Japan has a history of revising its economic figures all over the place. The QQE era seems to have made GDP accounting something of an art form rather than the quantitatively determined “science” of how it is presented. For example, last December the Japan Times ran a story on December 2, 2014, under the headline Japan’s Recession May Be Shallower Than First Thought only to run just six days later another purporting Japan’s Recession Deeper Than Initially Thought. The first article was predicated on a “surprise jump in capital spending” that was supposed to trim the contraction for Q3 2014 initially tallied as -1.6% to “just” -0.6%.

The updated estimate for GDP released on December 8, 2014, was instead a “surprising” -1.9%, leading to the contradiction of the second article.

One year later, Japan is still trying to figure out whether it is in recession or near it, or growing robustly as some like the New York Times recently suggested.

Japan’s latest recession turns out not to have been a recession at all.

The government said on Tuesday that the economy grew at a relatively robust pace last quarter, reversing a more pessimistic estimate it published three weeks ago.

That excited acclamation was based on an upward revision in the second GDP estimate for Q3 2015. Just a few weeks later, the New York Times redistributed a Reuters update for that “relatively robust”:

While Japan’s core consumer prices rose for the first time in five months in November, household spending tumbled, casting doubt on the central bank’s view that robust consumption will help accelerate inflation to its 2 percent target.

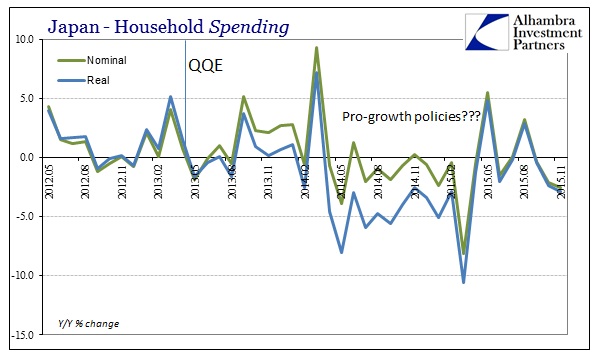

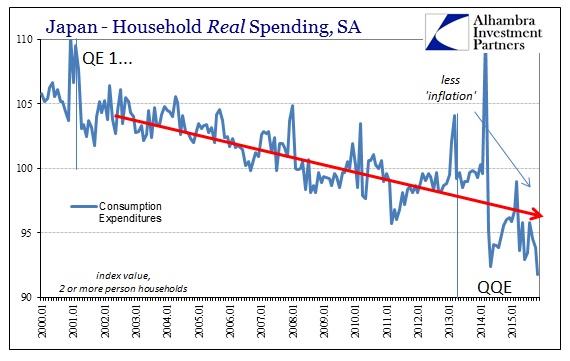

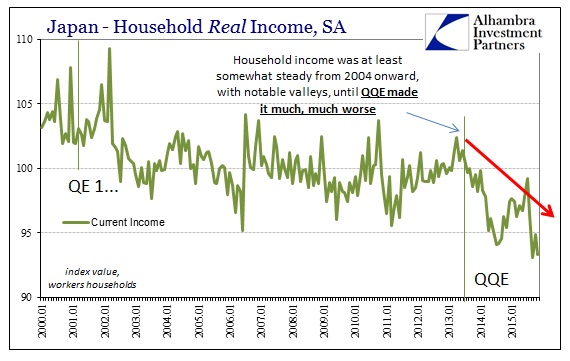

Indeed, the household spending and income estimates for November were atrocious, just as they were in October. Suddenly the wondrous upgrade for Q3’s GDP seems less of a foundation for future recovery (the same recovery promised in April 2013 and is yet to be delivered) and more so just what Japan’s economy has shown through the whole of Abenomics. It cannot be a healthy economy where households, the Japanese people, are essentially and perpetually devastated. There is no other way to classify it.

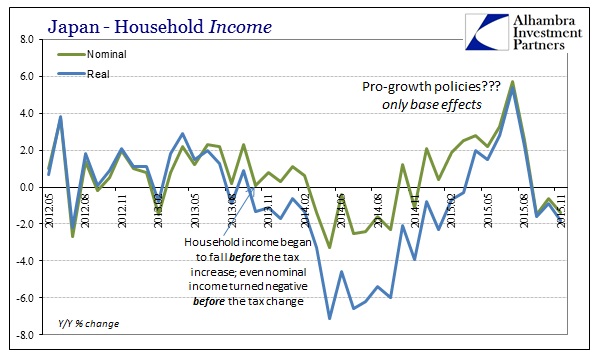

Household spending contracted in both nominal and real terms in November yet again, more than suggesting that whatever QQE does it does it exclusively elsewhere. Real spending fell 2.9% after declining 2.4% in October, making Q3 out to be a great anomaly (determined more of base effects than actual growth). Worse, household income fell by 1.8% in November for the third straight month, while disposable income contracted by 2.5%. Household consumption expenditures, a figure that flows into GDP, fell by an alarming 4.1% in November after dropping 2.3% in October.

