I had hoped that something would have happened by now and that April 15 would follow more closely the October 15 and January 15 events, if only for the sake of experimentation. We don’t really need any additional illiquidity and certainly nothing as globally severe as those, but with function the way it is and everything so stretched and imbalanced that may just be an inevitability at this point. Instead, all we really have to show for April 15 is a bunch of bankers warning about flash crashes in treasuries.

The whole point of the exercise was something deeper than that, as I think what Jamie Dimon and others are speaking of are more caricatures of funding markets as anything. The “dollar” has been off its pressure ever since March 18 and the FOMC, which would seem to suggest that what might have taken place today was short-circuited last month. The Russian ruble has been on a tear of late, as has crude, even the WTI versions. There are no outward and obvious signals of “dollar” distress at this moment.

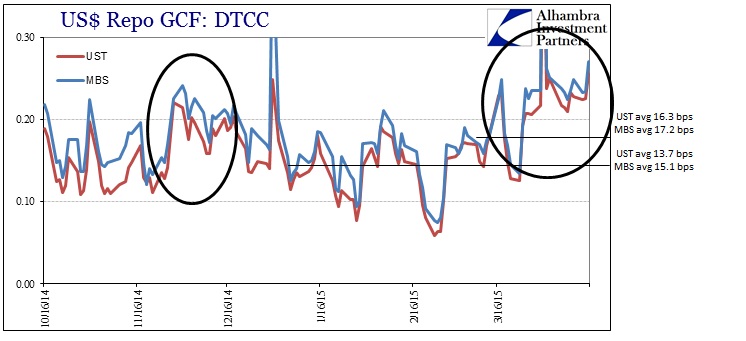

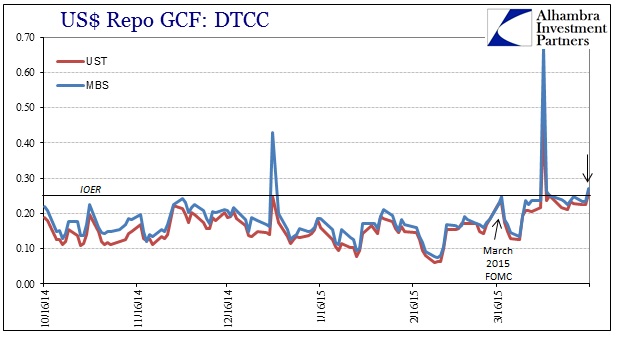

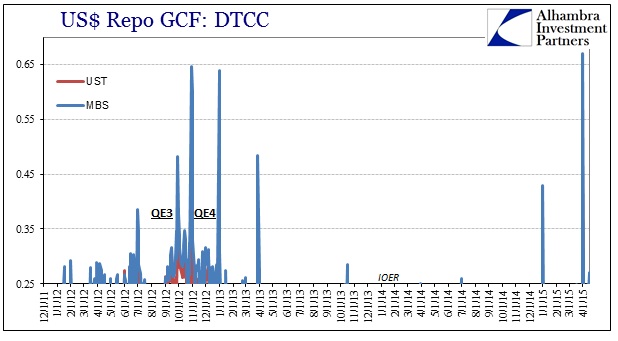

Despite that, I can’t help but think there is something significant out of the repo markets. The GC repo rates, as if to rub it in, in both UST and MBS crossed above the 25 bps threshold today. UST “fixed” at 25.6 bps and MBS at 27.1 bps; even agency repo was high at 26.8 bps.

25 bps is significant not just as a round number but as the upper range for the federal funds “target”, such that it actually exists anymore, and the IOER. These are significant boundaries and for GC rates to cross outside of a quarter- or year-end scenario is, I believe, an important indication – the problem is I am not sure at this point of what. I have a few theories that are little better than raw speculation and thus are not fit for publication, so this is for now a deepening mystery.

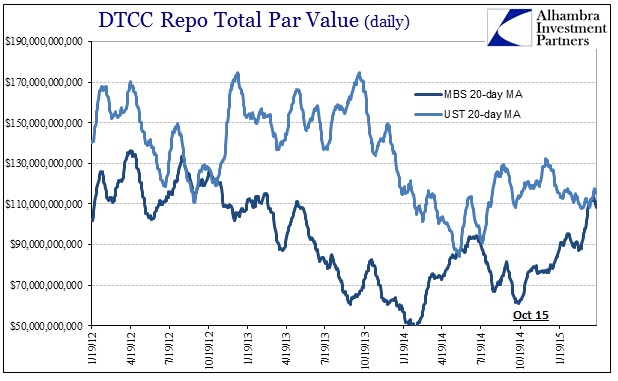

It’s not as if volume continues to spike in April, as MBS volume in particular has softened (MBS volume has been below $85 billion on three of last four days, and was barely at $100 billion on the fourth, compared to the 20-day average of about $110 billion). Overall repo volume is relatively high compared to last year, but still below what was once regular.

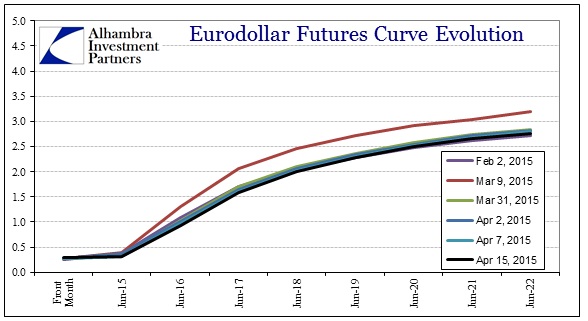

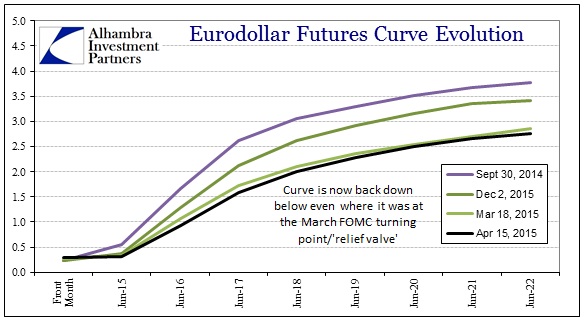

You could make the argument that repo participants are reshuffling in anticipation of the FOMC moving off the 25 bps “corridor” level but everything about money markets suggests continued, severe doubt about that. The eurodollar market, in particular, has become as bearish and flat, and even more so in the interior right where policy changes are supposed to be reflected, than the curve had become on March 18.

The curves are sort of jumbled together above but that is exactly the point. There is nothing of recent vintage in eurodollars to suggest even the smallest hint of a rate “lift off” anytime soon. If anything, the curve continues to run in the opposite direction, a point that is very much revealed by longer-term comparisons (it is amazing, really, how compressed the futures curve has gotten in a relatively small space of time).

All of this more than suggests that repo rates are not at all reflecting any increasing expectations for even a June end to ZIRP, and maybe not even one as early as the end of this year (I continue to believe, and I think it increasingly recognized as possible in funding markets, that the FOMC will never get there given growing and now evident strains in the economy). So what are the repo and eurodollar markets telling us?

What we can more reasonably assume is that the high degree of pessimism and upward expectations for volatility remain in that heightened state, undisturbed by the outward prices of “dollar” proxies and such. Beyond that is, again, far, far from clear. With repo rates crossing the IOER “boundary” for the second time just in April (the other was April 1 related to the quarter-end redrawing) it is highly unusual to say the least. What I will say is that recent history tends to confirm that repo rates get “pushed up” around periods of greater economic and monetary uncertainty; 2012 being the prime example.

So we are left with a conundrum that I had hoped the regularity of April 15 would have if not resolved then at least provided a better understanding and context. I suppose the search for answers will have to continue only now unanchored to any specific point on the calendar.

Stay In Touch