Outwardly, you can appreciate why central banks act as they do under serious and dangerous circumstances. Prices aren’t just what someone will pay but also represent information that is transmitted broadly to all corners. Thus, if something is going wrong there are prices that will show it, potentially diffusing contagion to other places and markets. From a child-like perspective, it would seem helpful to interrupt the crisis flow of information in addition to whatever else might “need” to happen in order to regain control from the precipice of chaos.

That was the primary reason for the reverse repos carried out by the Fed in the days following Lehman. It still isn’t appreciated now years later, but a reverse repo is an “exit strategy” designed to “drain reserves” from the federal funds system. On the surface, it seemed the Fed was removing liquidity during a liquidity panic.

In reality, the Open Market Desk (it’s not clear to me on whose authority, and I have read all the transcripts) was responding to the federal funds rate falling and remaining below the FOMC’s federal fund target. For the Fed, any deviation from target, in either direction, is a huge problem as it transmits openly and widely their impotence. It didn’t matter as the system panicked and seized anyway (so the FOMC actually helped but not because or how they meant to) but it goes to show that central bank focus on what it thinks is important isn’t always helpful.

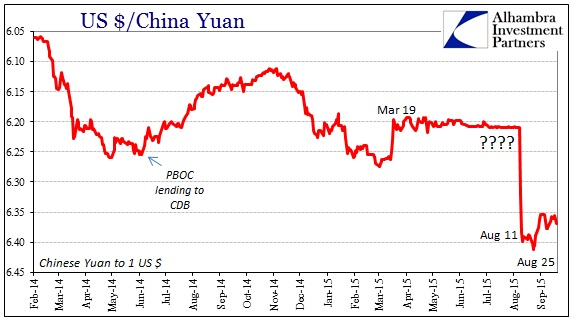

More recently, the PBOC underwent a similar construction first with the yuan. For five months, starting at the March FOMC meeting, the yuan-dollar cross stopped its typical variations (PBOC band or not). From an information perspective at the PBOC, I suppose that would be helpful only if “allowing” trading would signal something undesirable. In the case of what would transpire, that signal would be toward an enormous “dollar” run which the PBOC was straining mightily to contain. It would seem to make sense that the PBOC would not want the price of its currency to suggest anything like that; so the Chinese central bank underwent some significant “reserve” redistribution in order to hide it.

Outwardly, the fact that it lasted five months made it appear working and effective. “Selling UST” was undoubtedly confusing in implication especially when compared to the more straight-forward “devaluation” of the yuan which undoubtedly would have occurred under less central bank influence (though, judging by commentary since August 11 the PBOC might have been better served letting the yuan go its own way since “devaluation” continues to be the conventional interpretation). However, to anyone participating within the China/”dollar” liquidity system it wasn’t effective; in fact, you could argue, as I would, that by removing almost all variation it was instead calling greater attention to the fact that the PBOC was seriously engaged and trying to hide it (there are no positive implication from that interpretation).

In more practical terms, aside from just information manipulation, the impulse to suppress volatility seems (by empirical result) more likely to produce amplification than restore order. Here the analogy to plumbing is apt, as concealing pressure as it escapes from a broken pipe is more likely to lead to disaster than actually fixing it. The difference in orthodox monetarism is “rational expectations” whereby the influence on prices, and thus information, is believed to actually be a durable solution (supposing that if there is a run, and nobody else can see it, it will die out on its own; rather than examining the great imbalance causing the trouble in the first place).

In that respect, the events of mid-August were consistent with that of the FOMC in the autumn of 2008 (different scales and locations notwithstanding). While the yuan has resumed more “regular” variation, its “dollar” link to internal liquidity has not. In the Chinese wholesale node to the eurodollar network, internal yuan liquidity is directly tied to external “dollar” conditions. That is why, parallel to “dollar” interventions, the PBOC is forced to inject yuan liquidity.

