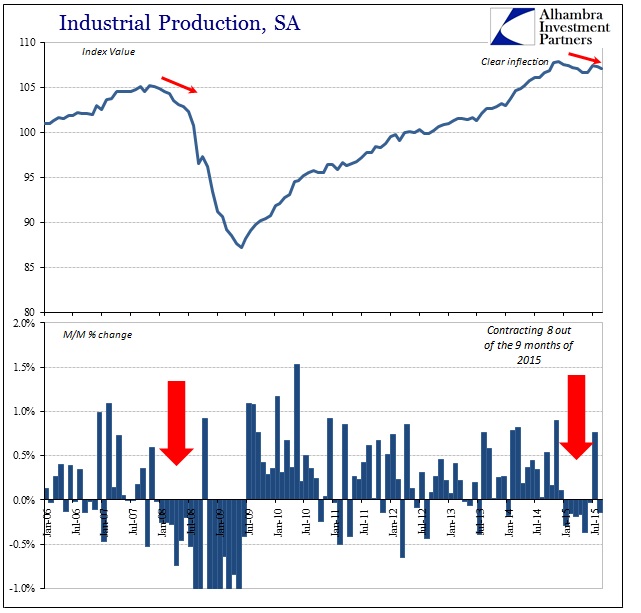

Industrial production fell again in September, seasonally-adjusted month-over-month, for the eighth time out of nine months so far this year. Year-over-year IP was barely positive, at just +0.4%. The last time output growth was so stagnant (on the way down) was March 2008! It has become exceedingly difficult to assign this trend some temporary designation or as if it was even some larger course of “normal” variation. Having encompassed now three quarters of a year and with no sign of relief (following the “dollar” waves, after all) the US is only more closely aligning with the global economy.

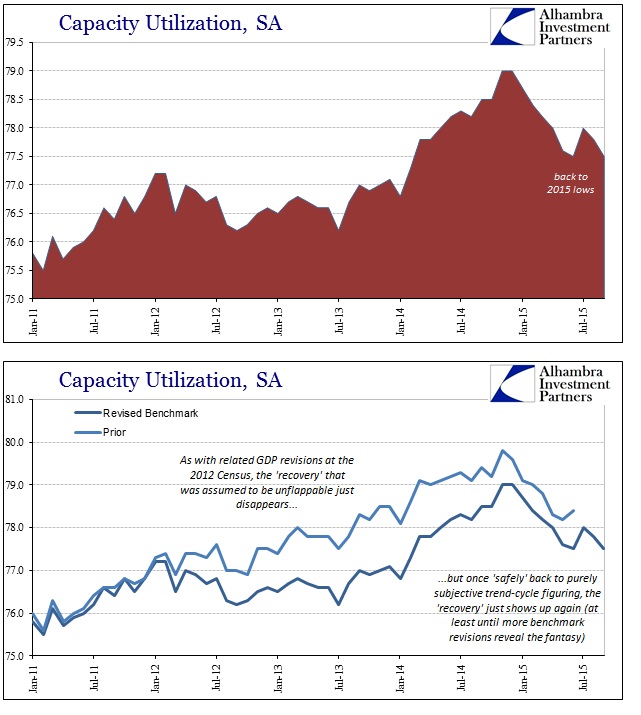

Capacity utilization rejoined the lows for this year which is likely worse than it seems by longer-term comparison. Recent benchmark revisions have skewed capacity results post-2012, featuring a prominent rise in utilization last year that may be nothing more than trend-cycle fancy. That would establish the downturn this year, as the Establishment Survey count of payrolls, in capacity utilization as valid while leaving the magnitude and depth to more arguable interpretations.

And while there will be those to dismiss all this as a function of oil prices and oil production, that sector continues to contribute to overall IP rather than to have yet subtracted. However, because IP in the oil sector slowed to its lowest growth rate in four years in September, the overall weakened US industry component is not likely to rely anymore on crude oil from here forward. The negative confluences are starting to merge.

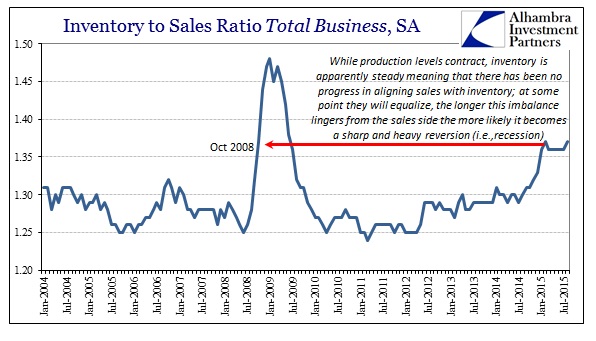

While this overall, broad slowdown is significant itself, it is made more troubling by the distinct lack of progress in re-establishing inventory control. The Census Bureau reported separately this week that total business inventory-to-sales, which includes the whole supply chain, from manufacturing to wholesale to retail, rose to 1.37 again in September matching the “cycle” high from February. In other words, despite all these non-oil cutbacks in production, inventory remains as high as ever. That suggests both a highly unfavorable “demand” environment (despite so much time and trillions of units dedicated to demand “stimulus”) and production that is still far too high for it.

That is the basis for the self-reinforcing recession cycle, as production cuts back and only introduces more downward pressure on “demand”; and so on. In short, after almost a year of weakness, there isn’t yet the full measure of it but it grows closer as more and more shake off last year’s narratives and hollow promises. The longer this drags on and accumulates to the downside, the more forceful that awakening.

Stay In Touch