It seems as if the PBOC is doing a whole lot and getting very little from it. That is actually expected at least to anyone not caught up in the cult of QE and the like, as that is the very nature of central banks dating back to the original at the Bank of England. Even though the focus has changed from an emergency apparatus surrounding “currency elasticity” into soft central planning in superficial direct and foreword intervention, there still seems to be something left of the “from behind” mechanism. In other words, the fact that central banks are doing something indicates not proactivity but dangerous reactivity; “something” has already happened and central banks are simply trying to counteract what already is.

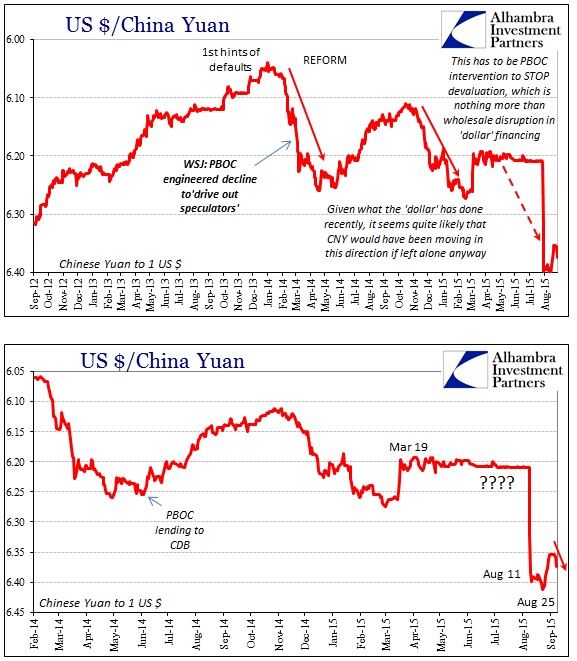

So it is in China but again China’s problems are not yuan but “dollar.” The unique yuan arrangement against the “dollar” is certainly of China’s own making over the decades, but the PBOC is fighting a battle that it seems certain to lose (as August 11 showed). They may have managed to pull back from the open outbreak of disorder, but that is not the same as performing a fix. Indeed, the PBOC has already been in this situation when the yuan went silent for five months marking some great intervention that likewise was if not wasted than at least wholly ineffective.

More recently, the yuan had moved back upward from the worst on August 25 (and the global liquidations) but even in those two weeks there persisted the same internal struggles in yuan liquidity that were directly related to ongoing and unsolved “dollar” illiquidity, at least focused on the Chinese and Asian version of the eurodollar. In the past few days, the yuan has traded lower again, sharply, which suggests that nothing has really changed or been accomplished outside of temporary reprieve.

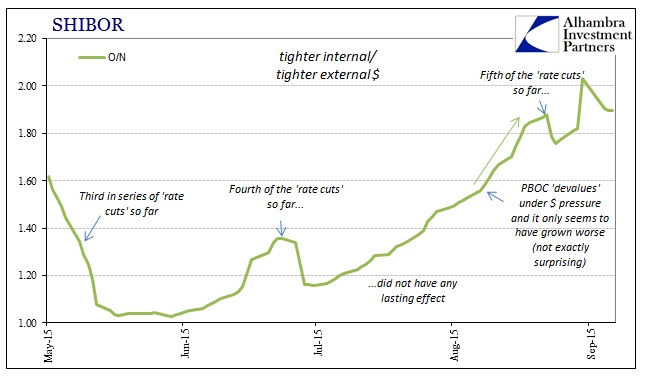

Again, we knew that already from internal Chinese liquidity as SHIBOR at the ultra-short end had reached 2% on September 1 and remained elevated well beyond even those liquidation levels (all pretty much ignoring the last of the PBOC’s “rate cut”).

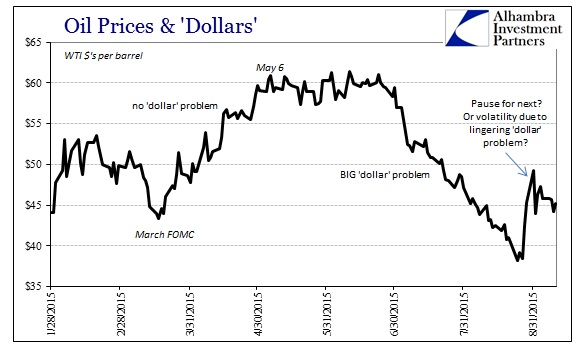

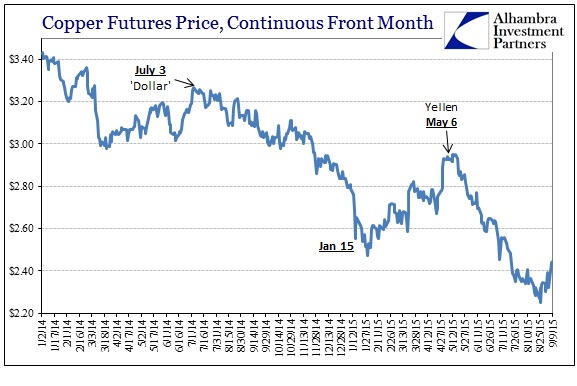

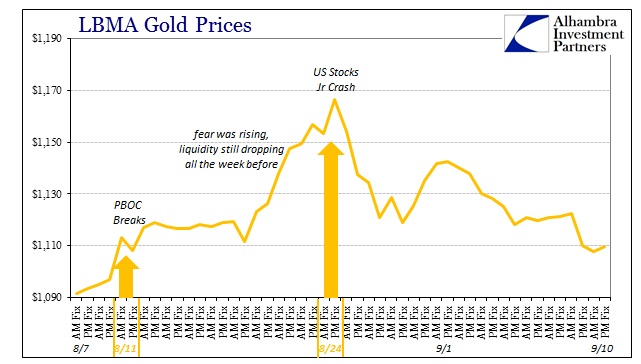

This all contrasts, somewhat, with commodity proxies for “dollar” funding conditions. From copper to crude and even gold, there has been if not more optimism than at least volatility to the upside (down for gold; less fear). Copper at the front end of the futures curve is trading back up to $2.45 while crude is around $45; neither are really an improvement so much as getting back to levels that were concerning before all this, only so far as they aren’t as low as during the worst of August.

In my view, none of those seem directly related to China or even general “money dealing” more broadly. It might be simply the usual trading pattern off of steep lows, but whatever the case the eurodollar funding system remains aside highly agitated. The “dollar” indications at least of interbank trading are more like SHIBOR than gold, copper and crude. You can see some of that in the currency translations, particularly Brazil where the real is rapidly heading toward a 4 (and then who knows where).

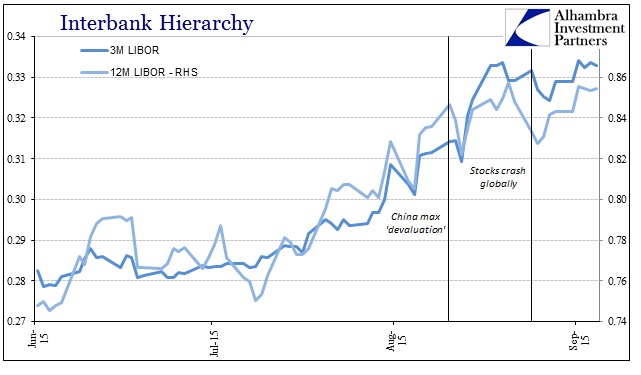

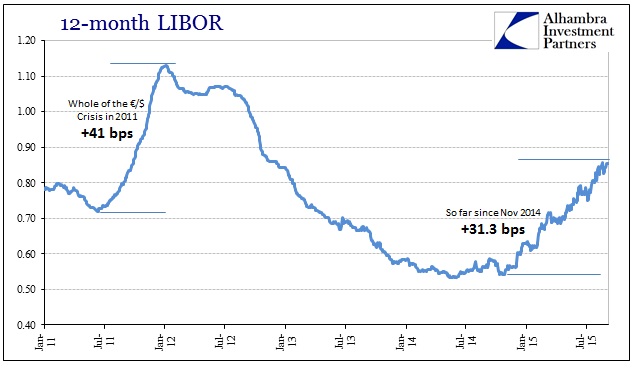

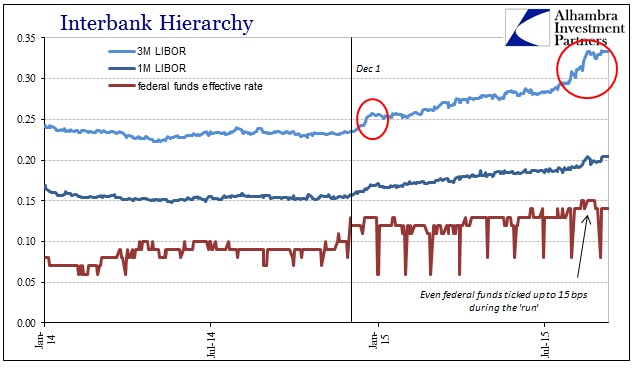

LIBOR rates had, obviously, surged in the weeks ahead of the yuan “devaluation” (that was a wholesale run, but it is still referred to as that) as even 3-month LIBOR was caught up in it equally as troubling as the extended maturities, particularly 12-month. Those rates backed off but only for a few days immediately following the liquidations. By September 1, again like SHIBOR, LIBOR rates were/are right back at the same levels as what unleashed all that global carnage in the first place.

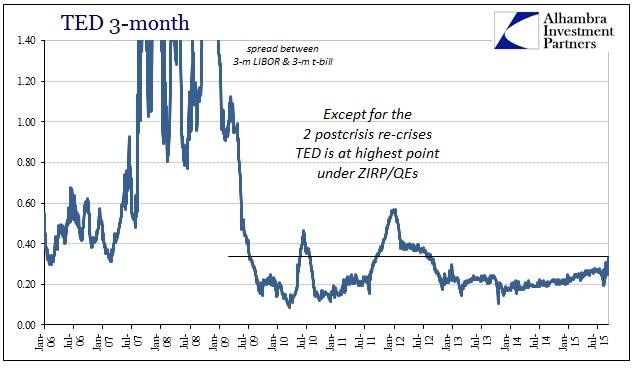

With t-bills settled down again (another clue as to how disruptive the “dollar” run became at its worst), the TED spread has exploded higher indicating, as convention, a marked increase in at least perceptions of interbank credit risk.

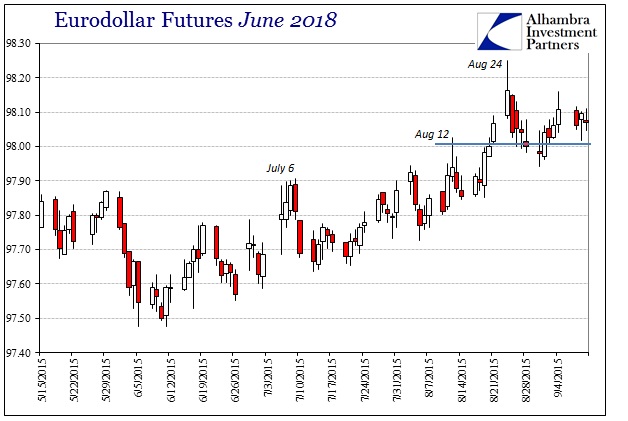

The TED spread now is where it was in the weeks just following the flash crash (Greece/euro) in later May 2010, and equal to October 2011 after the SNB pegged to the euro and the Fed reproduced dollar swaps globally. This is significant and seems to be underappreciated everywhere but places like VIX (and especially longer VIX futures). There is no comfort in swap rates/spreads or eurodollar futures as these total money dealing indications suggest that there has been no solution even though some of the more visible parts and places appear much more relaxed.

That, too, isn’t surprising as asset prices are typically on the receiving end well after “money” imbalances linger far too long having strayed too far. That idea seems quite appropriate here in both the short and long terms, as more recently the “dollar” has remained frantic and stressed though more so limited to the deeper and less observed parts of the liquidity markets (as trying to explain how “devaluation” wasn’t). Any part of those asset prices counting on renewed central bank activity are, like the buildup of pressure in later July and early August, likely to be quite disappointed as the PBOC, at least, proved not nearly enough to withstand the inevitable rebalancing through liquidations despite engaging tens of billions in “dollar” supply through UST. They simply don’t have the tools.

In the longer run, this is just another episode in a string of them stitched together on August 9, 2007. In that sense, the futility of central banks truly stands out, as they are hard pressed against each individual outbreak, typically failing an arrest until much damage is done, and thus not even willing or able to consider the actual problem in the structural failure of the governing dynamic. To that view, the continued break in money rates and condition still rules here.

Stay In Touch