The problem of recession is that nobody seems to know what one is, even though Japan presents perhaps the perfect example in practice. The “technical” definition of two consecutive quarters of negative GDP is complete bunk. As noted here, the NBER refutes that very idea, instead relying upon the more qualitative analysis of an inarguably broad-based and persistent slowdown:

The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

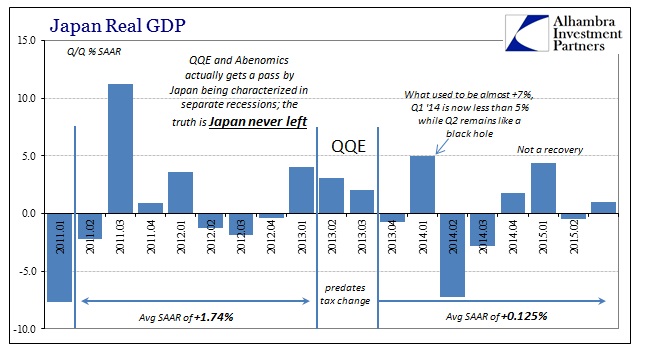

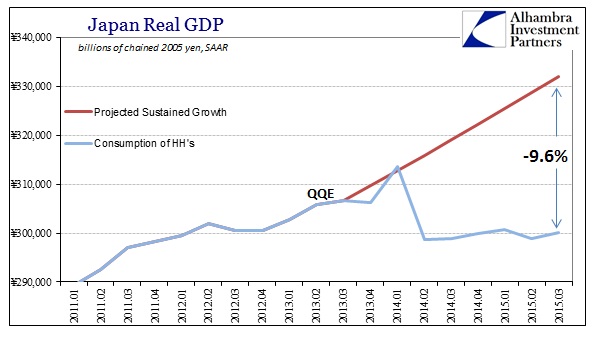

We can argue about the NBER assigning itself the task and whether it is qualified to carry it out, but the relevant notion is that this is an orthodox outfit describing in its “guidelines” exactly what we see in Japan. By that definition, Japan has been in recession for eight quarters as is easily observed in a broad range of statistics including GDP – no matter what it was for Q3 (initially reported last month as -0.8% but revised to +1.0%, getting the New York Times and economists temporarily provoked).

