Top News Headlines

- Kinder Morgan, Freeport McMoran, Anglo-American cut dividends

- Climate deal reached in Paris. Not legally enforceable, all voluntary, no one cares.

- Dow, Dupont agree to merge, divest and keep Wall Street employed.

- Junk bond fund halts redemptions.

Economic News

- China loosens Yuan peg to the dollar.

- Oil hits new lows.

- Jobless claims hit 5 month high.

- Retail sales disappoint again; auto sales down second straight month.

- Fed expected to hike rates this week.

Random Thought Of The Week

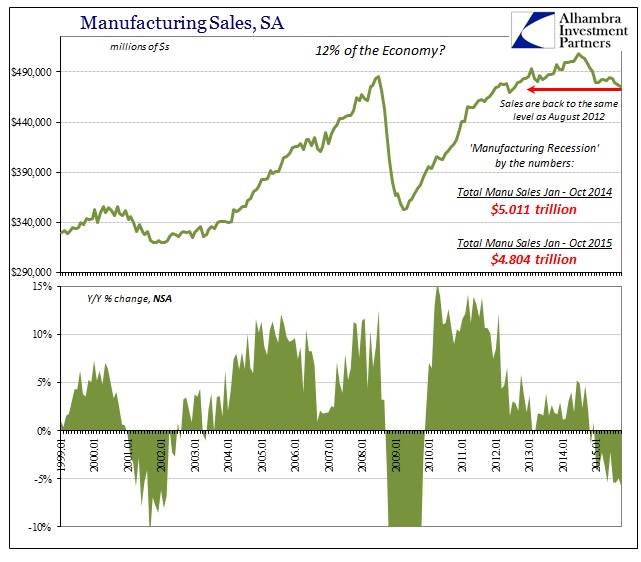

In recent weeks I’ve heard that we are in an “earnings recession” and a “manufacturing recession”. The oil patch is in recession and mining companies are, I guess, in a dividend recession since they all seem to be cutting them, in some cases all the way to zero. And yet no one has proclaimed yet that the overall economy is in recession. One wonders how many “recessions” we have to have before the qualifiers are removed.

Chart Of The Week

If it walks like a duck and it quacks like a duck, well you might have a duck on your hands. Manufacturing is not the tiny piece of the economy the talking heads would have you believe and it isn’t doing well.

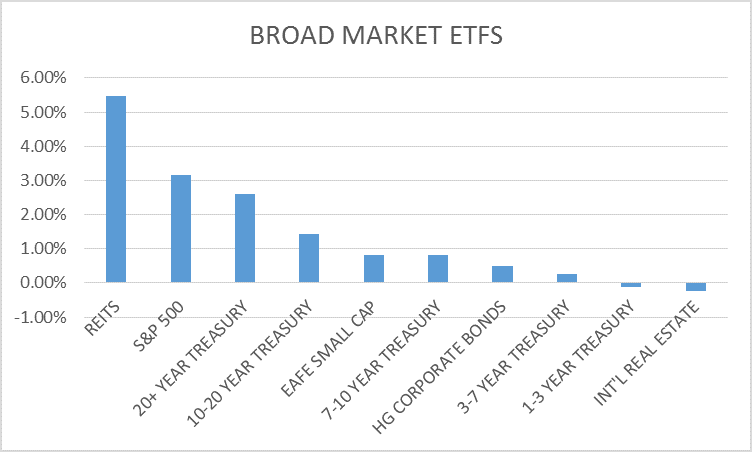

Broad Market – 3-month Returns

REITs and the S&P 500 are back at the top of the 3 month rankings but that’s just because stocks are back near their highs. A longer term look shows that stocks have made no progress over the last year. Long term Treasury ETFs have moved back into the top 5 as stocks have sold off over the last week.

MOMENTUM ASSET ALLOCATION MODEL

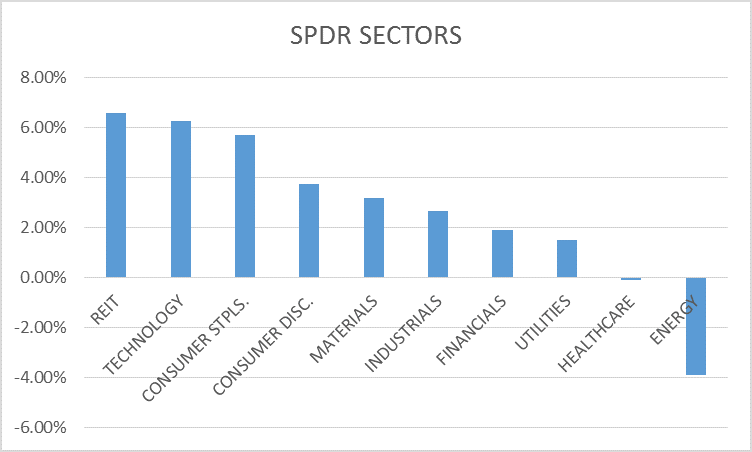

SPDR Sector Returns – 3 Month Returns

Consumer staples moved back near the top as the market gets more defensive. Interesting that technology has gotten a lot of attention as a leading sector but REITS have actually performed better over the last 3 months. Technology outperformed REITS by a wide margin – until the late August selloff.

SPDR SECTOR ROTATION MODEL

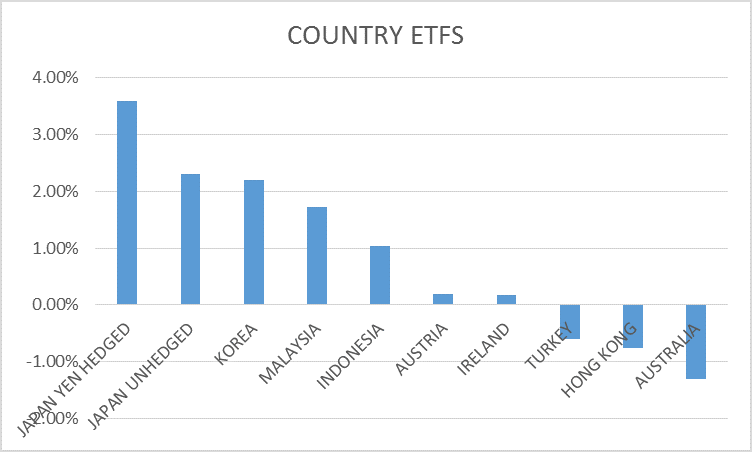

Country Returns Top 10 – 3 Month Returns

Japan back in the lead and Asia generally leading. One wonders if China’s economy is stabilizing.

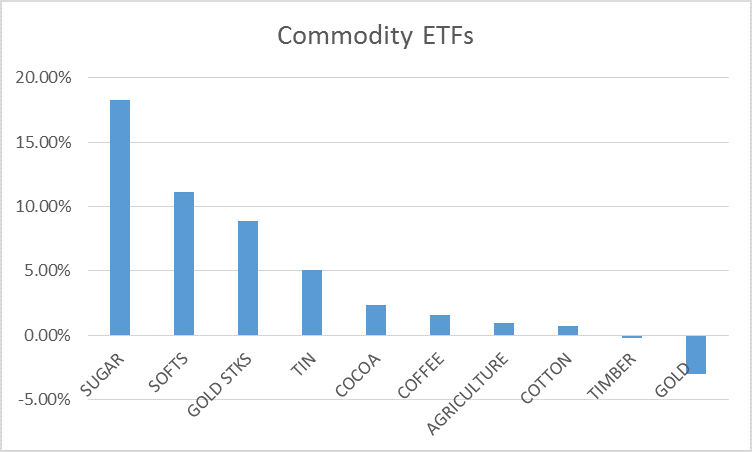

Commodity Returns Top 10 – 3 Month Returns

Sugar bulls better enjoy it while they can. There’s a developing glut and India is about to dump a large inventory on the market. Gold cracked the top 10 for the first time in a while although still down.

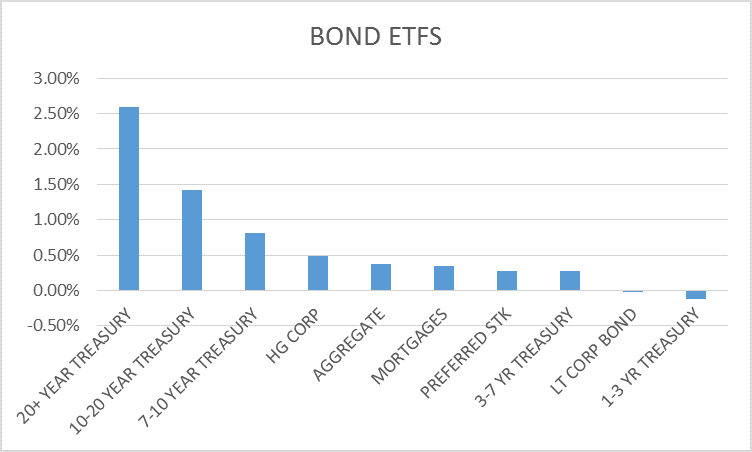

Bond Returns Top 10 – 3 Month Returns

Duration and high quality is winning in bonds right now.

Stock Valuation Update

Have valuations finally peaked? In case you’re interested that’s about a 35% drop down to the median. You don’t want to know how far it is down to that other line.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or  786-249-3773. You can also book an appointment using our contact form.

786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch