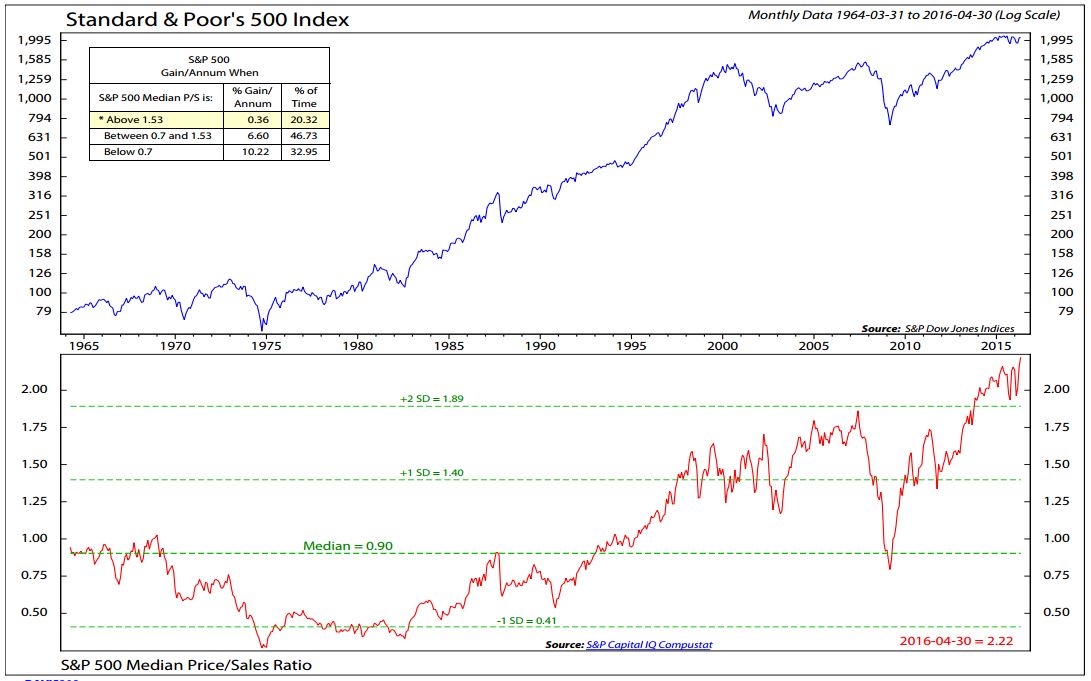

This week’s chart comes to us from Ned Davis Research via this article on MarketWatch:

What that bottom pane shows is that the median price to sales ratio for the S&P 500 is about 2.2. That is higher than in 2000, which was about as obvious a bubble as one is likely to ever see. But….there are big differences between the 2000 and 2016 markets. Back then, one could pretty easily avoid the overpriced parts of the market by just avoiding technology. Value investors did fine during the bear market of 2000-2002. Today the overvaluation is more diverse and diffuse and much harder to avoid. Many of the traditional “safe” stocks are also some of the most expensive in the market. Proctor and Gamble (3.06), Johnson & Johnson (4.49), General Mills (2.22), Paychex (6.85), Pepsi (2.35), McDonald’s (4.19) and ADP (3.5) are all in the S&P 500 and also in the top 10 holdings of the US Minimum Volatility Index ETF that has seen some of the largest inflows this year. Investors seeking safety are crowding into the most expensive part of the market. Probably not a recipe for long term success.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch