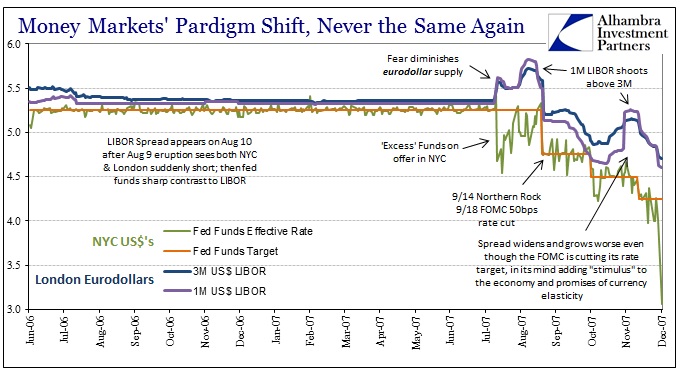

It is absolutely clear that the eurodollar system last functioned on August 8, 2007. Starting August 9, nothing would ever be the same. In describing and detailing how it got that way (the sudden fragmentation between “dollars” in NYC and London, for example) there is a natural tendency to compartmentalize even realizing the drastic implications of what it all meant. In other words, while understanding that global finance would never be the same it is still very important to realize that what happened then was not limited to eurodollar banking construction and operation. The global economy has never been the same, either.

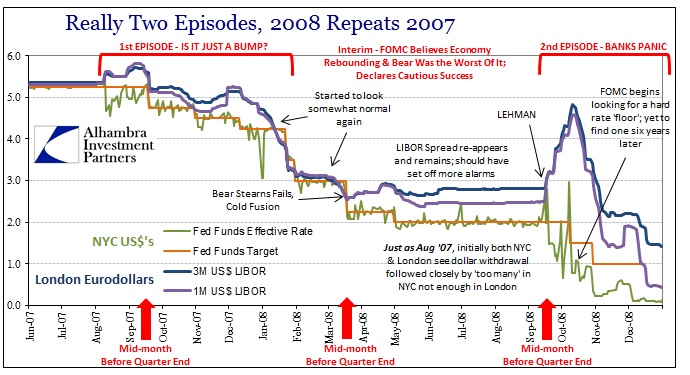

When first confronted with what would become the Great Recession (and panic originating in London, not Wall Street NYC), policymakers somewhat understandably responded in orthodox fashion as if what was happening would be the usual if severe cyclicality. By the time Bear Stearns failed, however, they should have realized that greater forces were at work. Given the Fed’s mandates and really their own PR about themselves and their near “omniscience”, there was no excuse for not discerning the difference ahead of time. “Stimulus” is ineffective outside of cyclical conditions (and it is arguable inside them, too).

What followed was a campaign of ineptitude from one side of the planet to the other, and all flowing from that same mistake. I wrote in August 2014 on occasion of the seventh anniversary of the eurodollar break these conditions which meant why I was seeing the economy much differently than the FOMC and mainstream:

Why bring all this up, particularly after seven full years now? The first reason is simple, since from then on we have seen an absolute intrusion into market function of historic proportions and all in the name of “stimulus.” To what gain? We got the Great Recession anyway in spite of it all; and nothing like a recovery afterward. The very reasons for total market repression were born that day in August 2007, to be repeated at every questionable instance (like September 2008 when there was no real panic outside of banks).

Second, and perhaps more important with regard to the future, the FOMC demonstrated both a blindspot and a curious ignorance about the systemic weaknesses of “its” financial system. The crisis period shows not just one limited instance of the feebleness of monetary response, but rather the template by which monetarists will fail time and again. When you are captured by systemic ideology, you will never see the cracks in that system from looking inside out.

