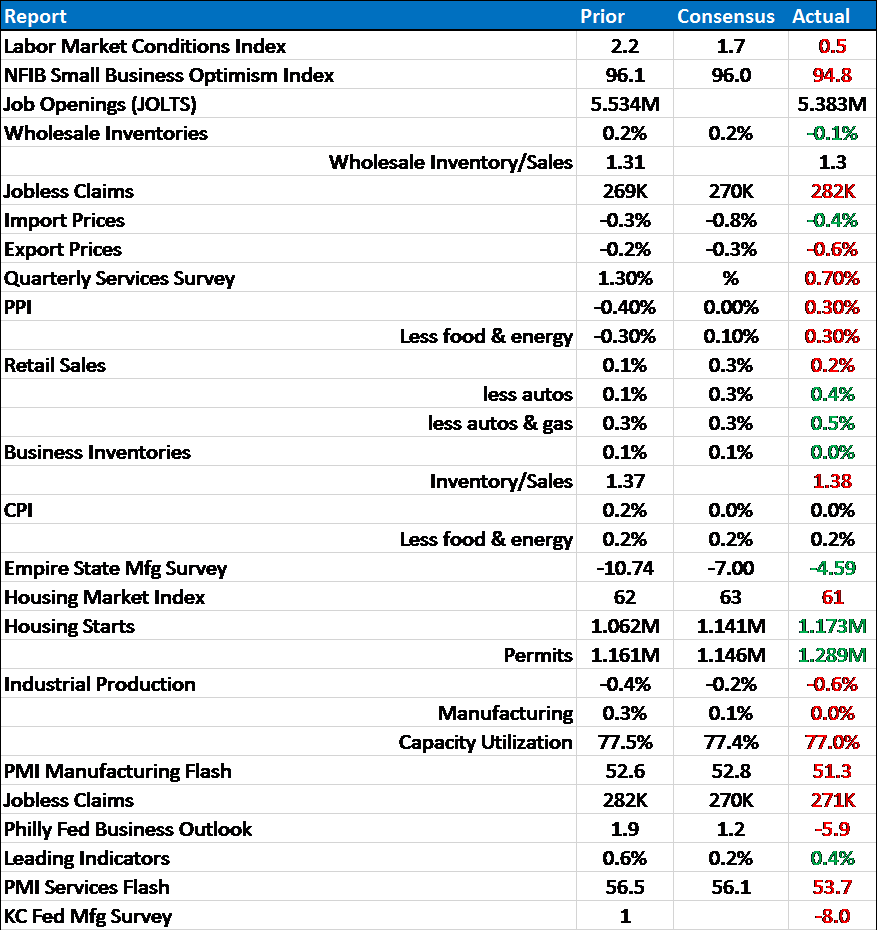

Economic Reports Scorecard – 11/6/15 to 11/20/15

The incoming economic reports ran two to one negative over the last two weeks, continuing the trend we’ve seen all year. That’s one of the worst two week stretches we’ve seen all year. Janet Yellen has been telling us for over a year that changes in policy were “data dependent” but that is hard to square with, well, the data. The only data from the last two weeks that supports the idea the economy is improving is the housing data. Ironically, the improved housing data may be a product of the anticipation of the rate hike the Fed just executed. With a year of preparation and warning, it seems likely that some home sales were pulled forward to avoid higher mortgage rates. Yes, the change in rates is miniscule but if you know the hike is coming and you know you are going to be buying a house don’t you at least try to move ahead of the Fed? I would certainly think so. Of course, that doesn’t mean that you won’t continue to see that effect as more rate hikes are anticipated but how long can that go on before you’ve sucked forward so much of the future that there isn’t much more to borrow? And, just to think out loud here for a moment, what happens if future rate hikes start looking iffy? What happens if economic growth continues to disappoint?

What is most disconcerting about the recent data is that the parts of the economy that have been performing well are starting to look a little worse for wear. The manufacturing side of the economy is now widely agreed to be in recession but the automobile industry has been going gangbusters. The most recent retail sales report though showed better results when auto are excluded. In fact, vehicle sales are down for two consecutive months now and that is more than a little worrisome. With inventories across the economy already high and manufacturing already contracting, about the last thing we need now is for auto sales to start slowing. Will the Fed’s rate hike have any impact on auto sales? Just asking.

While manufacturing has been a big drag on growth, the economic bulls keep pointing to services as the more important part of the economy. And it is true that services represent the larger portion of our economy but the “we don’t make anything anymore” meme has always been overstated. It is true the US economy does not produce much in the way of consumer goods anymore but we are still the second largest manufacturing economy in the world behind China. And services are dependent, at least to some degree, on the manufacturing/industrial part of the economy. Does anyone really believe that the service sector hasn’t been impacted by the shale oil bust? And now, the service sector may be slowing as well. The Quarterly Services Survey last week showed a slowing in the rate of growth and the PMI Services flash index came in well below expectations this week. One report doesn’t make a trend but this needs to be watched very carefully.

As for the manufacturing reports, when the most positive report is one that is merely less bad than expected, that kind of says it all. The Empire State survey was better than expected at -4.59 but positive it was not. That was the fifth consecutive negative report and the internals were no better than the headline. New orders also contracted less but for the seventh straight month. Employment however worsened for the fourth month in a row at -16.16 the worst reading since July 2009. The workweek also contracted to its worst reading since April of 2009. The Philly and KC Fed reports were equally miserable while Industrial Production fell into what can only be described as recession territory. Not manufacturing recession but actual overall economic recession. Yes, part of that was weather as utility output fell but manufacturing was flat and capacity utilization fell again to 77%. Who thinks companies are going to be anxious to make investments in new capacity soon?

The one area Janet Yellen probably feels most comfortable with is the employment situation but the news there hasn’t been as rosy as one might think given the rate hike. The Fed’s own Labor Market Conditions index which covers 19 separate components was a less than expected 0.5 in November despite pretty health non-farm payroll reports. Jobless claims have also been creeping higher although not enough to warrant concern yet. And the JOLTS report showed a pretty big drop in job openings. None of these reports point to big problems and they are not part of a trend yet. But they certainly bear watching.

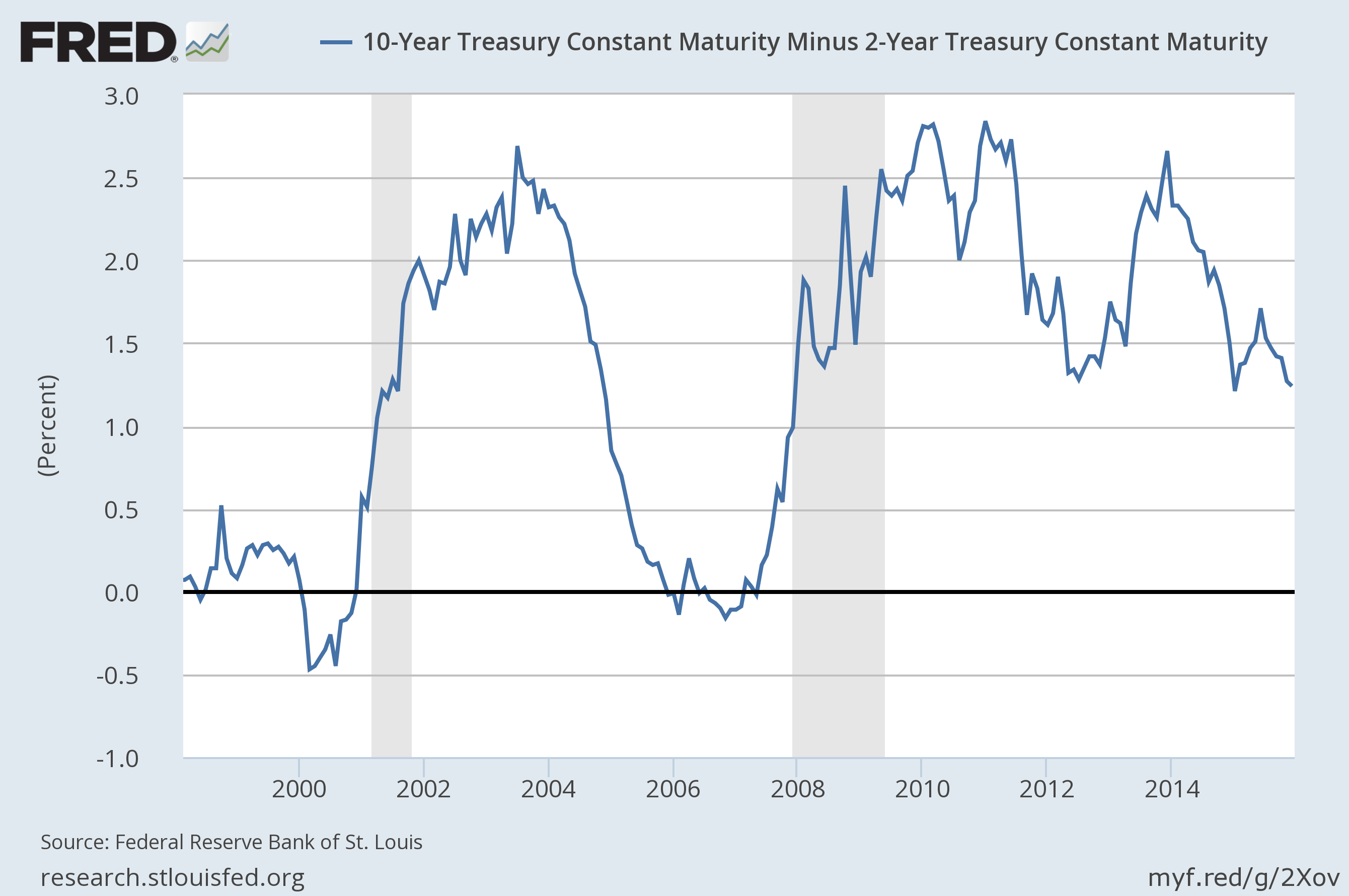

Our market based economic indicators all worsened since the last report. The yield curve flattened on the rate hike as short rates, influenced by the Fed, moved higher while long rates moved lower. It wasn’t a dramatic move and the curve is still far from flat or inverted but flattening tells us that market based growth expectations are at odds with the Fed’s view of the world.

