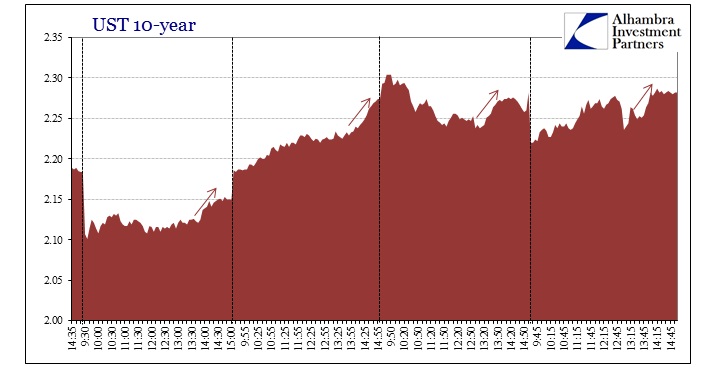

It was another pretty volatile session for UST trading, including the 13:30 selloff showing up right on schedule. The open was bid rather heavily, likely due to the nasty retail sales figures that increase the probability of something more than a temporary economic slump, but selling appeared almost from the open. There was heavy buying again around 13:00 and the release of the very strong 10-year auction (which priced through the When Issued by almost 2 bps) but selling, again, started right at 13:30 taking the yield up to a high of 2.287% from that opening low of 2.220% – for range of about 9 bps. Quite remarkable.

As UST rates were settling upward, GC repo rates have jumped also in the past few days. The MBS GC rate fixed just shy of 20 bps today, up significantly in the past two days again. It is admittedly circumstantial, but my assessment is that there is a link between this unstable or volatile funding environment and this persistent low liquidity in the treasury market.

We get a little better sense of that by viewing dealers’ reported inventories, which have persisted more toward hoarding rather than freely lending. As a risk proxy, a net positive inventory level is usually correlated with low dealer risk capacity or a strained environment. The most recent data through the end of April shows a continued net positive for coupons, which I think is both highly relevant and somewhat explanatory.

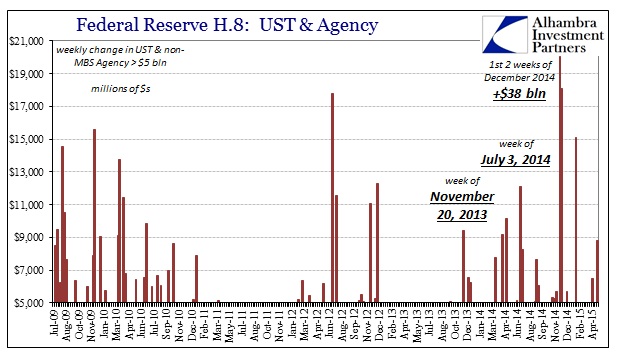

I think that this “tight” view is corroborated by the weekly H.8 estimates of broader bank balance sheet allocations, which showed a renewed buying interest in UST’s those last few weeks in April – with a net almost $9 billion increase in the final week alone. Obviously, I am making an assumption that these trends survived and continued into May which may or may not be the case.

It would be much easier if there were directly observable factors here, but bank balance sheet mechanics are too complex and frankly too hidden to make this easy and plain. From what we can piece together, wholesale liquidity problems seem to have continued regardless of any instrument that is looking for more QE. Maybe that is actually consistent, as QE has never really been any good for actual liquidity in the first place. While dealer inventories turned away from a net positive position in coupons after QE4 started, even reaching again a net negative in the middle of 2014, that only gives us the suggestion that dealers were perhaps re-risking and that UST’s themselves may not have flowed anywhere but SOMA.

In any case, there does seem to be consistency in negative liquidity parameters and the occurrence of volatility in the UST market. It might be too early to start anticipating July 15, or even September 15 (the real regularity), but not much has changed even if April 15 was a dud.

Stay In Touch