Economic Reports Scorecard – 8/31/15 to 9/11/15

The majority of the reports from the last two weeks were worse than expected but the overall view of the economy hasn’t changed much. Manufacturing, with the exception of autos, continues to struggle and the majority of the pain is centered in the oil patch as evidenced by the awful Dallas Fed report. The employment report for August was weaker than expected, especially on the private payroll side but I would caution against reading too much into it. August is a notoriously difficult month to seasonally adjust due to back to school issues and has historically seen some of the largest revisions. Nevertheless, the overall picture is still one of an economy that is struggling to maintain the sub-par growth path of 2 to 2.5%. Services continue to offset the drag of manufacturing and trade and inflation pressure is wholly absent. I’ve said all year that I don’t expect the Fed to hike rates this year and nothing in the economic data makes me think any differently.

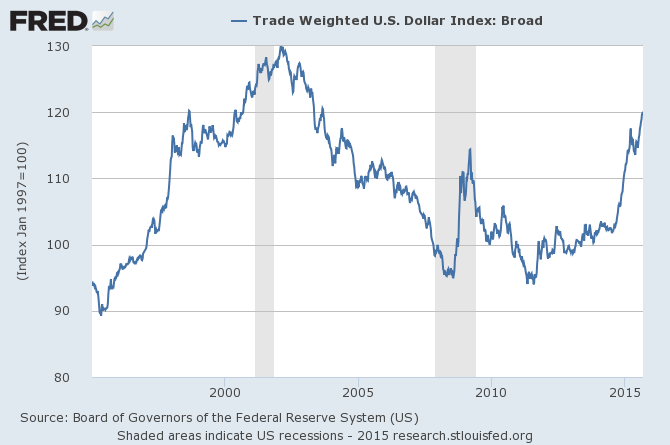

The dollar index continues to look toppy when viewed against the major currencies. It hasn’t broken down yet but frankly if it hasn’t been able to keep climbing with all problems in Europe and the domestic Japanese economy – remember the dollar index is mostly a Euro and Yen story – then my guess is that it won’t. With sentiment very negative on foreign markets and commodities, a breakdown in the dollar index would be just the thing to wrong foot all the EM and commodity bears.

The Dollar has been strong against a broader basket of currencies. Indeed the broad dollar index is approaching its 2002 high.

The rapidly rising broad dollar index is presenting problems for the global economy as it always does. It isn’t currency movement per se that cause problems; it is the rate of change that presents a problem. Individuals, businesses and governments can’t react quickly enough to a rapidly changing exchange rate. What economies need is currency stability, something sorely lacking around the world these days.

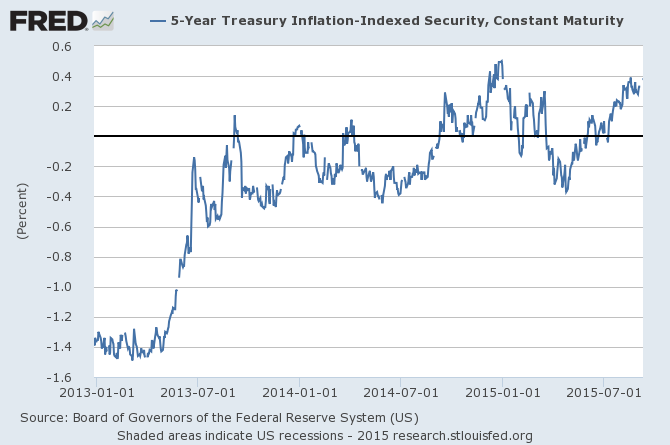

Dollar strength is a function of real interest rates which have remained firm:

But with inflation expectations continuing to fall along with global growth expectations, it seems unlikely that real rates will keep climbing.

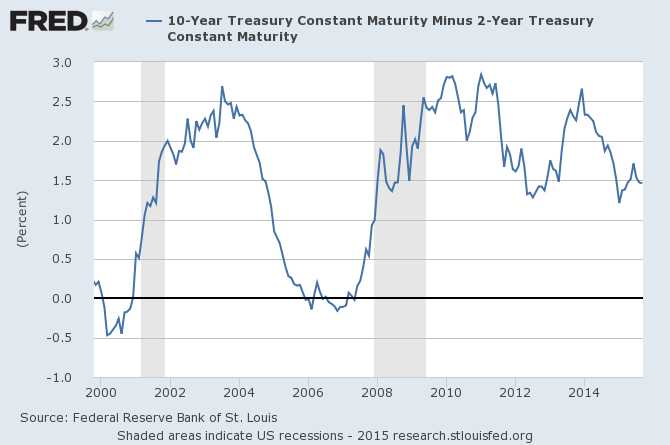

The yield curve flattened slightly since the last update but the curve remains in the middle of the historic range providing little guidance on the economy.

