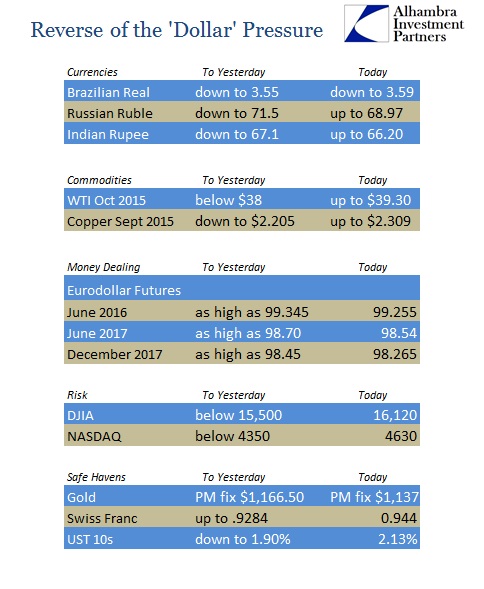

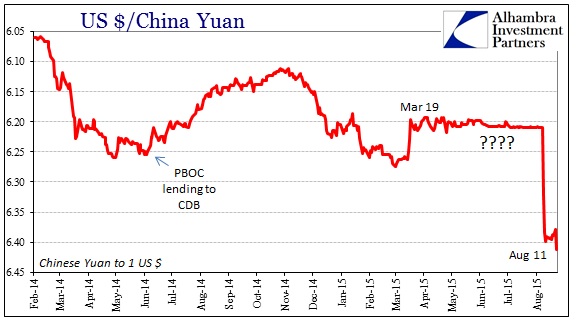

I think broad trading today actually confirms yesterday’s hypothesis of the marked appearance of fear. In reversing exactly (or nearly so) almost everything from yesterday, across the board, it seems as if the juxtaposition settles that interpretation. I noted that it wasn’t just gold bid in contrast to the selling and “dollar” frenzy, the Swiss franc had joined on the safety side contrary to its behavior before August 11 (when the PBOC finally broke). Today, both are moving opposite as “risk” and “dollar” proxies are once more celebrated.

Gold had fixed at $1,160.50 in London afternoon trading but was already lower by today’s AM fix and then cut again by the PM; to $1,137. The franc had risen to .9284 to the dollar (after falling nearly to parity just a few weeks back) and is down today to .944 in a reversal. Against those, as usual, “dollar” assets and proxies are being bid which marks contrary behavior in those two assets for two days running in both directions – again, clearly fear yesterday and less so today.

It was that way across a broad range of indications, where the only proxy not “behaving” is the Brazilian real (likely on idiosyncratic associations, such as a darkening and related slump on all internal accounts including now massive labor deterioration).

We don’t have the updates yet for the corporate debt bubble on this “easing” side, but in yesterday trading it was clear that there was more than just illiquidity at work. The BofAML junk bond indices were at new high yields, above even the August 13 first reported yield for the Master II index (before “pricing” irregularities were apparently clarified and the index revised). Both indices show a higher yield (lower price) than August 13 even in revision.

The S&P/LSTA Leveraged Loan 100 index dropped from 952.37 on Friday all the way to 948.17. That was the lowest market value component since the start of 2012 trading and the worst single-day decline since the December 16 dropoff.

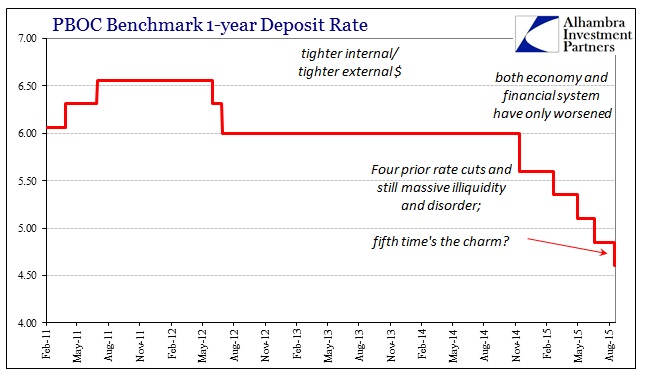

Undoubtedly, there was more than a little total fear in that action that seems to have been restored in some part. That, however, is quite the problem given that the mode of renovation is just repeated activity on the part of a central bank that has been coming up very empty for some time. The “dollar” market “wanted” some relief, clearly, and so latched onto anything that might provide it, but the PBOC’s rate cut is not very likely to stand athwart the “dollar” tide, especially since this is the fifth since November to no avail thus far.

What we can infer from that is fear still is not yet anything more than an unwelcome intrusion, treated as temporary when possible, and that happy and hopeful belief remains the default setting. That is, of course, a serious downgrade in its own right since any appearance of fear, particularly where it would spread so vastly and quickly everywhere, into every corner including “impenetrable” stocks “fairly valued”, was thought impossible not long ago; that is the nature of an unappreciated “dollar” run. China was China and the US was assumed the best of the lot despite obvious drawbacks.

It may actually be the yen that indicates the severity of the shifting undercurrents of sensitivity. Japan’s currency doesn’t hold the same wholesale characteristics as all the rest, given Japan’s quasi-reserve standing. It is very difficult to finger any specific case for currency moves in that situation, but perhaps the yen’s strengthening of late against the dollar relates to these relative shifts in perceptions. The yen, by obvious virtue of QQE and rumors of more, was simply thought to be far poorer condition than the dollar and the US economy and markets. More recently, despite Japan getting “unexpectedly” worse yet again, might perceptions be shifting against the US to an even larger proportion? In other words, the balance could be changing in that Japan remains mired but belief that the US might be as mired if not more so could be gaining.

That would suggest, as the “dollar” run now runs internal to the domestic markets, the assumed immunity of American condition could be waning. Broad liquidations inevitably have that potential, to penetrate into every place and indication no matter how disassociated they seemed only a moment before.

In any case, the only thread holding this all together, as today’s trading indicates, is further belief that central banks not only know what to do but can actually do it to positive and intended effect. Recent history on that account is not at all kind, which might be why fear broke out yesterday beyond strictly the same unwelcome illiquidity. The litany of central bank failures just recently is getting too long to simply ignore that the latest at the forefront will be different and actually can and will get it right.

Stay In Touch