In addition to global “dollar” markets, the treasury curve and “inflation” trading both suggest more so disruptive potential than the optimistic path forward laid out by the FOMC’s policy decision. Upward monetary policy adjustments are in anticipation of “overheating” or an economy in the predicate position for its imminent take off. Since credit markets are discounting mechanisms in a manner that stocks no longer seem able to visit, you would expect to find the Fed’s hopeful suggestions at least somewhere in credit.

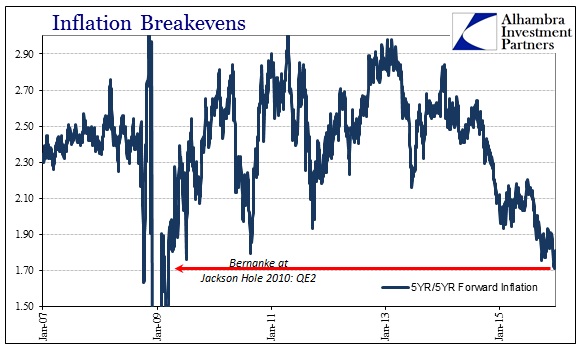

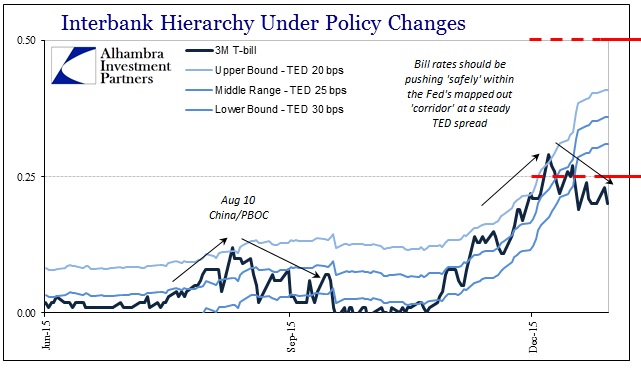

Again, money markets as at least the first step in ending ZIRP have been and remain non-conforming, as is the treasury curve and perhaps more importantly inflation trading. The FOMC claims confidence in attaining, eventually, its 2% target on the PCE deflator but TIPS and especially calculated forward rates maintain the opposite direction. Worse, the Fed’s preferred market expectation gauge for inflation, the 5-year/5-year forward rate, just sunk to a new cycle low not much better than the worst of 2009 and the Great Recession! The consistent term for “under-heating” is recession.

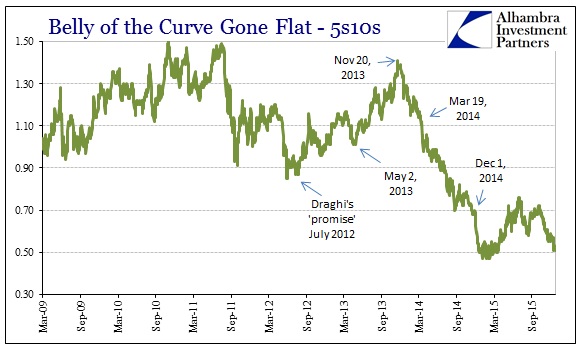

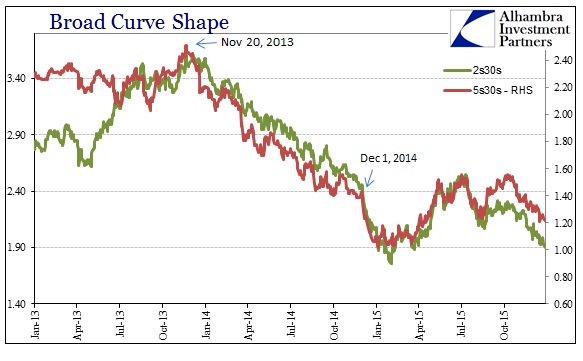

Concurrently, the treasury curve has again flattened close to its worst points of the year, also cycle lows. Front end treasury rates, though, again, curiously not bills, have pushed up as they did in late 2014 and early 2015 while the back end holds at least steady if not, over time, taking descent. The result is the highly bearish flattening that signals once more not “overheating” but the growing possibility of (further) economic and financial cycle denouement.

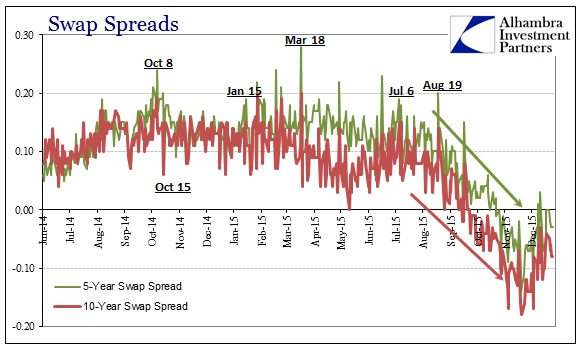

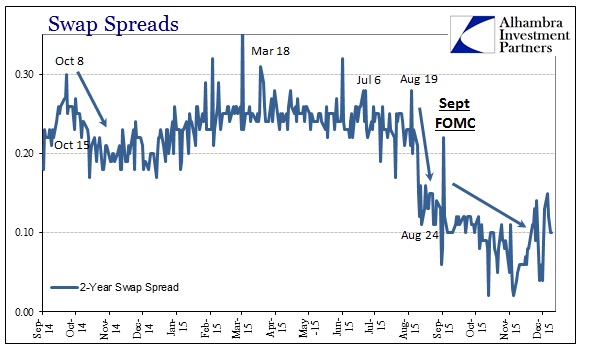

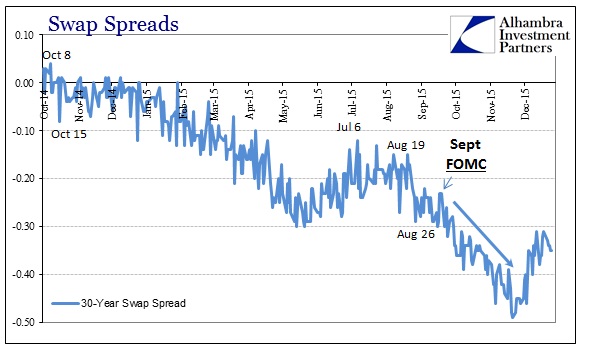

I would hasten to add swap spreads into this view, too. Despite the fact that spreads had decompressed somewhat from their dizzying downdraft of the summer, it isn’t as nearly the kind of countertrend or retracement that would be expected of monetary policy confidence (or confidence in monetary policy and interpretation). At some point, swap rates were bound to find a short-term bottom and trade up off that, but having done so there isn’t much if any determination to it. Instead, swap spreads have taken toward meandering rather than sharply confirming what the FOMC is trying hard to convince the world exists.

Like the eurodollar futures curve, there remains significant compression particularly in comparison to before July and August, as well as continued negativity (constructive nonsense) for a huge portion of the swap curve. Potentially worse, that countertrend in decompression does appear to have stalled, if not ended, on December 11 – just as the junk market started collapsing again and the money market behavior turned. Treasury bills up to December 8 had been following the “expected” track based on the TED spread and LIBOR conformity, only to start and remain shallow thereafter.

That would seem to again link wholesale “dollars” to credit, and money markets to the contradictory conception of an economy posed to actually take off. Further, as noted here (subscription required), there is a lot of Asian influence seemingly in that money market turnaround, including, surprisingly, a heavy dose of Japanese involvement.

If there is “overheating” in any of these credit and money markets it is incredibly well-hidden to the point of such low probability. Not even “inflation” trading finds the Hollywood ending very likely, and that is the place that it would appear most visibly and indomitably; the uniformity of credit and funding markets is instead a very compelling contrast.

Stay In Touch