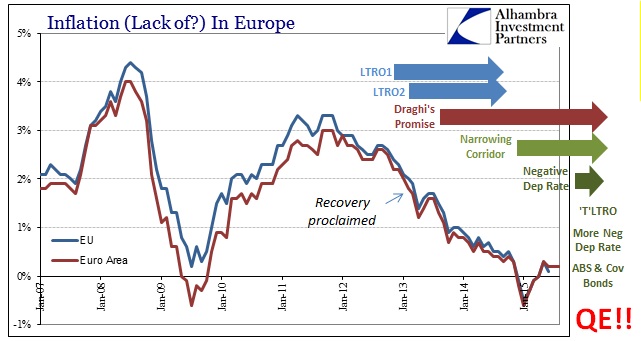

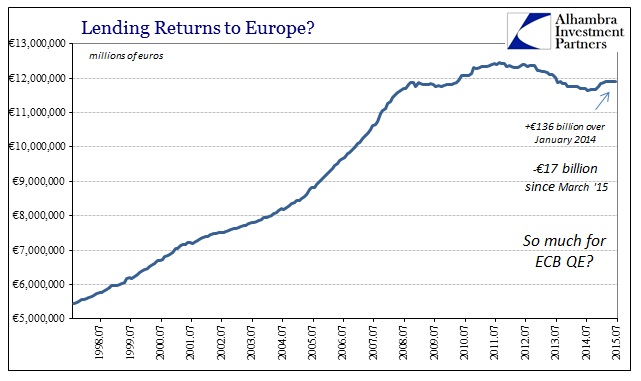

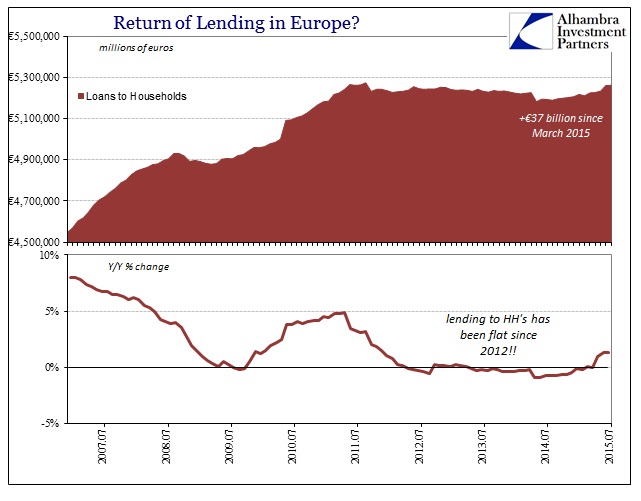

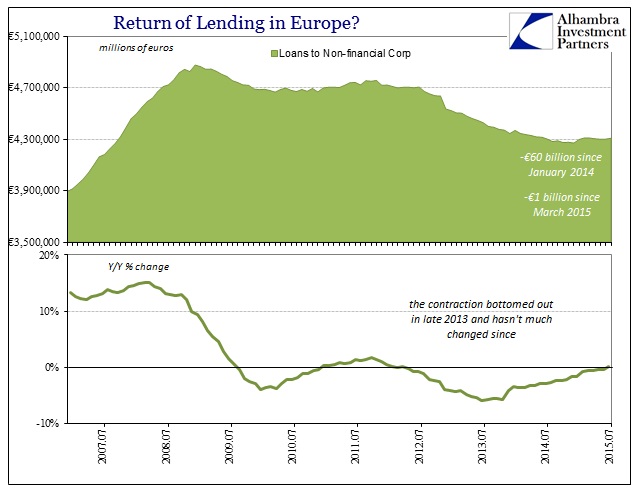

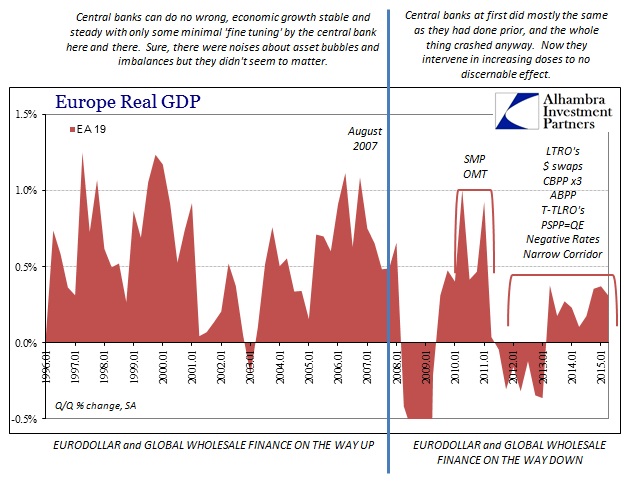

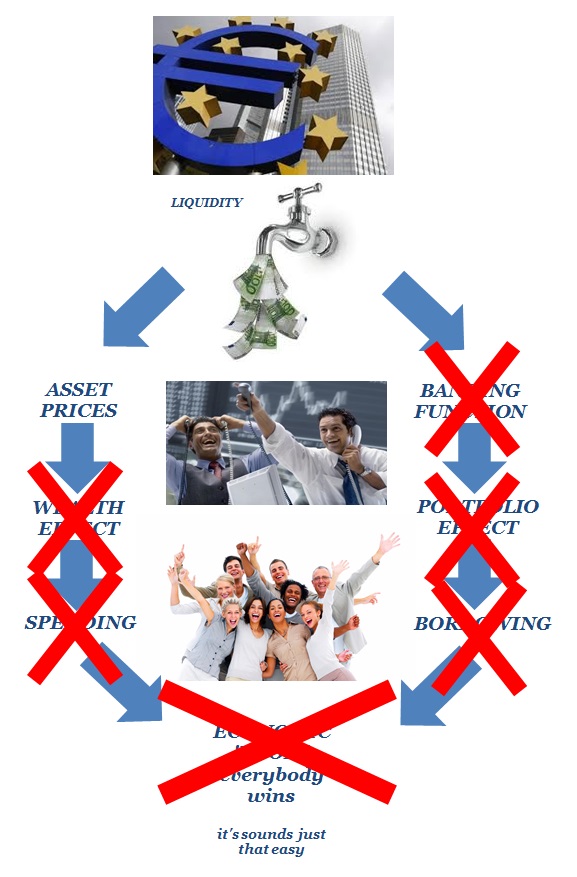

The re-crash of oil prices during the recent “dollar” wave/run were hard on almost everyone involved, economically and otherwise, but perhaps not more so than the ECB and its QE proponents. Despite being attributed with every minor upward move that could plausibly be assigned, for all the hype there has been very little actual movement anywhere of significance. The virtuous circle was intended as: liquidity > lending > economy; which would be confirmed by rising “inflation” given the orthodox treatment of official inflation as if it were synonymous with real downstream growth (particularly wages).

If you were to view the economy backwards in that formation, you might be forgiven for thinking that there never was any QE in the first place with its impact so utterly undetectable. Clearly, the European economy has gone nowhere so far and, one step down the chain, conspicuously without any actual burst of lending (beyond exclusively financial rearrangements to take advantage of the ECB’s banking “generosity”) and a liquidity system that appears increasingly unsettled if not fully grotesque.

That has left only “expectations” of QE’s success with which to suggest that outcome. It began almost straight away, in March, even before QE’s launch when inflation breakevens and calculated forward rates jumped. That was, of course, taken as proof QE had the economic performance already in the bag.

From March 6 (one week before QE even started messing up autonomous liquidity factors):

“We interpret it [inflation expectations] as a sign of the credibility of (ECB chief) Draghi’s measures,” said Guilhem Savry, investment manager in Unigestion’s Cross Asset Solutions team.

Along with revealing details of the scheme, the ECB forecast on Thursday consumer price growth would rise from zero this year to 1.8 percent in 2017, close to its target of just below 2 percent. The rise in inflation expectations reflects recent more positive euro zone economic data, a rebound in oil prices and the weakening euro, which will make imports more expensive.

The European Central Bank appears to be winning its battle to persuade households and consumers that inflation will pick up over coming months and years.

The ECB last month ushered in a new era by launching an aggressive bond-buying program known as quantitative easing that will flood the eurozone with more than €1 trillion in newly created money.

A key indicator of euro zone market inflation expectations rose to its highest in almost eight months on Thursday in a further sign the European Central Bank’s trillion-euro bond-buying programme may be working.

While inflation expectations in the 5-year/5-year forwards may have been rising, HICP inflation numbers were not. There have been positive for the Euro Area since May but for the past three months running (through the latest month of July) have been stuck at just 0.2%, which is not appreciably different from zero.

It has only gotten worse since, as even forward inflation expectations sunk with oil during the “dollar” run, leaving QE without any outward sign of even the circular logic of forwards. The 5YR/5YR rate was 1.798% on March 6 when everything was looking in the upward direction, but collapsing to as low as 1.61% on August 24 during the downdraft. They have only slightly recovered since.

Inflation expectations in the euro area climbed on Monday even before oil prices bounced up. The five-year, five-year forward inflation swap rate rose to 1.68 from 1.66 percent at the end of last week and 1.61 percent on Aug. 24, the lowest on a closing basis since February.

Despite that fact that even though inflation expectations are worse now than when QE started, every small rise is still, somehow, interpreted as a “recovery sign.” This is not a scientific endeavor in any possible format; it is showing as a total act of blind faith. After half a year, if you can, again, find QE’s imprint upon Europe (and not so much in asset prices anymore) you have set out to do so.