Credit spreads actually improved very slightly since the last update but the trend is still toward wider spreads. This continues to be the biggest source of concern. I find it very concerning that spreads continue to widen across the credit spectrum; this isn’t confined to junk.

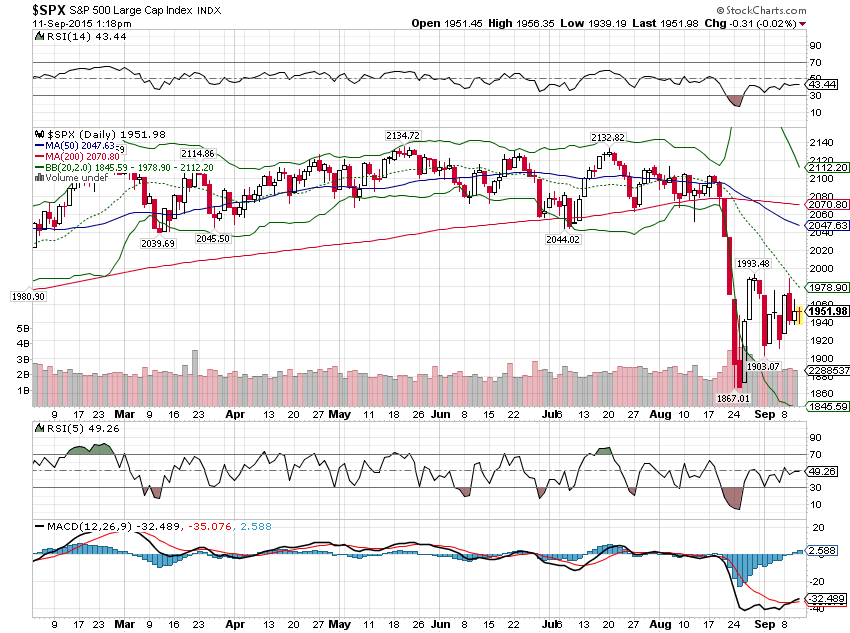

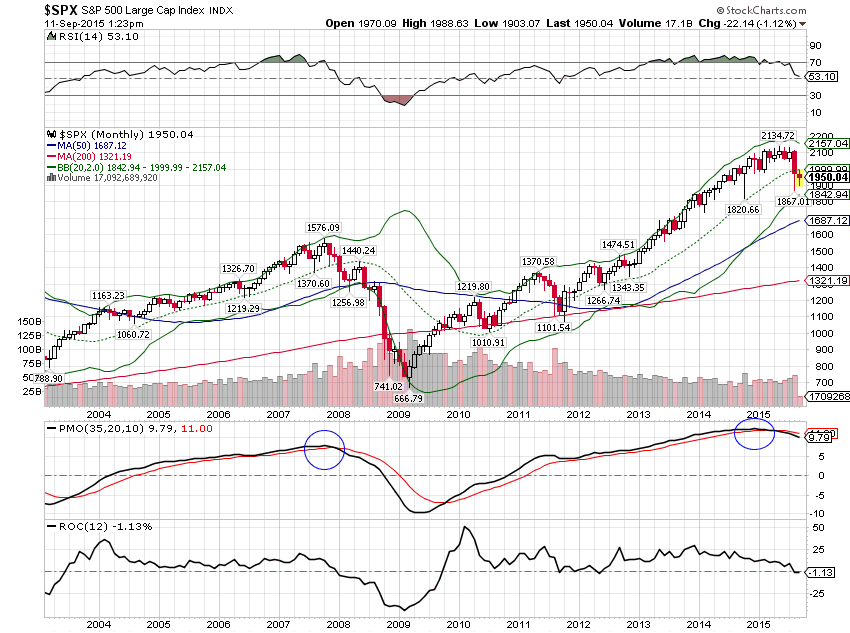

The stock market has essentially marked time since the last update, building a wedge that will be resolved soon. I suspect it will be resolved to the upside, a correction of the correction so to speak. Sentiment has gotten very negative, very quickly and a nice 100 point rally in the S&P would knock the bears down a peg.

But the long term momentum is still pointing to more pain the months ahead. Rallies should be seen as opportunities to lighten up on equities:

The economic outlook hasn’t changed much in the last two weeks and frankly hasn’t changed much in the last few years. It is a 2 to 2.5% growth economy and it appears there is nothing the Fed can do about that. Whether they hike rates next week – I don’t think they’ll do anything – is probably irrelevant to the economy although it may not be to the markets. How would stocks and bonds react to another delay in the rate hiking cycle? On the one hand it would mean policy staying looser for longer. On the other it would mean the economy isn’t healthy enough to hike. With sentiment already very negative, a delay in the rate hiking cycle may be seen, at least initially, as a positive for stocks. Will it last? I have my doubts. Significant improvement in the economy – and therefore corporate earnings – will not come from Fed policy. We need a big change in fiscal and regulatory policy and that is a long way off at best.

Stay In Touch