The estimates for home construction in May were pretty much as expected except for one single data point. The calculation for new permits in the multi-family segment jumped by 53.5% year-over-year, completely out of character with everything else. Given that fact, it seems far more likely that the permits estimate is an outlier or artifact of even expected variation. That interpretation is strengthened by the other direction taken by housing starts overall, but especially in the same multi-family area.

The single-family sector is the same slow, plodding pace absent any excitement whatsoever.

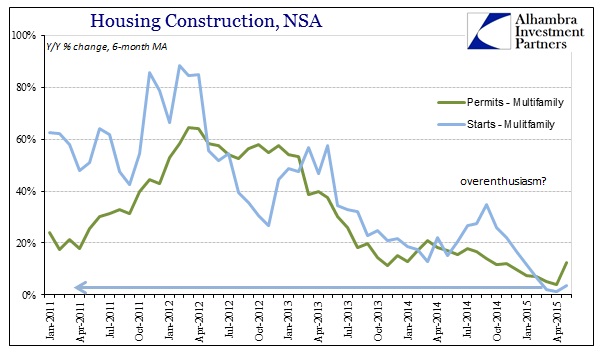

The surge in apartment permits stands out as unique in recent months. It was not that unusual to see such gains during the mini-bubble period a few years back; in fact, 53% would have been at the lower end of that period. Since the middle of 2013, coincidentally, apartment construction has tapered along with QE. Not only have permits fallen back to almost a standstill (before May), actual starts and construction have fallen even worse of late. Maybe the jump in permits is a one-time adjustment to bring construction back up in-line with at least the population, but even that seems dubious.

Whatever the ultimate case, and we will see next month if it either stands for revision or reversion in June, even a one-month surge does not really alter the degradation in home building appetite. The headlines scream that jump in permits to a new multi-year high, but overall, the housing market seems the same uninteresting rut as has been the case for almost two years now. In economic terms, there isn’t anything here to put any emphasis into the faltering “recovery”; rather, it still looks rather bleak from that perspective absent greater income or jobs enthusiasm.

Stay In Touch