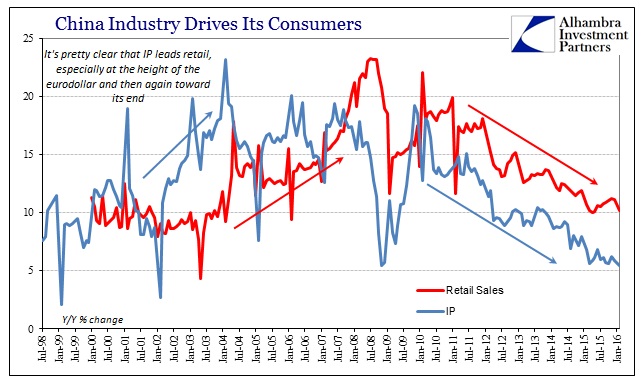

As the indications of hitting a cyclical turn multiply against the steady and alarming negative trend baseline background, there is more clarity on how what looks like an unrelenting slowdown had not yet morphed into the traditional recession setting (the “V”). For the most part, it appears as if the business or corporate sector has absorbed the negative pressures not just in the US but overseas including China. Undoubtedly the ease of funding and borrowing contributed to the reluctance to begin massive paring of resource utilization especially on the labor side. That was always the great danger of the “rising dollar” period and what it inevitably called for in terms of shifting out of “easy” funding.

The private firm China Beige Book has compiled the potential labor shift on the other side of the Pacific.

The most interesting finding of this quarter’s report is that the labor market is finally reflecting the weakness in the general economy. This hasn’t been the case throughout the slow-down, which started in the second quarter of 2014 according to the CBB data.

“Led by rising layoffs at private firms, first quarter job growth took another notable hit, sliding to a new four-year low. Expectations of future hiring have also taken a dive,” states the report. Only 23 percent of respondents said they were hiring, with 15 percent of companies said they are firing. China has announced it will lay off millions in the moribund steel and coal sectors of State Owned Enterprises (SOE). However, the CBB survey indicates it was mostly private companies which didn’t want to hire more workers.

What that suggests is more of the economic or cyclical turning point perhaps toward the more traditional recessionary circumstances:

The good news: Profit growth stabilized overall and didn’t further deteriorate compared to last quarter, although the report notes this may be due to cost cutting and layoffs.

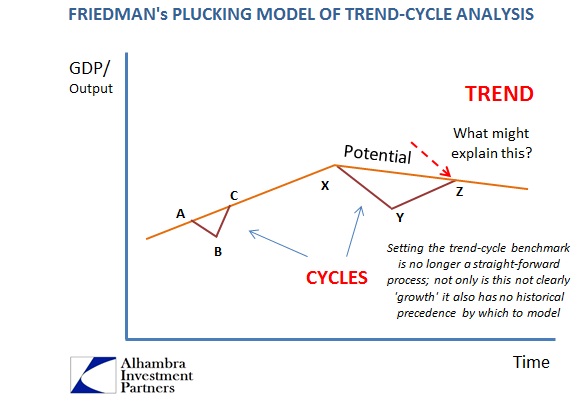

That is what recessions have always been, as businesses at first absorb the risks of temporary economic disfortune turning at some point into more than a temporary variation. Beyond some unknowable threshold, the business sector relents and layoffs are meant as the chief method of restoring profitability. The problem in China, as elsewhere including the US, is that there are far too many indications of “unusual” structural circumstances that further suggest this profit pressure is more than temporary itself no matter the adjustment via layoffs (unless there is another massive recessionary adjustment like 2008-09; and that may only be a temporary process contained within this declining global potential baseline as even the Great Recession itself increasingly appears).

It is a slowdown that more and more takes on the serious properties and economic assignments, but still do nothing to alter the unrelenting nature of the slowdown. In that way, it isn’t recession in the main, only in temporary circumstances, which suggests instead continued structural dislocation over a very long period (it’s been nearly a decade already, if not more than that, and no end yet in sight). Wikipedia (FWIW) currently proclaims:

In economics, a depression is a sustained, long-term downturn in economic activity in one or more economies. It is a more severe downturn than an economic recession, which is a slowdown in economic activity over the course of a normal business cycle.

Check on all counts: long-term; sustained; one or more economies; more severe outside the normal business cycle (time component now being the largest uncounted cost). The implications of recession are relatively straightforward, which is why nothing central banks undertook after 2007 had much effect beyond short bursts. The implications of depression are much more dire (usually economic conflagration turns to political conflagration and social disruption, a flavor more and more apparent these days). And, as I suggested in my other posts today, there is nothing preventing recession from combining with depression to make for truly unpredictable circumstances.

Stay In Touch