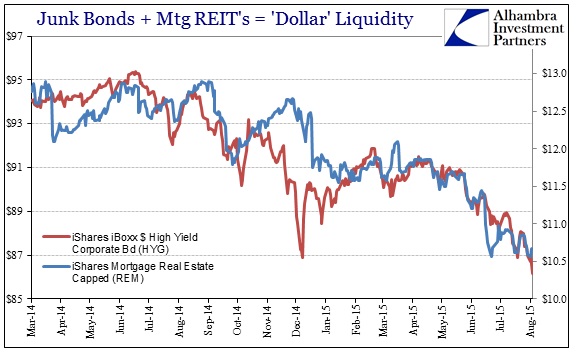

On this side of “dollar” funding, risk continues to drain, steadily, but rather methodical about it. While China is taking most of the attention, deservedly, credit markets are not enthused about any of what has taken place. Again, I think that is more the yuan’s relation to the “dollar” than of anything else interpreted for or about the PBOC. It seems as if China’s central bank has been trying to shelter from the oncoming “dollar” storm, and we are increasingly seeing just how stormy it has become.

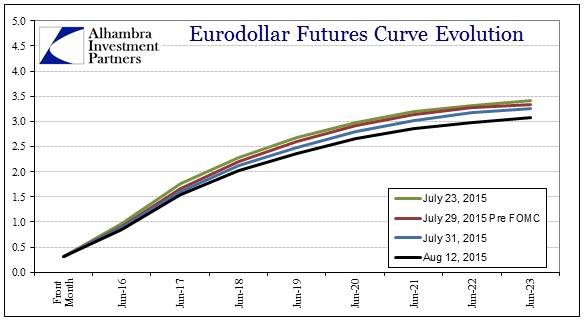

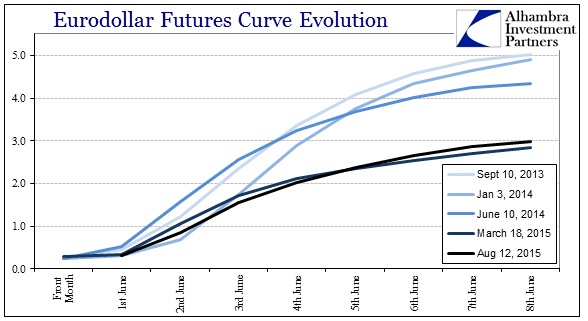

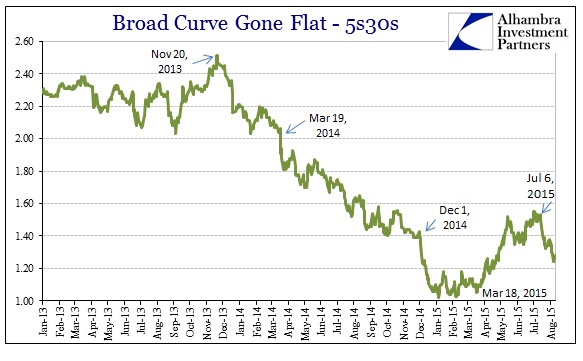

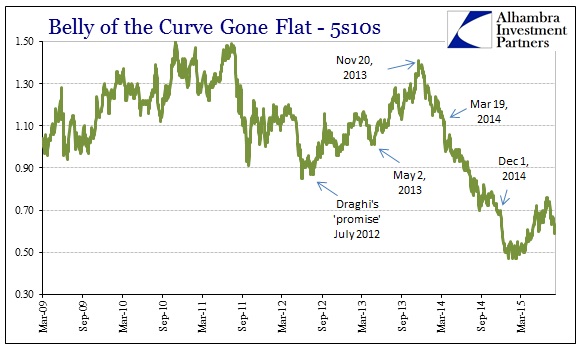

While commodities and currencies are at least flat to somewhat bid today, fixed income is sliding to new lows. Funding markets such as eurodollar futures suggest that much bearishness even when compared to March 18.

The trend over the past month has been clear, so it isn’t surprising that the yuan would finally feel too much pressure to maintain its five-month illusion any longer.