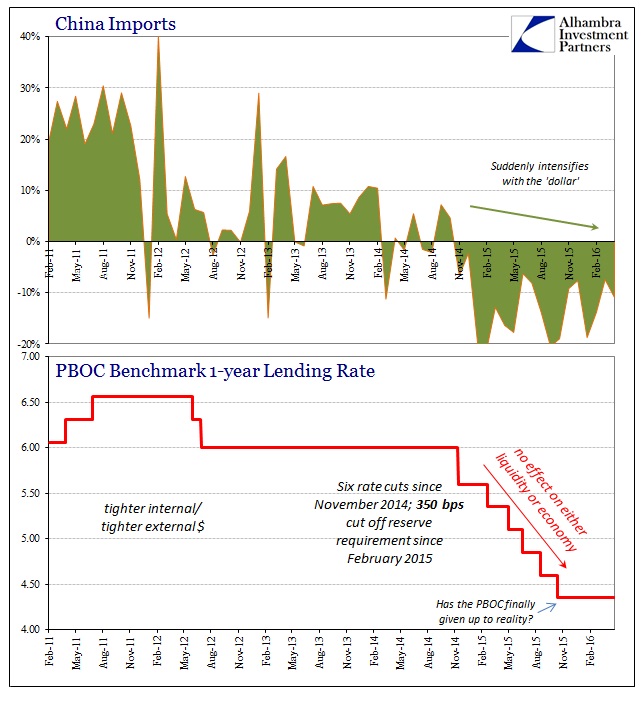

The Chinese awoke to this realization far too late, but unlike other Western central banks they seem at least aware now. It isn’t clear exactly when this awakening took place, but it was almost assuredly far later than it needed to be which has left China facing immense costs (bubbles) for following the orthodox textbook. “We” expect policymakers to be the “best and brightest”, holding the most technical knowledge and professional distinction, but in reality they perform not at all unlike the economist you see quoted in almost every news article.

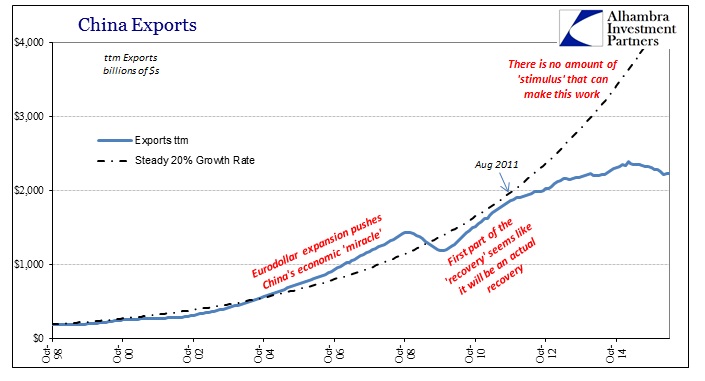

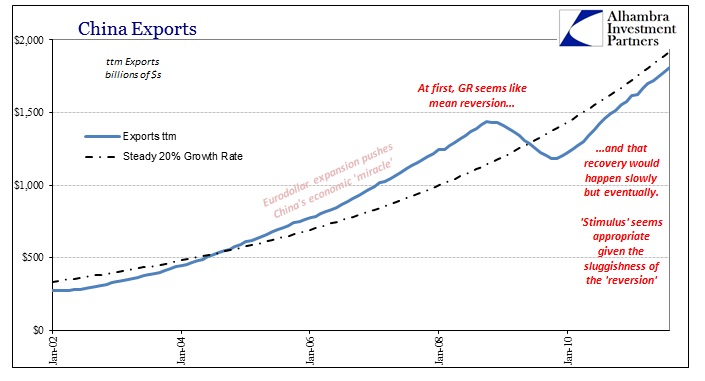

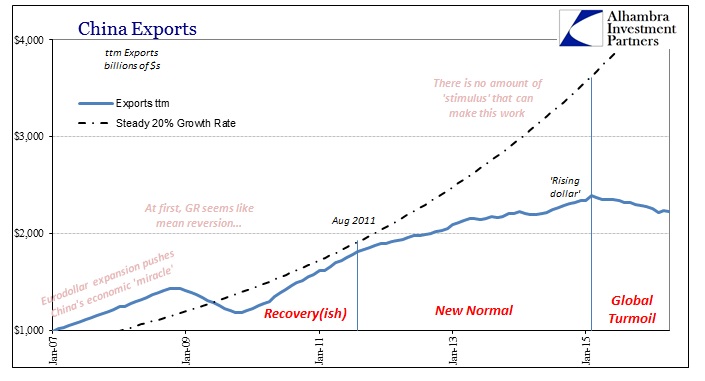

China’s is an export manufacturing economy, so its “miracle” in the decade of the 2000’s was especially significant there. The trajectory of external trade seemed to indicate this special place in the global trade hierarchy.

If you use a 20% growth baseline, the late 1990’s follows rather well that pattern even in the aftermath of the Asian flu. The dot-com recession in the US and elsewhere pushed global trade and Chinese exports underneath that baseline, but as the eurodollar system pushed into its maximum mania China was the place that benefited the most. When the Great Recession occurred, it initially seemed as if it might be just a reversion to the mean for China’s export economy. The rapid growth prior to the crisis might not return, but surely the overall economy, it was assumed, would at worse fall back so far as its pre-eurodollar baseline.

From that view, “stimulus” seemed entirely reasonable. The point of accommodation monetarily and with government spending is to aid the cycle transition from recession to full recovery; to reduce, at the very least, the time it takes to return to “normal” growth. Through the middle of 2011, that all seemed plausible though increasingly worrisome. Chinese exports were heading toward that baseline but could never quite seem to reach it.

Reality has been far less kind. Starting in the middle of 2011, China did as the rest of the world and followed the eurodollar into even slower circumstances. This second transition (the GR being the first) occasioned another round of global “stimulus”, China included, again to no discernable effect. While it is easy to think Europe of the eurodollar, the truth is far more cosmopolitan and, I would argue, perhaps much more Asian in this post-August 2007 aftermath. That much was apparent in full review of the events of summer 2011 (subscription required):

It seems likely (and I have to be careful to point out that this is speculation on my part since there is no “confession” or hard data to confirm or deny, only partial media reports that discuss “derivatives” or in the rare case as shown above with actual reference to “swaptions”) MUFJ Morgan Stanley was writing delayed funding commitments in “dollars” at a very bad moment to be doing so. When the swaptions were exercised starting around Q1 2011, this “short dollar” position was far, far more “expensive” than ever anticipated (even with the eventual QE2).

On December 21, 2010, the Fed and Bank of Japan announced they had extended the dollar swap line reinstituted in May 2010 past the original January 2011 expiration. The swap line was extended again at the end of June 2011. By early August, during what would be the broadest global liquidations associated with the 2011 “dollar shortage”, the yen and Japan were once again right at the forefront of illiquidity.

Tokyo being a ready “dollar” conduit into China, it is not at all surprising that Chinese exports began their “unexpected” retrenching at just that moment. The global economy ignored all the “stimulus” and instead the next shift was the “rising dollar” that hit in the middle of 2014 (related very much to the shifting eurodollar behavior of 2013). What was once slowing growth had become outright contraction and increasing turmoil because of it (self-reinforcing economy to finance to economy again).

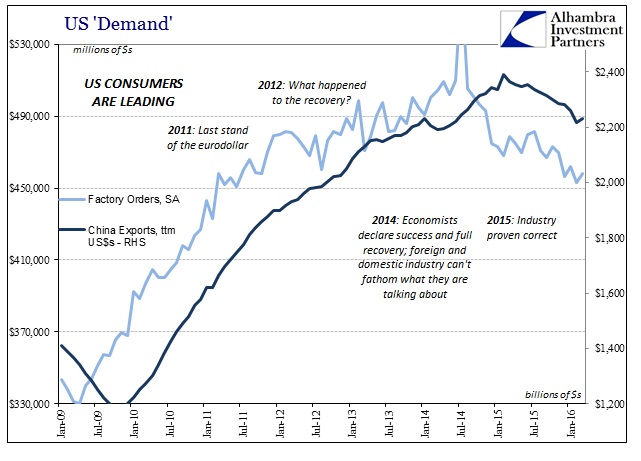

Global trade is supposed to be mutually beneficial over the long run. There may be hardships associated with the transition, but in the end everyone wins. What we find here and elsewhere during the eurodollar run, as revealed by its retreat, is that nobody won at the trade terms imposed during the past two or three decades. In China, the nation most directly receptive of manufacturing productive capacity, they now suffer for it having built up said capacity in anticipation of a trajectory that was never realistic. The US having financed itself out of that productive capacity no longer has the (income) base by which to support Chinese trade. Both sides lost, and the damage goes way beyond the US and China.

The eurodollar was not free trade because the eurodollar isn’t money. It is a credit-based currency system more alike the internet than the monetary replacement for gold exchange (Bretton Woods). There is only debt on both sides rather than free trade and wealth, which leaves them equally impoverished for their supposed prosperity. That was the “gift” of August 9, 2007, as it shattered (permanently) the illusion. You only had to be free from orthodox ideology to see and appreciate it.

At the core of this insufficiency are US consumers. As you can plainly observe on the chart above, there is a good and direct correlation between US domestic factory orders and the level of Chinese exports. Since factory orders are forward looking and trailing-twelve month totals of exports backward, the lag between them is understandable. What that means is that Chinese factories are responding as if the order levels placed for US factories and industry was meant for them. The only way that happens is if US consumers are the uniting center of weakness.

It is a global paradigm shift that defies all “stimulus” because there isn’t even the smallest hint of cyclicality. Central banks should have known better but they aren’t actually monetary experts nor are they, obviously, economic experts. Central bankers know only statistics and regressions and unfortunately none of their equations are fit for a paradigm shift. That is why they just keep doing the same thing over and over and over. As I wrote this morning, all that does is drive up the cost of the inevitable systemic reset for as long as they are allowed to continue demonstrating their self-imposed ignorance. It really doesn’t take much effort to see this so very clearly and easily; it can only take tremendous effort not to.

Stay In Touch