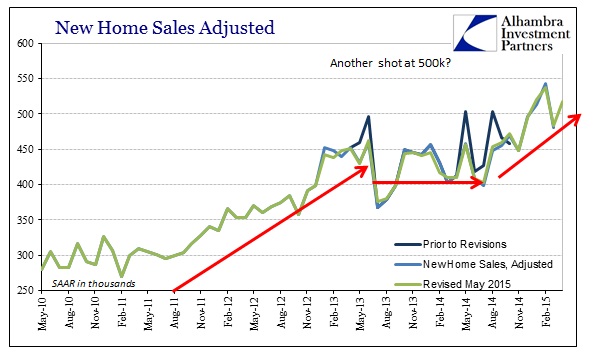

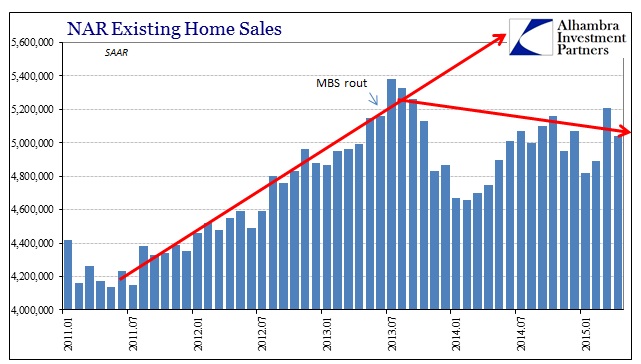

So far this year, there has been a divergence in the housing statistics about the state of real estate markets in the US. The National Association of Realtors (NAR) estimates that existing home sales (resales) have lagged, stagnated and even faltered all the while the Census Bureau’s figures on new home sales surged. The latter moved to seven-year highs (which sounds great until you realize the housing bust, proper, is almost a decade old now) and quite a bit just in 2015. The series had been stuck around 450,000 units (SAAR) for most of the period after the post-taper turmoil in mid-2013.

Resale estimates largely matched those trends until more recently. There was the inflection in 2013, the downdraft into early 2014 and then a modest bounce which has seemingly lost momentum and depth.

It could very well be that the real estate market is picking up once more in a non-winter bounce, driven first by new builds before existing structures, but I submitted a few weeks ago an alternate explanation that suggested instead builders were far too optimistic about what 2014 suggested and got too far ahead of themselves for it. Thus, the surge in sales activity was an almost desperate attempt to sell inventory before any financial difficulties might arise under perhaps less-than-ideal financial circumstances in the “dollar” world.

With homebuilder companies reporting earnings, it appears as if at least the first part of that supposition might be true (there isn’t much talk yet about tightening up on leverage for new build propositions). The most recent “unexpected” weakness was reported by Hovnanian. Revenue in the latest quarter was up 4.2% at $469 million, but that was far short of the $534 million “analysts” were looking for. Worse, for the stock anyway, net income and comparable EPS suffered; -$0.13 per share versus -$0.05 the same quarter prior year.

Hovnanian, based in Red Bank, N.J., said it offered more sales incentives — enticements such as free upgrades and financial assistance with closing costs – to goose flagging sales of its speculative homes in its latest quarter. Builders start construction on so-called spec homes before they are sold in anticipation of buyers arriving later.

Hovnanian acknowledged Thursday that it had been “too aggressive” on its spec counts, and therefore had to offer the freebies to unload many of those homes, which increased its sales but sapped its gross margins.

That quote above was from Q1, reported in the Wall Street Journal, but it appears that the same carried through into Q2. In the latest disappointment, the company’s CEO indicated that once again they were “too aggressive” in pricing homes, as deep concessions were necessary to move inventory where sales volume wasn’t keeping up with expectations. While management expects still a rebound, it should be noted Ara Hovnanian sold 314,937 shares on April 16, representing about 10% of his total holdings.

Hovnanian wasn’t the only large homebuilder to suffer from margin problems, as the four big builders have all reported “disappointing” results. In April, Pulte reported income of only $55 million versus $75 million a year earlier. A week later, Ryland Group reported gross margins falling to 19.7%, the worst since 2012.

“An example of the impact of mix would be the Phoenix market where closings were up 50% over the prior year, but their margins are below the company average,” said Chief Executive Larry Nicholson.

He added: “The land side…we see some pressure there in some markets right now. So I think it’s a battle every day and every community you look at.”

Even DH Horton, the largest of the builders, reported a 30% rise in orders but again deteriorating margins. CEO David Auld noted on his company’s conference call that, “We haven’t seen a significant number of our projects where the margins have improved.”

I think we have the same economic problem here as in other places, such as the inventory mini-cycles, where businesses treat every slight upturn as if it were the final push to full recovery at long last. They have, of course, every economist in the world telling them that is the case and to expect as much, but in the end they flail on their over-eagerness to follow. In the case of home builders, it appears quite likely that they built a mass of houses expecting a flood of new buyers flush with new jobs and incomes from the “best jobs market in decades.” Economists said that it was the weather so go nuts, and they did only to find themselves potentially on the hook holding specs. To dispose of developed properties meant serious discounts and concessions, which I think explains both the surge in new home sales overall as well as the apparent stagnation in existing sales – pure competition in overall dim market.

As per usual, these same home builders are putting all this behind them and focusing their attention on the rest of what “should” be a robust 2015, with all these job openings if not actual job candidates, and the annual ritual of the same over-eagerness. As Ara Hovnanian put it:

“But I have no doubt that we are going to recover,” he continued. “We’re still way below demographically supportable housing- production levels. And I think it’s going to come back.”

That was what he told CNBC in March 2014, but it seems to be a constant enough sentiment to apply to whatever year.

Stay In Touch