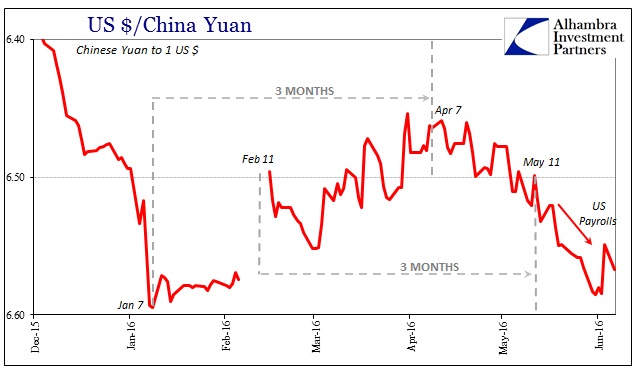

To the surprise of no one, the Chinese yuan on Monday picked back up where it left off last week with Friday’s big move only shifting the level from which it now sinks. Straight from the Asian open, CNY quickly traded lower and settled again closer to 6.57. If it exposes Friday’s reversal as a one-day, knee-jerk reaction then it might not take any time at all before the burst of “dollar” availability is long forgotten. Efficient markets.

To sum up the end of last week under the gross disappointment of the Establishment Survey:

Today is one of those days where wholesale still clashes with tradition. The huge run in CNY was not about China but (somehow) Janet Yellen. With the worst headline Establishment Survey figure of the “recovery”, the “market” decided there was no way the FOMC would follow through with all the “hawkishness” that its members have been displaying in recent weeks and days. Thus, there was heavy “dollar selling” by those who had them. The Chinese, being short of them, and increasingly so, were very likely the primary beneficiaries of such foolishness as believing in Yellen’s recovery agenda – “buying dollars” as much as they possibly could to help out all the chicken hawks.

With a surely unanticipated flood of “dollars” heading in that direction, the ticking clock was surely reset by this spark of policy generosity. But for how long?

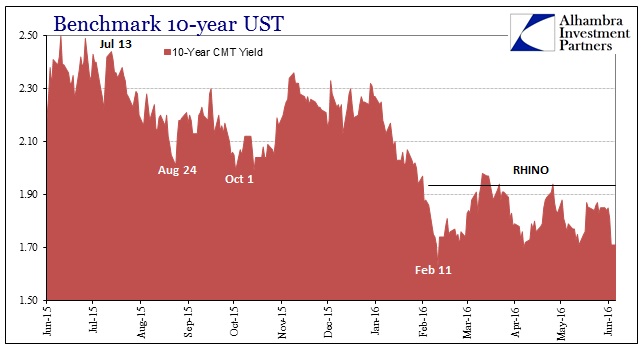

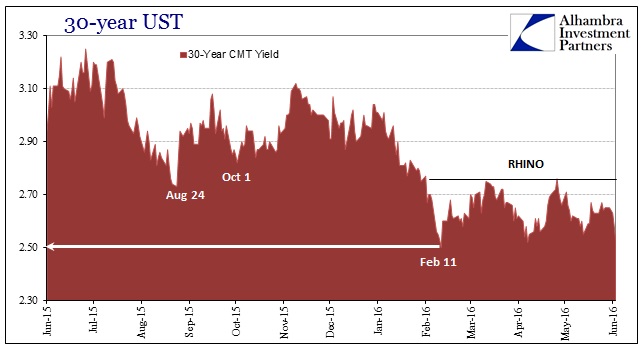

Here today, gone tomorrow. As I noted Friday, the behavior of bond and funding markets was in the direction of further CNY devaluation, indicating, strongly, that credit/funding markets were never enthralled by the move and rather more differential to how downward CNY and US economic deterioration are really one and the same. That includes CNY forwards that opened at a slightly lower relative price. The 6-month forward was calculated (median interbank market maker bid) at 6.5988 today, a higher spread to the spot price than had been the case before the “dollar selling” helped out. It suggests the CNY forward market isn’t expecting last week’s jump to continue, either.

That (so far) leaves the whole episode right where it should be especially given its origins is US monetary policy “expectations” – very likely nothing more than a very short-term distraction.

Stay In Touch