On September 28, Mark Haefele, Global CIO at UBS Wealth Management, wrote at CNBC.com there was much more to the central banking offerings than currently employed. The implication, obviously, was a reassuring call to not heed any darkening outlook. Blaming that upon “overanalyzed data”, Mr. Haefele insisted that investors were becoming far too pessimistic given the potential monetarism yet untapped.

The progress made toward recovery has been largely overlooked, whereas the magnitude and breadth of the weak economic data has been overanalyzed. We believe disappointing data represents a mid-cycle slowdown, not a slide into recession. A combination of improving readings from the U.S. and a gradual recovery in China should help restore faith in the global growth picture.

There’s a very good chance that September’s payroll report, which came out after this article, rendered such reassuring support moot; at least in terms of investor confidence in the economic outlook such that it is right now. Stock market action, on its own, has been more conforming in excitement toward what central banks might do, but that is all still predicated on simply redoing what hasn’t worked. Even Mr. Haefele was depending on the same old:

In the euro zone, European Central Bank President Mario Draghi has been explicit in his willingness to unveil bigger monetary policy guns, saying on Sept. 3 that “the size, composition and duration” of quantitative easing could all be enlarged. We consider it likely that the Bank of Japan’s asset purchase program, running at 80 trillion yen ($663 billion) annually, will be increased in response to low inflation readings.

And in the U.S., while debate rages about the merits of the Federal Reserve’s recent non-decision, Chair Janet Yellen and her colleagues have proven they are flexible enough to maintain ultra-low interest rates if they see fit.

Second, we should remember that stimulus takes time to feed through into hard data.

While his second point was related to what he thinks should be a more patient approach to China, does time (lags) really matter at this point? For this orthodox perspective, China started “cutting rates” almost a year ago, and the country is still sinking and threatening the global economy with it.

When Europe “unexpectedly” fell back into “deflation” in September (August data), economists and policymakers were quick to dismiss it as “only oil” or irrelevant since European QE was “surely” still gaining. Obviously, the latter assertion was quite problematic given the inflation rate itself but also because there has been no appreciable change in the lending situation in Europe before or after QE (except in clear financial reconstitution where some financial firms were certainly expecting to gain from the ECB’s new entrance into PSPP). It’s as if QE never occurred in terms of lending, which is the primary conduit all through which this financialism is supposed to widen and expand usage.

So in early September, Mario Draghi made a technical change to PSPP to “give” markets something suggesting as Mr. Haefele has continued, while downplaying any significance in the negative impression left by that “inflation” as if that was something the ECB could actually address (if it hasn’t worked so far…). Others simply parroted that as a complete expectation:

“I am very glad he hinted at further action, but frankly I was disappointed to hear that further expansion of the balance sheet was not already considered. Given the very sizable downward revision in the inflation forecast for next year, I would have expected that further action would already be considered today,” former ECB Governing Council member and former Cyprus central bank governor, Athanasios Orphanides told CNBC.

“I am not extremely concerned about the market turmoil in China, I think we need to see through that. But I am concerned by the fact that the inflation numbers and projection have not risen as much as the governing council had hoped, so looking beyond China I think an adjustment of policy would be warranted,” he added.

The imbalance in all these perceptions is striking; the economic data, “overanalyzed” or not, is all moving in unison while the most that can mustered against that growing reality is the possibility of central banks doing only more of the same? Given the latest economic estimates, particularly today German factory orders, Europe might now have a Europe-inflation deficiency (in orthodox understanding) and a growing Chinese problem with only more QE-promises athwart.

German factory orders unexpectedly fell in August in a sign that Europe’s largest economy is vulnerable to weaker growth in China and other emerging markets.

Orders, adjusted for seasonal swings and inflation, dropped 1.8 percent after decreasing a revised 2.2 percent in July, data from the Economy Ministry in Berlin showed on Tuesday. The typically volatile number compares with a median estimate of a 0.5 percent increase in a Bloomberg survey. Orders rose 1.9 percent from a year earlier.

Two straight monthly declines in the seasonally adjusted series is a serious warning, as the year-over-year changes in the non-adjusted data point to the conspicuous lack of progress for even German output so far. In other words, despite everything the ECB has done prior to now, and that is considerable despite mainstream attempts to elude otherwise, Germany remains stuck at around zero. Thus, if China is to exert an appreciable negative pull on German economic activity in the near or even intermediate term as its recessive potential continues to gain, “inflation” might very well be right on track.

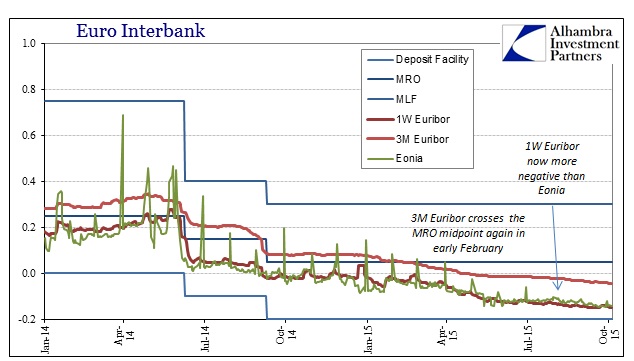

As far as any tangible impact from QE, it remains limited to the euro money markets (not to be confused with eurodollar money markets, though they may be linked by the roster of participants and shared balance sheet resources) and not in a particularly favorable way. In short, there is now no evidence that negative nominal rates have any more positive impact than QE, ZIRP and everything else the ECB has thrown around since 2012 (really 2010). Negative impacts, on the other hand, can be more easily argued, leaving Europe looking more and more Japanese and mystified as to how that could be.

Stay In Touch