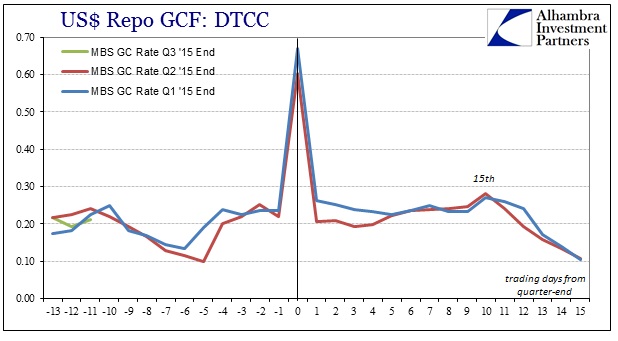

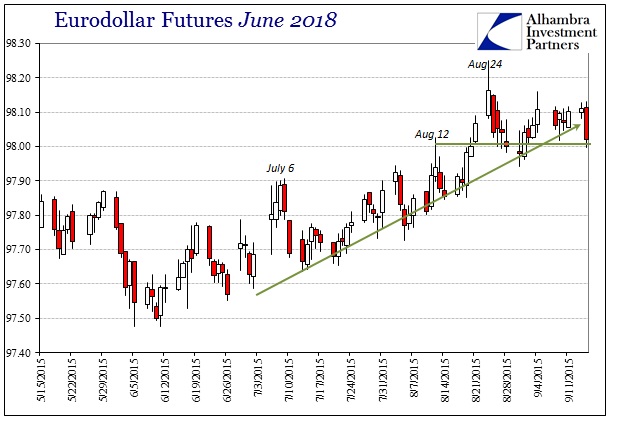

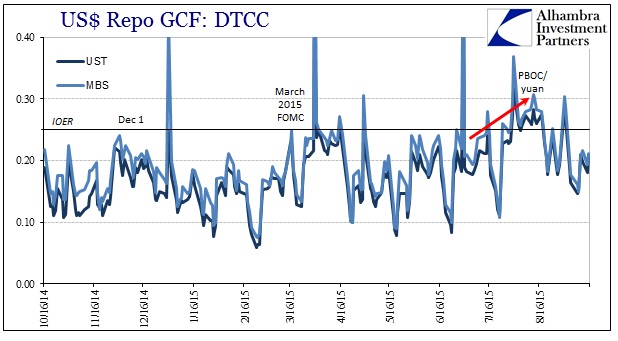

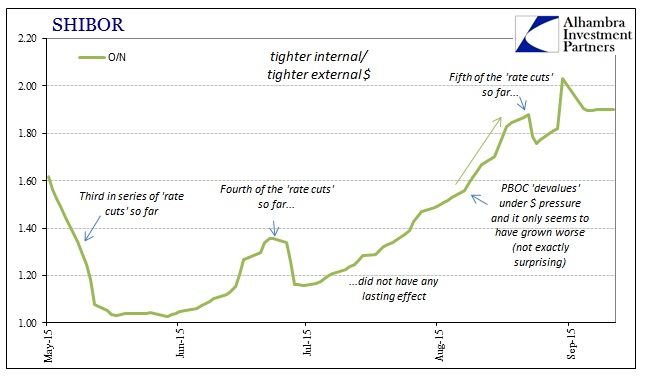

Being September 15 and thus entering the final two weeks of the quarter, it seems appropriate to review all the liquidity bottlenecks (or at least the symptoms of them). Since GC repo rates found themselves retracing the end of Q1 at the end of Q2, it feels appropriate to start there. As you might expect, the repo rates thus far are following the same pattern, though I wouldn’t say it is as exact. That may not matter so much as it is the after-quarter end trading regime that seems most affected and transmissible (the “dollar” run through August seems to have started in that window, at some point around July 6).

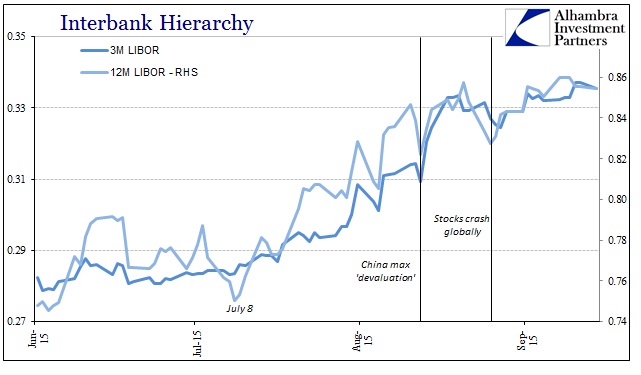

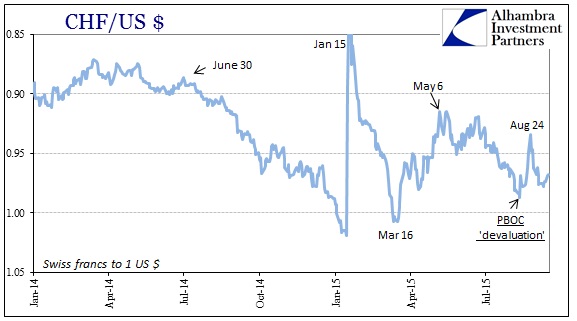

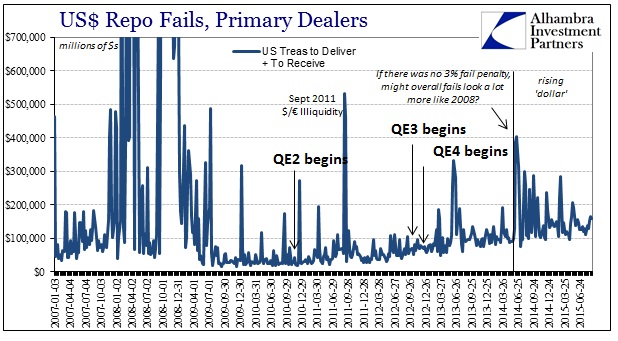

It should also be noted that repo fails in UST (but not MBS) were slightly elevated around August 24, and remain so at least into the first week of September. LIBOR rates were only fractionally lower yesterday over Friday while funding currencies continue in the “wait and see” pattern.

Stay In Touch