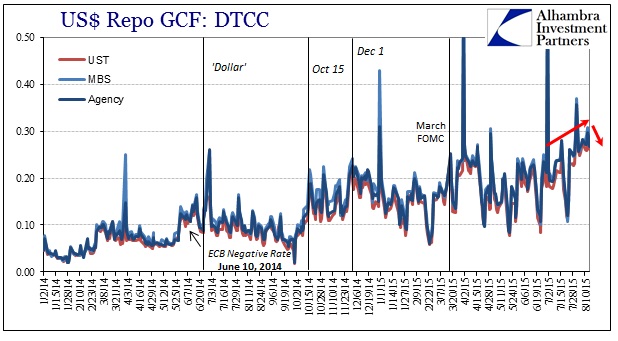

The repo rate today ticked slightly lower for the second consecutive day, suggesting, as the PBOC’s yuan fix last night, that the heaviest part of the “dollar” run has abated. The repo rates are still very high, though, which does not suggest a terminus in the “dollar” retreat; at least not yet. All three classes remain above IOER, with MBS only coming down from 30.1 bps (and 30.7 bps at a high on Wednesday) to 28.3 bps. That is the 13th consecutive trading session above 25 bps (and 16 of the last 17), which, in my view, is not coincidence to the great difficulties in the rest of the “dollar” elsewhere.

Ought to be an interesting week next week.

Stay In Touch