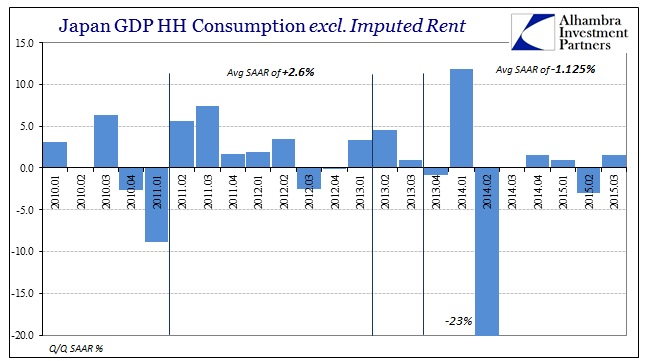

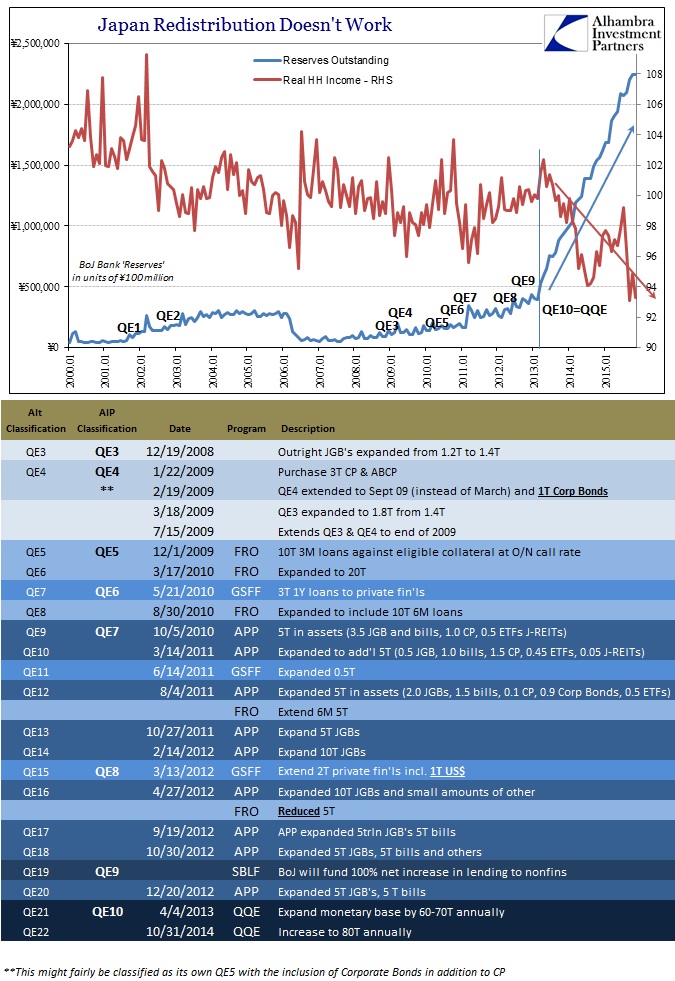

The uneven nature of GDP belies any idea of growth or recovery even if it doesn’t find two straight negative quarters but once in the middle of 2014. The average growth rate over the past two years is barely positive, and thus essentially flat; a “significant decline in economic activity spread across the economy, lasting more than a few months.” In the eight quarters prior to QQE’s rude interruption, GDP averaged +1.74%; still uneven and highly unstable, but at least on the whole moving slightly forward. It was that instability that convinced Abe and the Bank of Japan to initiate QQE in the first place, but instead of restoring anything like growth (sustained) the monetarism turned an arguable recession into a less arguable one.

But it is the household sector that continues to be dispositive on the subject. The decision and declaration of recession is unimportant; I seriously doubt that the Japanese people care much about how their misery is to be described and categorized. By all practical measures and interpretations, the Japanese economy has been especially hard and rough upon the Japanese people for two years – which is saying something given the economic hardships visited upon Japan in the years just before. As per usual, the monetarisms implemented here had the practical effect, recession or not, of making a bad situation noticeably and continuously worse. That point, whatever the final determination of academic economists, cannot be argued.

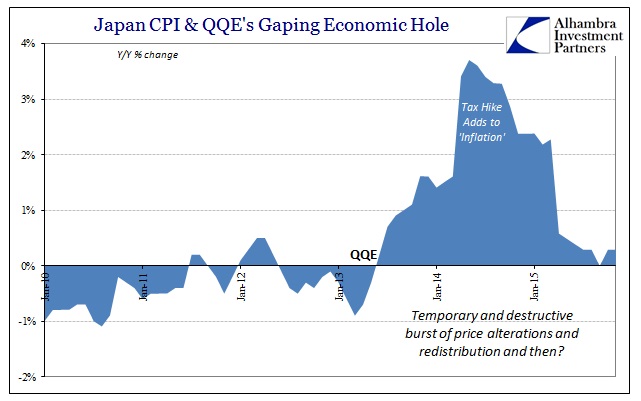

QQE has left a vast and visible hole upon the Japanese economy. What matters is truly realizing causation; something that has been clouded, often intentionally, by 2014’s tax hike. However, by easy virtue of timing, it is absolutely clear that QQE bears that burden. From the CPI to the direct comparison of QQE’s byproduct creation of bank reserves, Japanese incomes and spending suffer the initial decline shortly after QQE begins – and they have never recovered despite the incidence here and there of some positive numbers.

If this isn’t recession then it surely isn’t what QQE was supposed to accomplish. By my count, it is much worse than “technical” recession because it continues unabated; unstable GDP and all. The Bank of Japan punched a hole right through the Japanese economy, with the blow landing squarely upon Japanese households (some Japanese businesses have been instead the beneficiaries of the redistribution), and is increasingly desperate in trying to convince everyone that the benefits of doing so are somehow still coming. Despite the latest GDP revisions, it might be dawning that there will always be these revisions and that instead time suggests the BoJ’s fairy tale will never find its happy ending.

The government has made scant progress toward its goal of a 2 percent inflation rate it has said is needed to ensure a “virtuous cycle” of rising demand and rising production, partly due to the sharp drop in global crude oil prices…

Incomes fell 1.4 percent from the year before, suggesting companies are not heeding appeals by Prime Minister Shinzo Abe and other leaders to raise wages and increase investment inside Japan.

Inflation never was “progress” to begin with, which is entirely the point more so than defining recession. That, after two and a half years of QQE and its like, the government is reduced to begging companies for wage increases is all the evidence needed for classification.

Stay In Touch