Top News Headlines

- Migrant crisis grips Europe.

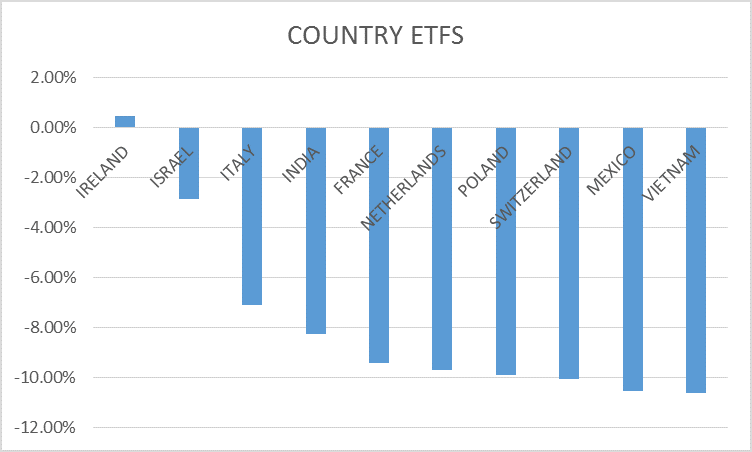

- China finds a way to stop market from falling; trading suspended for parade.

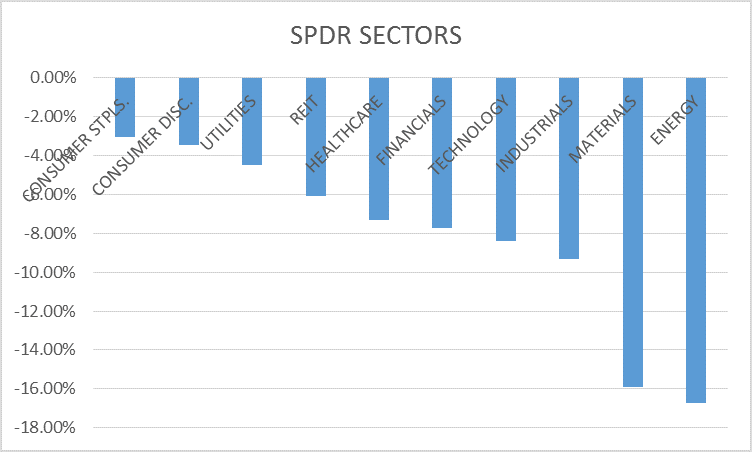

- US stocks resume slide, down 3.4% for the week.

- ECB contemplates new round of QE. Markets shrug.

Economic News

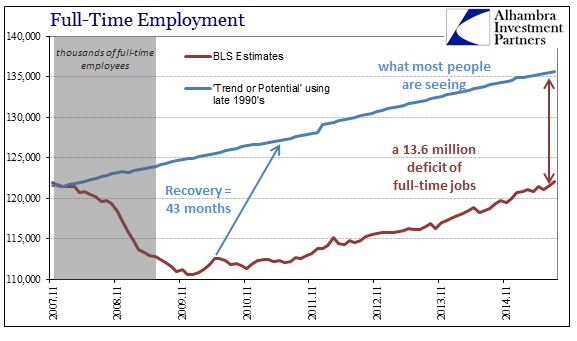

- Mixed employment report confuses rate hike calculus.

- Manufacturing still weak. Chicago PMI, Dallas Fed survey, ISM manufacturing all less than expected.

- Construction spending solid.

- Factory orders up month to month, down ex-transportation, down year over year.

- ISM services better than expected, offsetting manufacturing woes.

Random Thought Of The Week

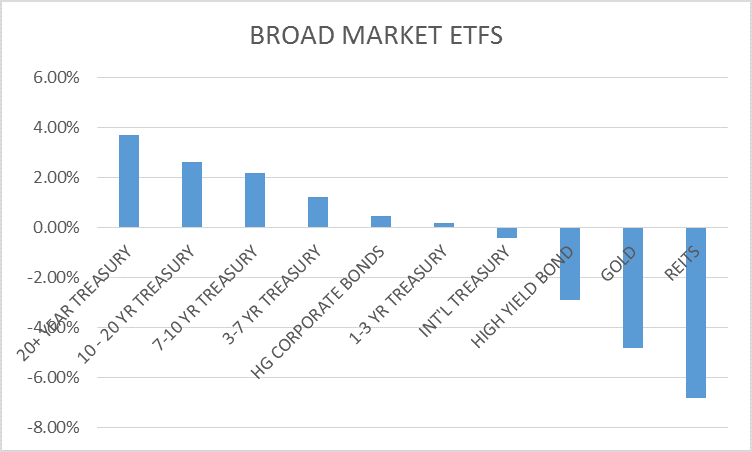

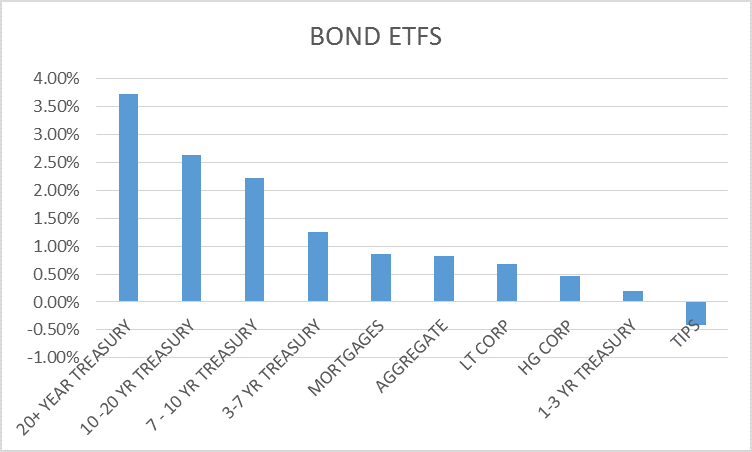

I’ve been reading for months now – heck maybe years – about the lack of liquidity in the bond market. No doubt, bonds do seem to be more volatile than in years past but with China and the rest of the emerging world’s central banks liquidating Treasuries to support their currencies – that’s why they accumulated all those reservers, right? – it is pretty amazing that we haven’t seen a big selloff in bonds. There seems to be plenty of liquidity in the bond market or at least the Treasury part of it. Where there does seem to be a lack of liquidity is in the stock market where big moves have recently become the norm rather than the exception. ETFs appear to be more a part of the problem than a part of the solution. Maybe giving people the ability to trade their mutual funds intraday wasn’t such a good idea after all.

Chart Of The Week

The Fed can say and do what it wants but it can’t change the reality of the economy or the employment picture. The fact is that the US economy, after all the Fed’s ministrations, is still not hitting on all cylinders. And in case you haven’t figured this out yet, there isn’t a damn thing the Fed can do about it.

Stay In Touch