The June FOMC statement has done nothing to clear up any suspicions in either direction for credit markets. I think that is actually consistent, in an irrational way, as the FOMC tries to labor under the delusion of recovery, which these “markets” are bound to at least consider, while all good sense says there is none. The result is markets that move in place, without too conviction yet again. Confusion seems to be the theme.

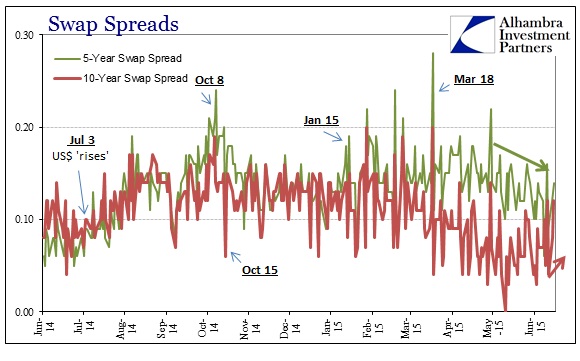

In funding markets, eurodollar futures were in the first week of June fully projecting “hawkish” policy while swap spreads were hedged for the opposite (the 10-year spread compressing while the 5-year stayed above). Now, as of this week and today’s FOMC madness, both have reversed with the 10-year swap spread decompressing and the eurodollar futures curve straddling in between (by maturities) opposing views.

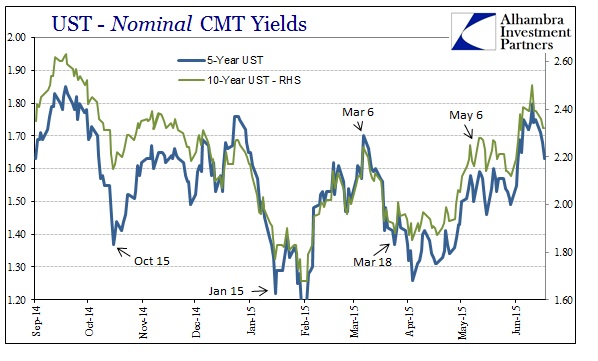

Nominal treasury rates are as volatile as ever, having sold off hard just a week ago (with the 10-year hitting 2.50%) and now bid.

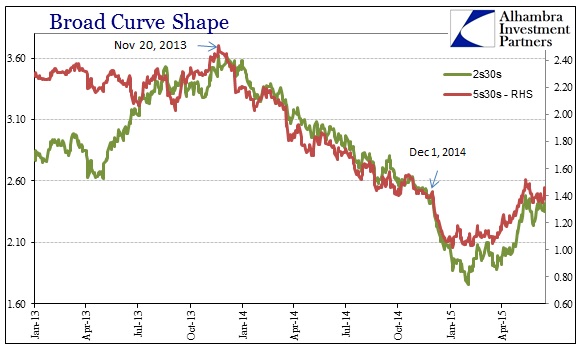

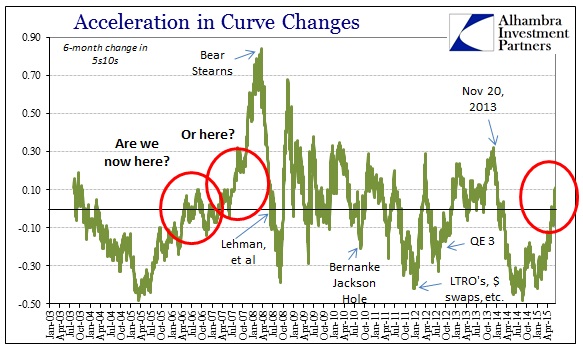

Throughout all that volatility, the yield curve itself does nothing. Since about May 6, there is neither steepening nor flattening.

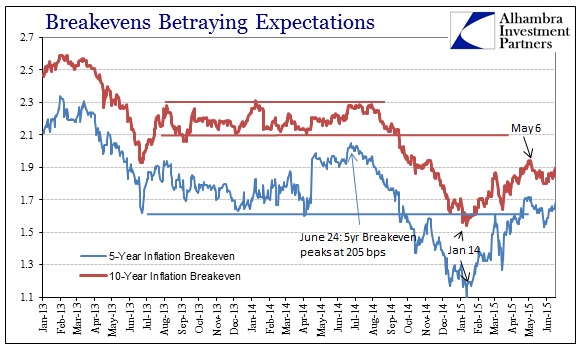

Even inflation breakevens have fallen into stasis, including the Fed’s preferred “market” indication for inflation expectations the 5-year/5-year forward rate.

The economy clearly looks bad even by official Fed numbers, but credit and funding markets still appear to be wondering if the FOMC is crazy/suicidal enough to follow the fantasy instead. I don’t see how today’s policy update clears anything up. About the only meaningful change has been time; as in how much time is left for possible deviation:

Stay In Touch