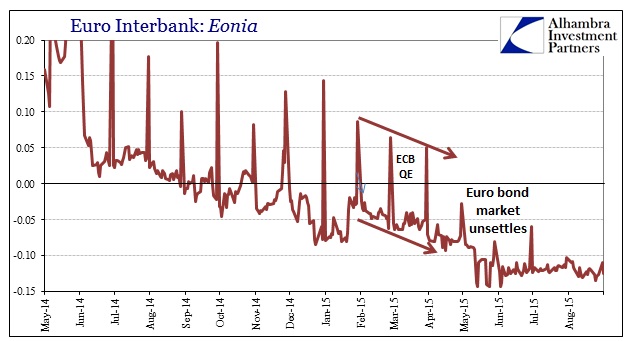

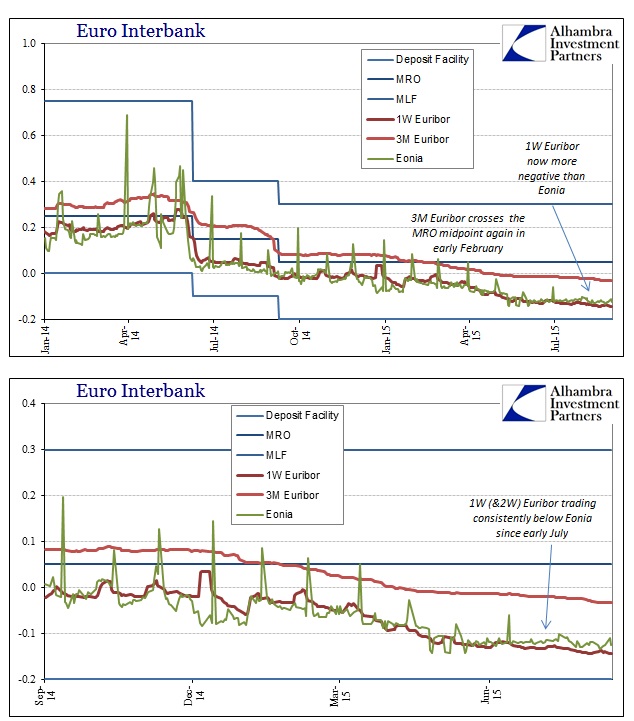

The only place where it has directly and visibly visited is in general liquidity that is growing steadily unhealthy. Eonia has been persistently negative for some time, but now short maturity interbank lending is inverted at the front – 1- and 2-week Euribor rates are now more negative than Eonia (which is overnight) and continue to get more so now into September.

If someone wants to suggest as to how that is a positive development, I am all ears because from my view that is just asking for trouble the longer it goes. I fully believe that this liquidity “arrangement” is a big part of why the European bond market starting in mid-April lost all proportion so quickly. The fact of the matter is that the ECB, as the Fed considered in June 2003, has no idea how wholesale banking might actually function in this condition let alone for an extended period. They are clearly assuming that it isn’t or won’t be troubling but there is absolutely no evidence to support that – it is pure speculation from a central bank that has failed at every turn for years to fulfill its own expectations let alone anything more significant.

Even if the ECB has taken these measures with proper seriousness and judged them necessary costs to achieve QE’s stated purposes, the total lack of progress on that front upends the calculation – all risk, no reward.

With its half-birthday approaching, QE in Europe has performed actually just as empirically-based interpretations have suggested all along. Everywhere QE is tried it leaves large financial imbalances for no detectable economic gain, even in “inflation” which is supposed to be the primary access point. That is true worldwide wherever QE or an equivalent has been unleashed, where “disinflation” is more apt a description than anything of “inflation”; that might suggest the true correlation, where more QE leads in the “wrong” direction rather than what central banks think of how an economy actually works outside the classroom mathematics.

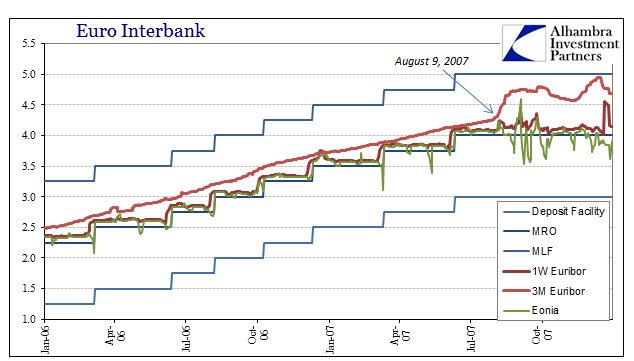

In terms of what is actually driving “inflation”, that would be the same factor that is the cause of central bank impotence going all the way back to August 9, 2007.

Stay In Touch