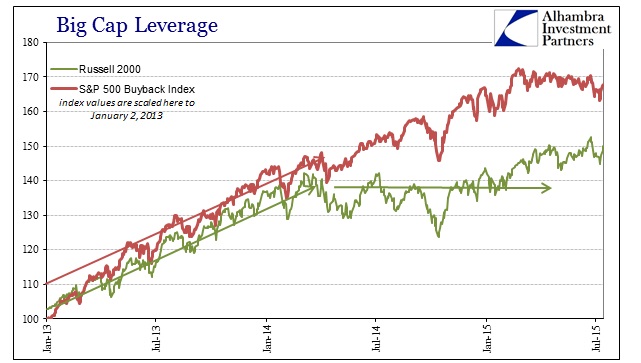

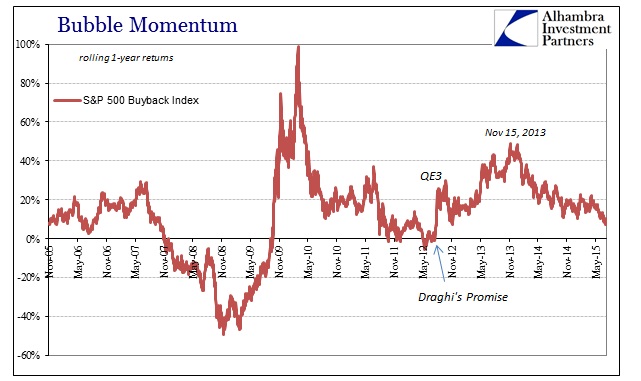

Having now passed the anniversary of the “rising dollar”, it is interesting to see the related and continued effects on the stock bubble(s). As should be obvious by now, stock buybacks, funded via corporate bonds and loosely categorized C&I loans, are responsible for the post-QE3 nearly uninterrupted rise. Repurchases are forming a separate “liquidity” conduit, indirect leverage if you will, which has already started to fray. Various broader “market” indices have diverged, starting with the Russell 2000 in early 2014 (with the economic slowdown that was supposed to be an anomaly of weather).

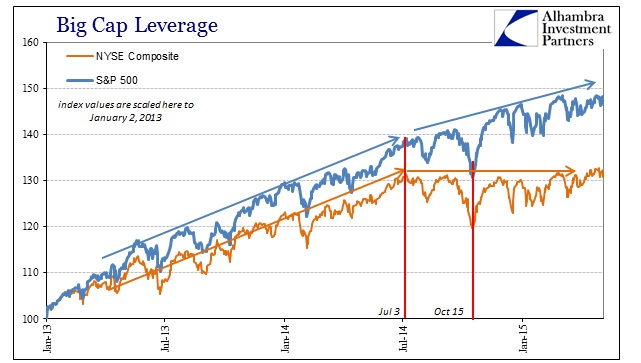

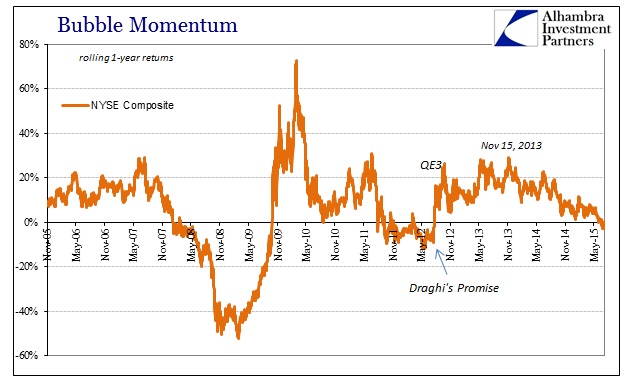

Since then, other indices have also broken away, notably the broad NYSE Composite index which includes the greatest cluster of ETF’s. The deviation there coincides exactly with the “dollar” tightening in eurodollar liquidity and less-smoothened wholesale transactions.

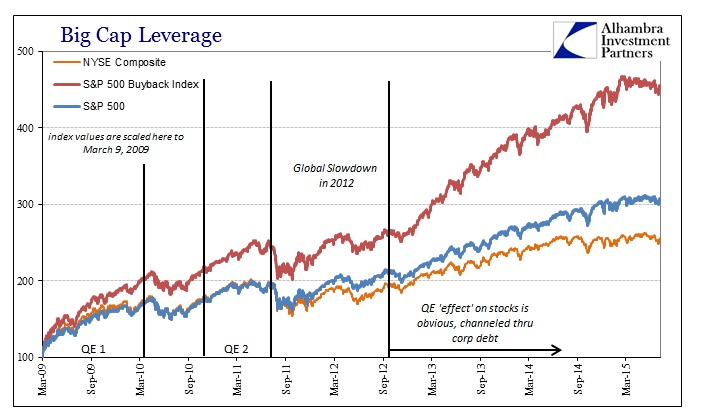

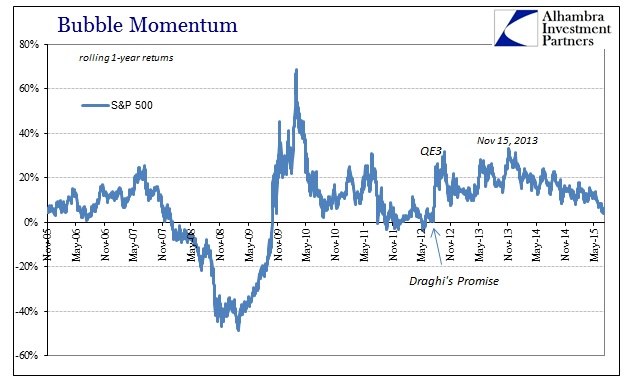

There really cannot be much doubt anymore that QE is the central focus of the stock bubble, especially the third and fourth applications. The timing is so obvious as to preclude any other interpretation – most especially a growing and sustainable recovery that never materialized despite all public and heavy exaltation.

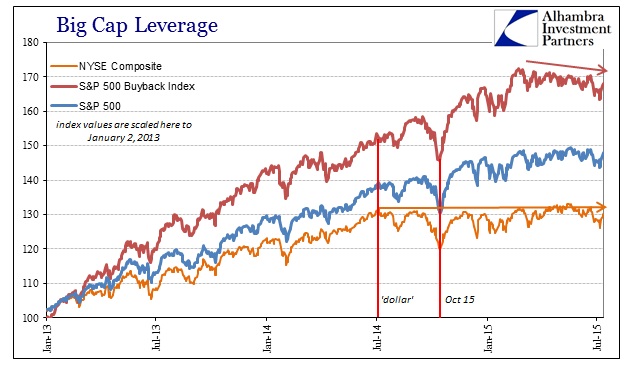

While there is undoubtedly some reinforcing inflation due to various views of “tail risks” and perceptions about volatility which become self-fulfilling, it really is repurchases that are driving price action. The most “effective” transmission is corporate debt funneled through shareholder returns, which are not very efficient in terms of economic circulation (especially by comparison to the opportunity cost of them).

In that respect, along with recession fears, it is perhaps quite significant that the S&P Buyback Index has suffered its first extended reversal since the 2012 slowdown, coincidental then to European concerns and just prior to both Draghi’s promise and QE3. It is unclear at the moment what exactly has caused that dramatic shift but the more likely explanations point to fears about corporate ability to continue repurchasing with economic weakness bearing down against both internal cash flow and even corporate bond pricing and liquidity.

Whatever the case may be ultimately, the stock bubble’s ties to central bank policy seem to suggest the quite waning influence; both in terms of active participation (on the Fed side) and, more importantly in my view, how blind faith in monetarism may be reversing because of that widespread economic fruitlessness. Stock momentum, for the first time since 2012, is decidedly waning on all fronts:

I find it significant that the broader market index, the NYSE Composite, has shifted negative in its one-year comparison again tied to last year’s “dollar” disruption. At the very least it might imply that the central bank paradigm that lasted since the middle of 2012 has greatly eroded or even ended.

Stay In Touch