception of what looks suspiciously like a discontinuity for January (when the labor force jumped by 1.05 million). February was just more of the same.

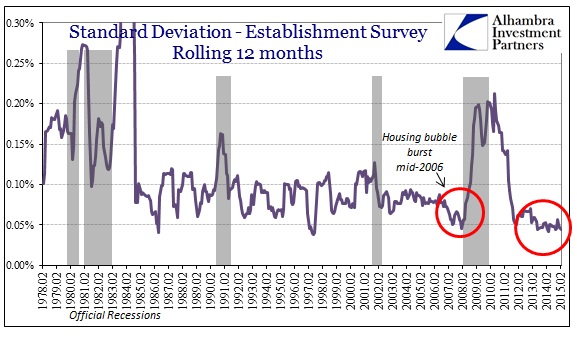

I don’t think anything is going to change until the cycle is declared differently. I am more convinced than ever that the BLS has great difficulty modeling employment under these conditions, so to make up for that they have simply set the trend based on their read of the cycle and “measure” only the slightest deviations from it. That is why the Establishment Survey, I believe, simply follows in basically a straight line – it does not measure changes in employment but rather sampled and modeled variation from and around its benchmark.

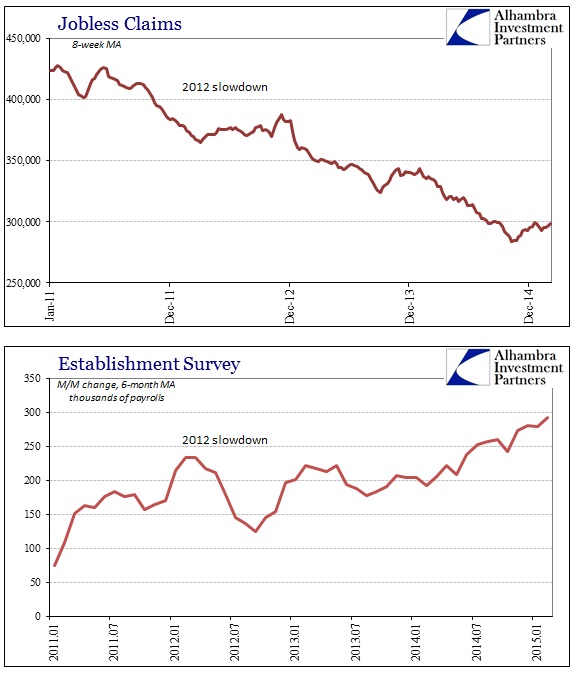

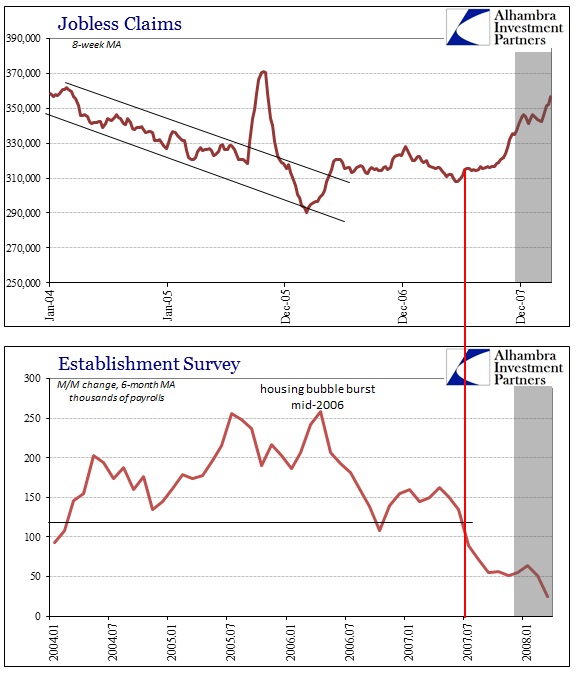

I also have little doubt that the track of jobless claims is highly influencing that set “trend.” The two data points are nearly mirror images, and it may make sense that jobless claims would be one indication of the state of employment (so long as jobless claims data and sampling are reliable).

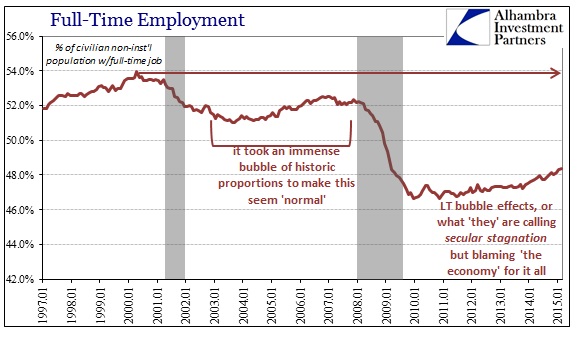

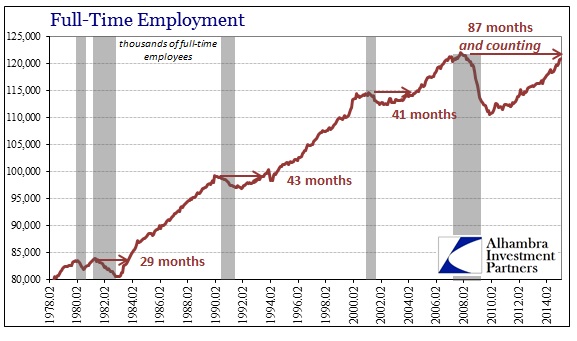

And that may be where a great deal of bias has entered the equations. Businesses in the aftermath of the Great Recession did not “gross up” on labor as they had done in the past, a condition to which we are too familiar. In other words, since they did not add potential “fat” to be cut when the economy slows, jobless claims may not be measuring the state of employment as it exists under “normal” conditions but simply the lack of “normal” expansion this recovery has been known for.

Since businesses are adding employees only carefully, if at all by count of income and spending growth, the level of labor utilization doesn’t much vary, sticking far closer to actual demand than perhaps what we have seen of every other recovery. In other words, when jobless claims have risen in the past (actually flattened out first) that was a signal that businesses had become reluctant about labor utilization, and thus the Establishment Survey adjusted accordingly. In this “cycle”, businesses have not become reluctant as they have simply stayed reluctant the entire time.

You can see this difference by contrast with the period immediately following the housing bust. Jobless claims stopped declining and flattened out for more than a year. The Establishment Survey picked that up with a reduced average monthly gain.

So what happens if businesses in general simply don’t follow the same pattern in this lower-utilization “cycle”? I think what we see of jobless claims and the Establishment Survey is the result of that, a condition where the statistics don’t match “reality” because they cannot – they were designed under the assumptions of the previous paradigm which clearly don’t apply now. The trend in income and spending, again, “proves” that without much doubt.

With regard to cyclical changes, as you can see anyway that jobless claims and the Establishment Survey do not signal recession until right before it happens. You are not going to get much of a prior read on cyclicality from jobless claims or the Establishment Survey, with or without structural deficiencies in labor utilization and the statistics that cover them.

Stay In Touch