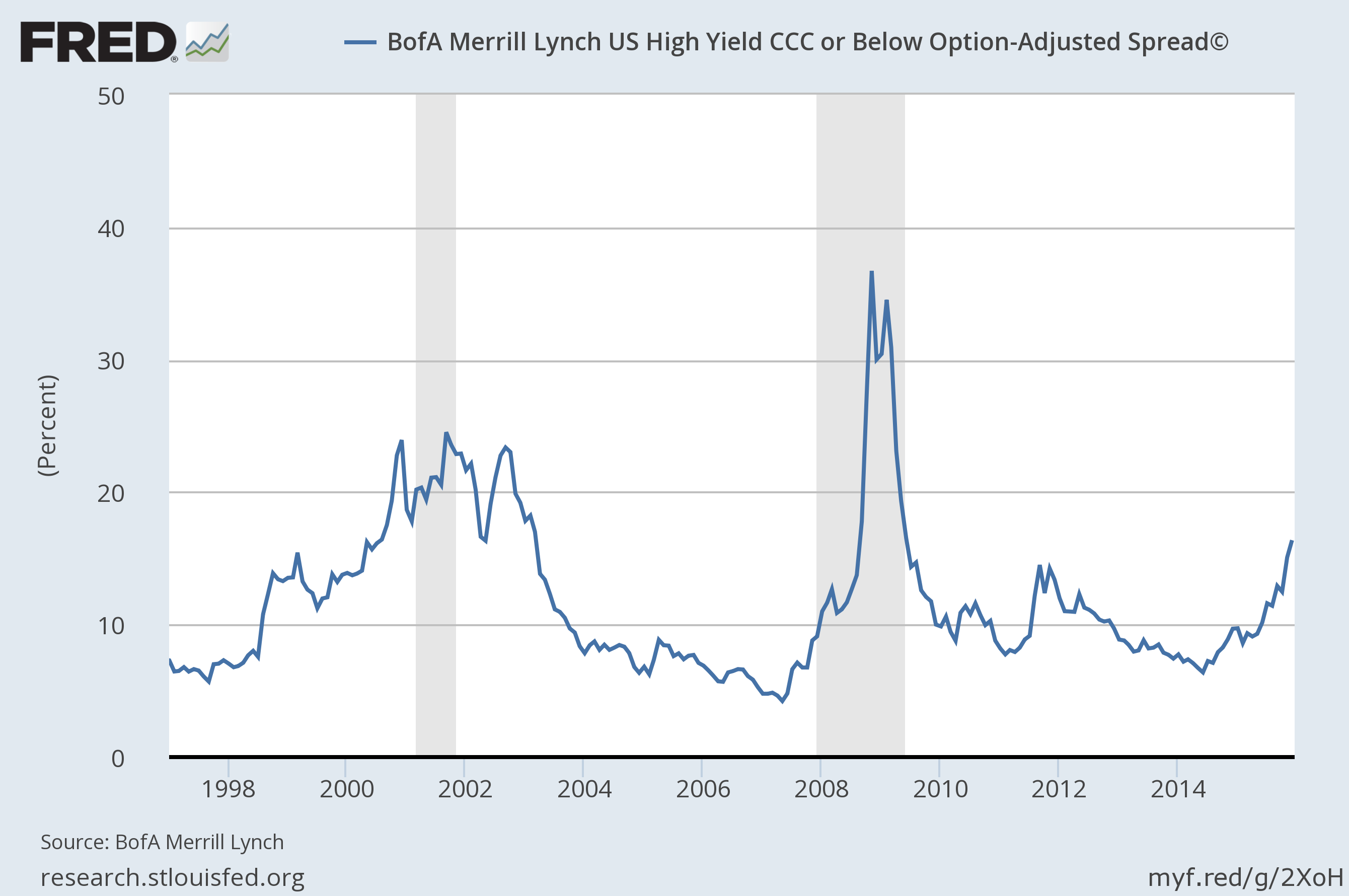

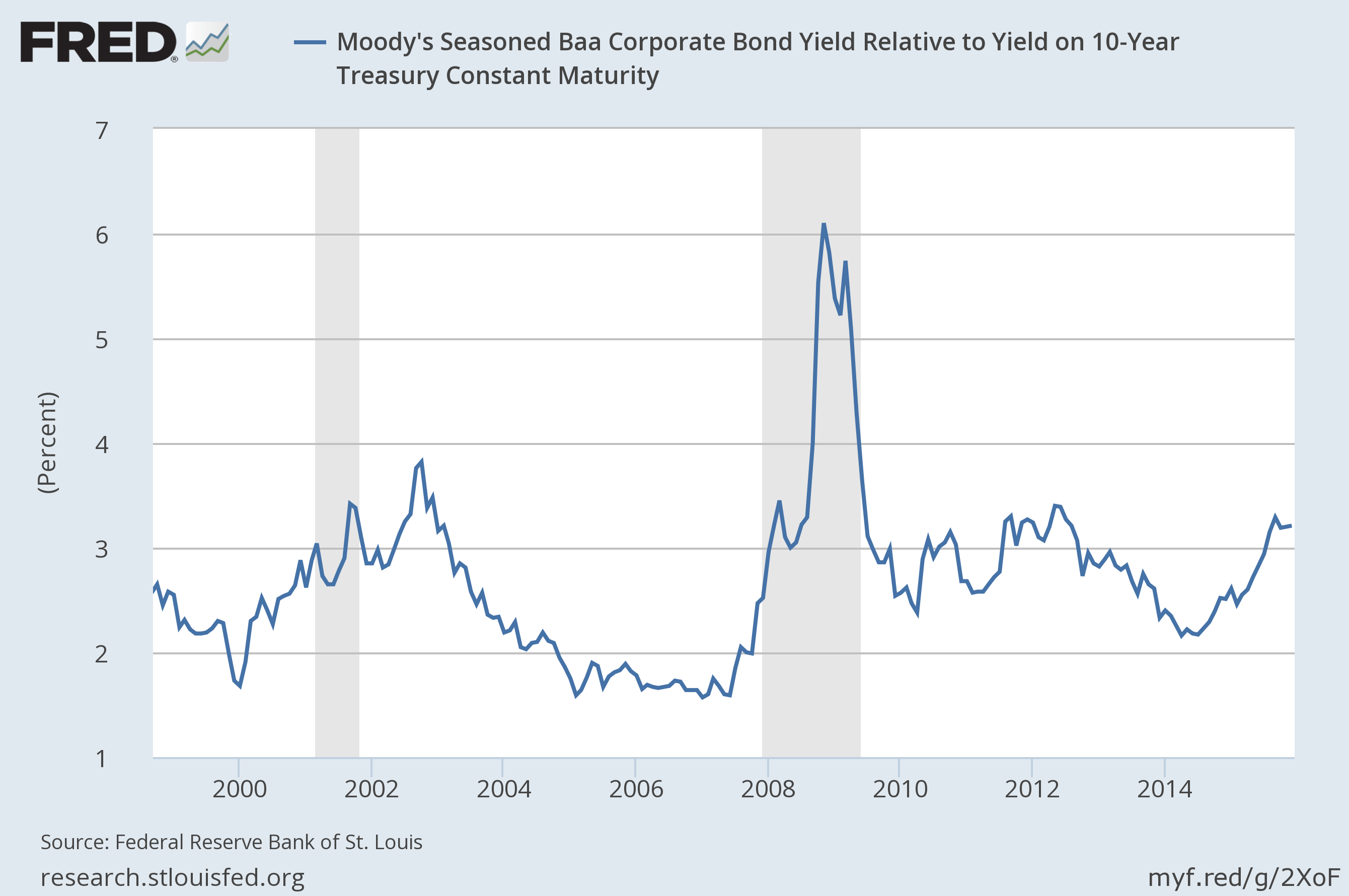

Credit spreads continued to widen as the stress in the corporate bond market deepened. As is usually true it was the lowest rated credits that saw the most damage. There does, however, seem to be a developing fear that the entire corporate bond edifice is facing a liquidity crunch that the Fed’s hike will only exacerbate. Even high grade corporate bond funds are seeing redemptions although it is certainly not a stampede.

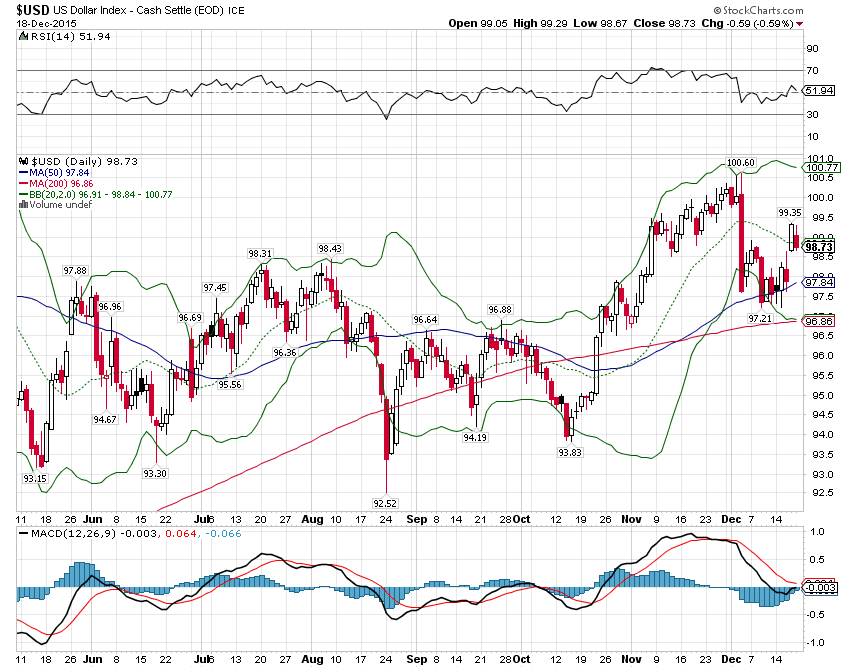

The US dollar index tried to rally on the Fed rate hike but frankly the move was underwhelming. It is often the case that the dollar fades after the tightening cycle begins – buy the rumor, sell the news – and this time may be no different. In a way it might be the best news for markets in the short term if the dollar were to pull back a bit. A lower dollar might take some of the pressure off the oil market which in turn might alleviate some of the fear in the bond market. It would also probably reduce anxiety about emerging markets. It isn’t, in the long run, good news for the US economy though. A strong, stable dollar – and stable is more important that strong – is in our best economic interests. It also isn’t bad from a geopolitical standpoint, hurting at least some of the right countries.

I said in my last report that the economic outlook hadn’t changed that much. I don’t think that is an accurate statement a mere two weeks later. The data continues to move toward recession and I suspect the Fed’s rate hike will be seen in the near future as a mistake. It isn’t that the 25 basis point hike is enough to cause recession but optics matter. If the economy falls into recession or stalls so the Fed has to take some action, the public will see that as a failure of monetary policy even if it isn’t. I’ve said for a long time that our problems can’t be solved by monetary policy and I think the events of the last few years bear that out. We’ve had a weak cyclical recovery that may be ending and if it is monetary policy won’t stop it. We have lousy monetary policy because we have lousy fiscal and regulatory policy – something that extends over the last two administrations by the way. Based on what I’ve heard from the leading Presidential candidates, I wouldn’t plan on that changing anytime soon.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch