The behavior of mortgage REIT’s lately embody a great deal of confusion about what they actually are and what that really represents. The first aspect to understand is that they are not participants in actual real estate, rather more closely aligned as a specialty financial firm akin to a non-registered bank. They make money as banks do (or supposedly they do in the textbook version) pocketing the spread between borrowing short (and ultra-short) and investing long (in mostly MBS).

Mortgage REIT’s as a group have struggled for several years which is attributed to the Federal Reserve’s impending (any day now) rate hike. This conventional theory posits a negative profit profile as borrowing costs rise against real lags and frictions in their investment portfolios.

Like many financial companies that borrow short-term and lend or invest long-term, mREITs can struggle during rising-rate environments because their funding costs rise faster than the yield on the assets they hold. Conversely, they tend to rally when investors believe the Fed will start cutting rates. A flattening yield curve –like Friday’s [September 4]—where short-term rates rise and long-term rates fall, also reduces earnings prospects. MREITs attempt to hedge out near-term rate risk, but they don’t always get it right.

These companies also deploy massive leverage – you “have” to because the traditional maturity spread doesn’t make anything worthwhile let alone this kind of specialty banking. Given that background, mREIT prices are not just susceptible to the Fed’s maybe/maybe not uncertainty. The funding equation, which should be more in mind given recent history, is far more often than not unrelated to monetary policy. This is particularly true when funding more generally is disruptive – the risk that an mREIT will find itself on the wrong side of a bottleneck is not trivial; and once the margin calls start in that situation you get the specialty equivalent of a “run.”

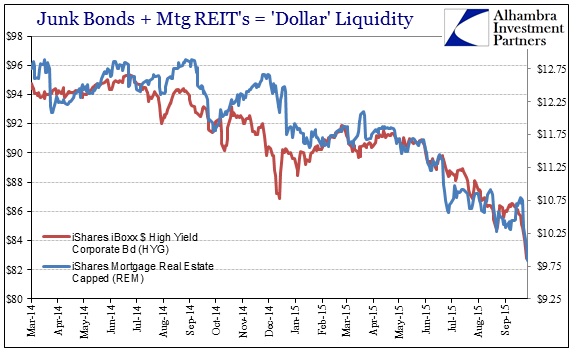

That has combined to produce a situation where convention dictates the resemblance of potential Fed action when in fact it is far more so general liquidity and leverage perceptions. While many will argue that mREIT’s even lately continue to follow the former, the action in pricing in the past few days alone obliterates that idea. It isn’t the Fed here:

You could make the case that REM (which tracks a benchmark portfolio of mREIT shares) had traded upward to a high of $10.77 last Wednesday based on those conventional interpretations of the Fed’s September 17 non-decision. However, there is no way to reconcile the crash dating back to last Friday with the Fed; this is a stark liquidity warning, as REM is down an alarming 8.5% just since Thursday’s close (even taking into account the $0.271 dividend paid Friday).

That is related to conditions in the junk/corporate bubbles as they exist in unstable fashion now, but there is more to it. In other words, liquidity applies to junk corporate in more obvious fashion, but to see risk pricing take such a nasty turn in the MBS sector (where almost all funding is repo) suggests internal contagion (at least in sensitivity).

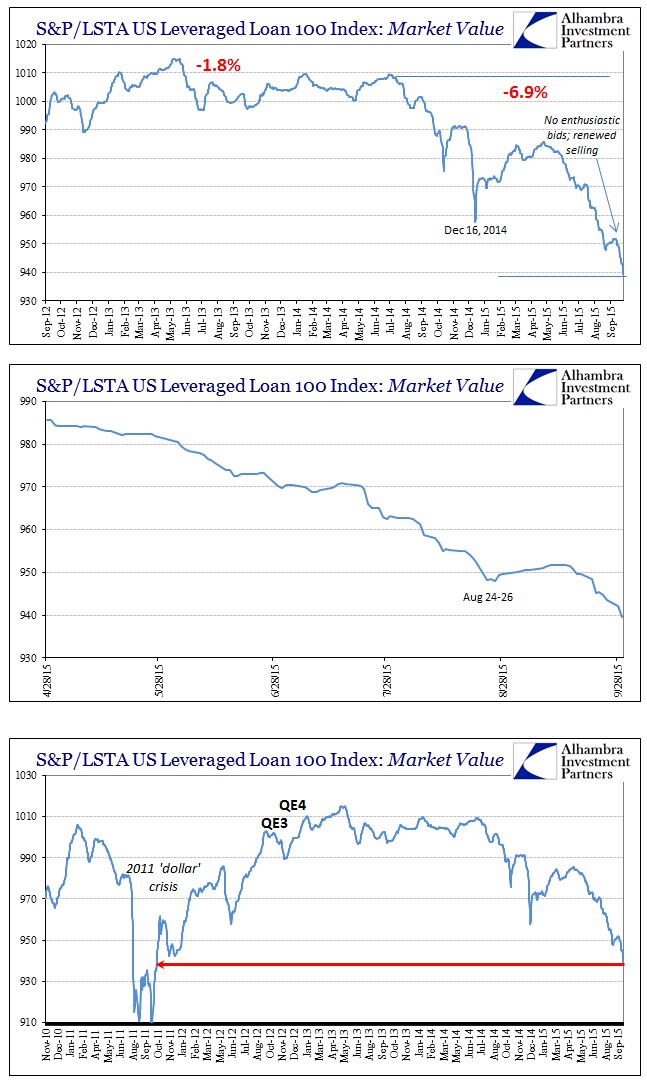

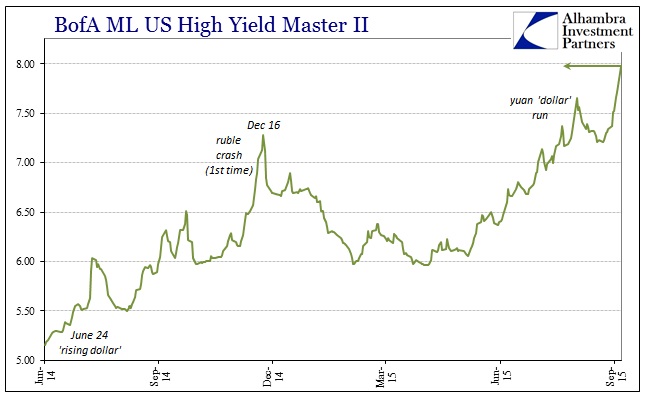

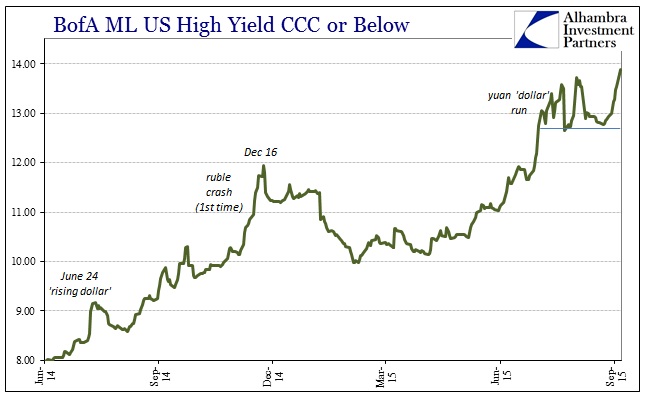

Institutional junk prices have sold off hard yet again, with leveraged loans seemingly catching up to other indications on the downside. There was no delay in pricing updates today for the S&P/LSTA Leveraged Loan 100, though I suspect many institutional syndicates wish there were. The market value subcomponent dropped below 940, which is equivalent to the raw downside during the 2011 “dollar” crisis.

Credit spreads in high yield and even investment grade issues surged, which will undoubtedly have further implications for squaring positions still tomorrow (VaR-type blowouts; when prices accelerate beyond modeled expectations the response on both sides of any trade is typically sharp).

Putting all this together: we know that the corporate credit bubble has been highly disturbed, but the action in mREIT’s these past few days more than suggests that risk perceptions systemically are being affected. That all ties back to funding considerations, as the collapse in REM may be investors selling ahead of liquidity problems that are still building and expanding. In other words, there may be a growing sense (not unlike inflation breakevens I discussed earlier) that the corporate pricing problems are going to break out in short order beyond just junk (and beyond what already has).

It could be that mREIT prices are being reactionary to the continuation of the corporate bond selloff, but the magnitude of the move in the past few days to me represents something different, a distinct shift in perceptions about what is a related market but not completely so. That might suggest growing expectations of liquidity providers (money dealers) reducing their activities broadly in multiple markets because of the corporate downturn, rather than specifically of leverage in individual trades or firms. That, to me, constitutes a liquidation warning.

Given both the obvious acceleration in the junk selloff and now the level it has attained, that isn’t really much of a projection. However, the true danger has always been (and remains) “contagion” and a general trend in liquidity that doesn’t answer to any rational basis, spreading more so on simple fear than conditioned analysis (even where appropriate). Once started, it goes until it exhausts itself.

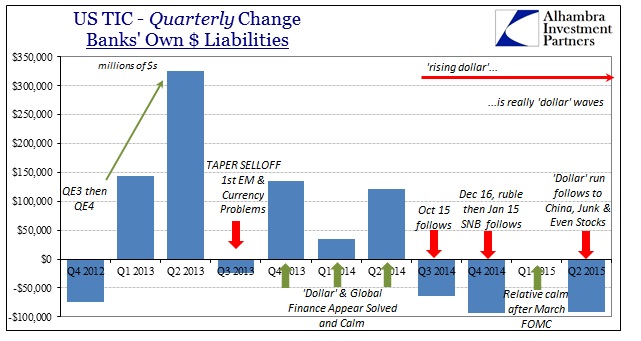

We have seen all this before, and REM has in the past year has pointed in those directions (at the end of Q3 2014 before October 15; almost the end of Q4 2014 before January 15; skipping, importantly, the end of Q1 2015 before returning at the end of Q2 2015 just ahead of the last “dollar” run started in early July). Thus mREITs might be suggesting, via the timing of prior and similar crashes, the dreaded quarter-end bottleneck appearing on schedule for Q3 into Q4. Given how each of those past logjams have turned out and the current state of the “dollar” and bubbles, this all points to another dangerous confluence perhaps even more extreme.

Stay In Touch