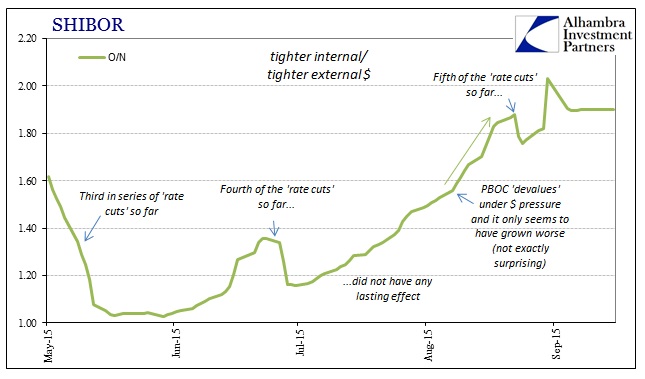

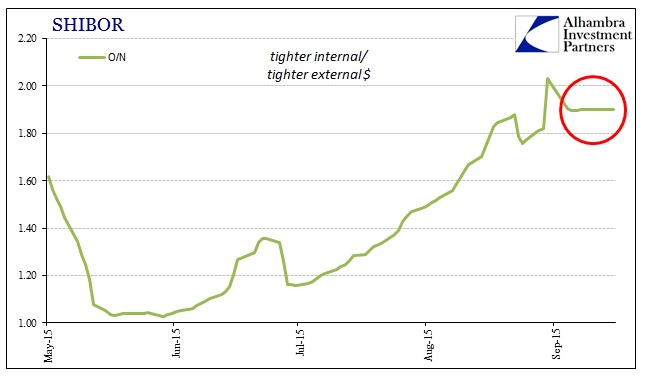

That financial imbalance has been signified by several key “prices”, O/N SHIBOR in particular. As the “dollar” run gained despite the yuan showing nothing of it, SHIBOR was clearly demonstrating the “dollar” rather than the forced placidity suggested at the currency level; thus, yuan strain equaled “dollar” strain. On this side of the run, now in September, suddenly SHIBOR (after not responding to the last rate cut) has lost all variation just as the yuan did earlier. O/N SHIBOR has been at or very near 1.90% since September 7, with only the smallest possible volatility (just 1 pip on either side) since September 10.

There is no question as to whether the PBOC is active in this “market”, only their intentions in being so active. You would think that if they were successful at having calmed money markets from all this persistent interference, SHIBOR would follow at least one of the three prior rate cuts in coming down away from 2%. Instead, to be stuck at 1.90%? To my view, that is as the yuan before August 11; active suppression the only way the PBOC knows, stamping out all variation altogether.

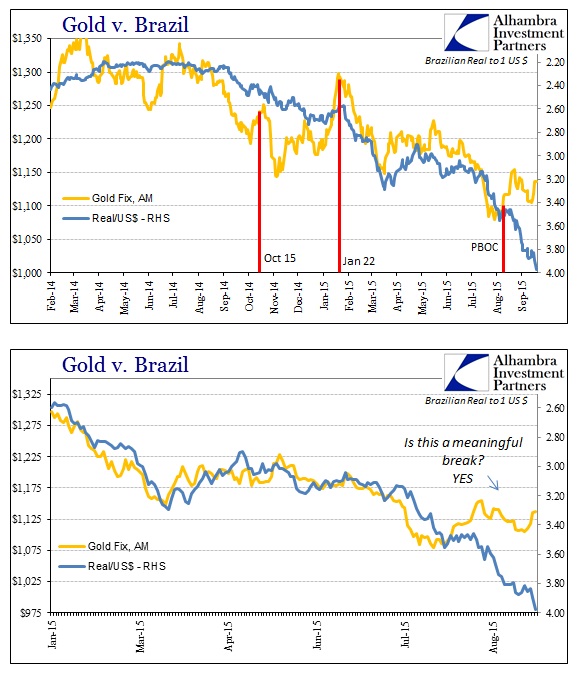

We know from other “dollar” indications that there has been no release upon wholesale illiquidity, so the timing is yet another element on that side. The Brazilian real, for example, has steadily sunk through September now only slightly shy of 4.0 to the dollar today. Brazil is in much the same condition as China, not just economically but the related wholesale “dollar” arrangement.

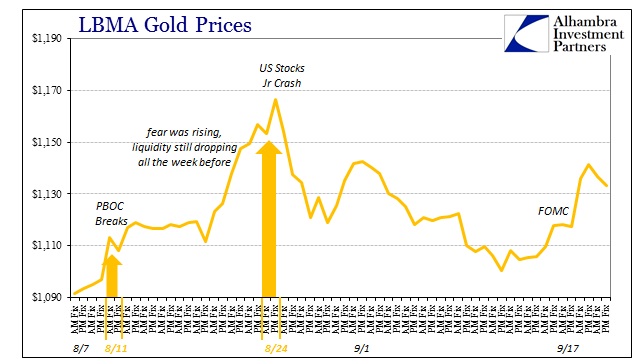

I would also add the behavior of gold within that timeframe. Gold’s break from close correlation with the real (since gold has acted marginally as “dollar” collateral globally) likewise suggests strain to the point of heightened uncertainty and even marginal fear. So, again, you can understand what the PBOC is doing and why, but also why that it isn’t likely to prove effective. The real question is whether, eventually, it makes it worse.

Stay In Touch