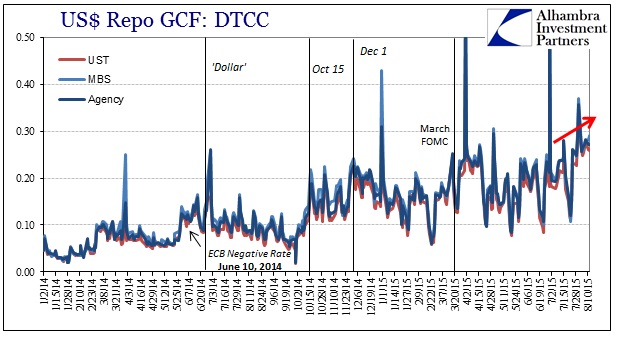

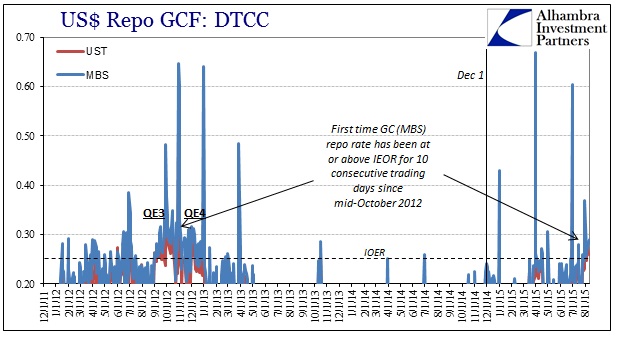

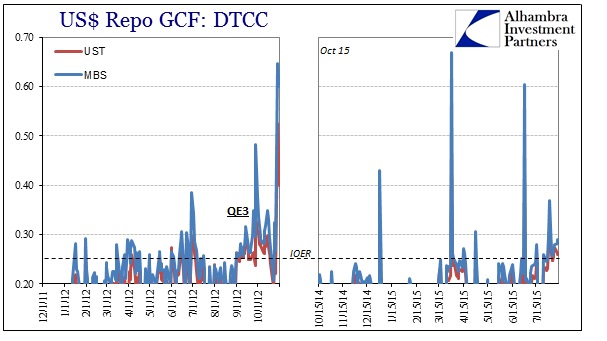

As the eurodollar curve draws low and flat, repo rates remain unsurprisingly highly agitated and elevated. MBS GC rates have been at or right near IOER since July 24; GC rates jumped to 29 bps yesterday on lower volume. That would seem to suggest continued hard strain.

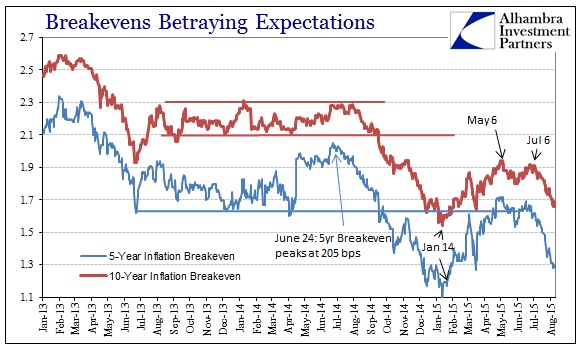

The treasury curve has flattened again alongside this “dollar” illiquidity, with “inflation” expectations sinking toward prior lows. There isn’t much doubt that the current “dollar” episode is widespread and penetrating; China is just the latest casualty in that line.

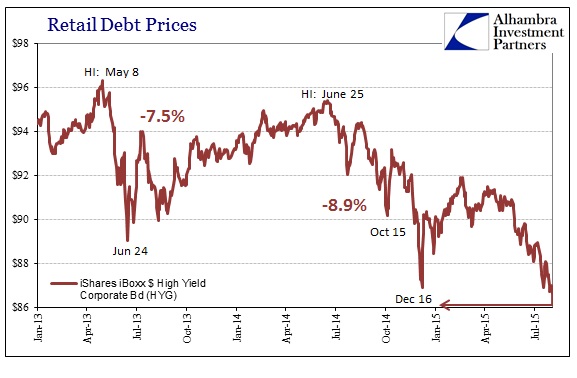

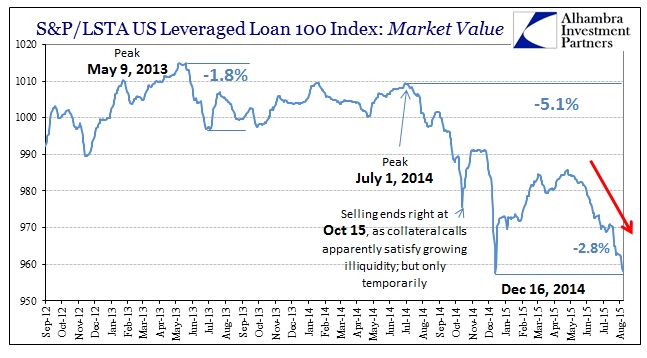

With that funding framework, new lows in junk and the corporate bubble aren’t unexpected. HYG fell below its December 16 low while the S&P LSTA Leveraged Loan 100 is likely the same in trading today.

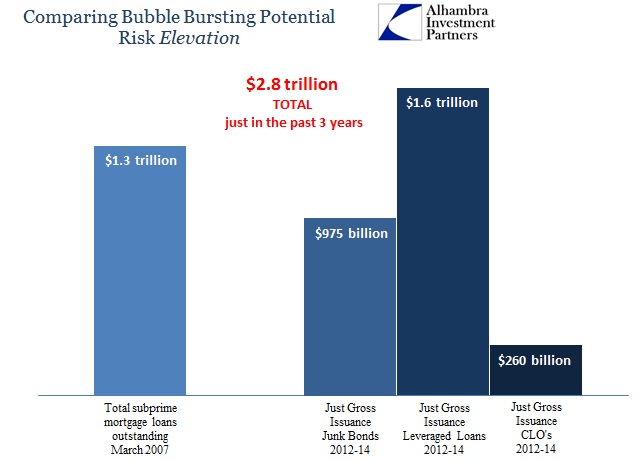

The problem with all this is obvious in the global context; for all these lows in risk there has been an orderly withdrawal here on the domestic side of the “dollar” while the most turmoil remains offshore. That is what is significant, potentially, about these lows as it reinforces the notion that the shift is durable if not permanent. It may or may not turn out to be the critical mass point, but it is at least a marker in that direction as any positions maintained and leveraged on perceptions that this was all “transitory” (as promised over and over and over) have to start being re-evaluated.

Leverage is just that fickle, and the amount of it at play is simply enormous. The events of the past month just reinforce the notion of narrow exits getting quickly narrower, even if they have been so most active elsewhere to this point.

Stay In Touch